Cloud Stocks: Dropbox Acquires, But Competition Remains Stiff

Dropbox (Nasdaq: DBX) recently announced its fourth quarter results that surpassed market expectations. The company is going strong on acquisitions and product upgrades, but competition continues to remain brutal in the market.

Dropbox’s Financials

Revenues for the quarter grew 13% to $504.1 million, ahead of the market’s forecast of $498 million. Net loss was $345.8 million compared with a net loss of $6.6 million a year ago. On an adjusted basis, EPS was $0.28 per share compared with the market’s expectations of $0.24.

Among operating metrics, it reported an ARR of $2.02 billion, growing 12% over the year. Paying users grew from 14.31 million a year ago to 15.48 million for the quarter and average revenue per paying user increased from $125 to $130.17.

For the fiscal year, revenues grew 15% to $1.914 billion. It ended the year with an EPS of $0.93.

Dropbox did not provide an outlook for the quarter or the current year.

Dropbox’s Acquisition

Recently, Dropbox announced the acquisition of San Francisco-based DocSend for an estimated $165 million. Founded in 2013 by Dave Koslow, Russ Heddleson, and Tony Cassanego, DocSend provides business leaders with a secure analytics and document sharing product. It lets its customers share documents with their end users and get real-time feedback on the documents. The acquisition will allow clients that use Dropbox to collaborate on messaging docs, presentations, and projects. They will be able to utilize DocSend to deliver proposals as well as track engagement.

Dropbox plans to integrate the offerings from an earlier acquisition, HelloSign, that has helped Dropbox manage contracts and invoices. Dropbox had acquired HelloSign in 2019 for an estimated $230 million. In the last reported quarter, HelloSign saw a 70% increase in end-user signature requests. Dropbox has also expanded support for HelloSign to 21 languages and is working on expanding it internationally. Together with HelloSign and DocSend, Dropbox will be able to deliver a solution that can streamline workflows for sales, finance, client services, and executive teams.

Prior to the acquisition, DocSend had raised $15.3 million in four rounds of funding from investors DCM Ventures, August Capital, Augusta Investments LLC, Adeyemi Ajao, Western Technology Investment, Cowboy Ventures, Uncork Capital, Jonathan Golden, and Lerer Hippeau.

Dropbox’s PaaS Strategy

Dropbox currently offers SDKs for several popular programming languages along with several pre-built components that let developers build applications on its platform. It also allows them to leverage APIs to build custom solutions. Dropbox claims that over 500,000 developers are working on its platform. It witnesses over 50 billion API calls each month and believes that nearly three-quarters of the business teams link to third party APIs on its platform. Dropbox has several integrations available that allow developers to add Dropbox features such as file storage, sharing, previews, and search to their apps. It has integrations with leading enterprise services including Zoom, Microsoft, Google, Slack, and Adobe to name a few.

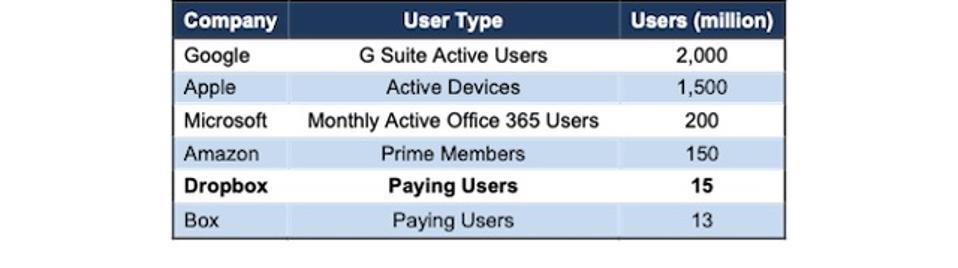

Dropbox’s biggest concern remains its ability to pry user base away from its competition. A report published last year saw Dropbox’s share of the global cloud storage market fall from 4.4% in 2017 to 3.6% in 2019. Dropbox is facing tough competition from the likes of Google, Microsoft, and Apple who offer free or inexpensive solutions to their customers as part of their integrated offerings. Google, for instance, allows 15GB of free storage space to all its users. Similarly, Apple iCloud and Microsoft OneDrive allow users to store 5GB data for free. According to a report by New Constructs, Google’s GSuite had 2 billion active users followed by Apple’s 1.5 billion globally. Compare that with Dropbox’s modest paying user base of 15 million. Given below is an interesting table showing the wide gap in the competition, courtesy Forbes.

Its stock is trading at $27.06 with a market capitalization of $11.6 billion. It had climbed to a 52-week high of $28.25 earlier this week. It had fallen to a 52-week low of $14.80 in March last year.

Disclosure: All investors should make their own assessments based on their own research, informed interpretations and risk appetite. This article expresses my own opinions based on my own ...

more