Citi Trends - Stock Of The Day

Summary

- 100% technical buy signals.

- 14 new highs and up 44.13% in the last month.

- 110.99% gain in the last year.

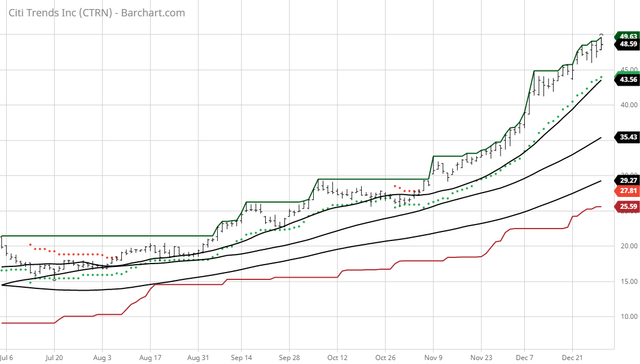

The Barchart Chart of the Day belongs to the retail apparel company Citi Trends (Nasdaq: CTRN). I found the stock by using Barchart's powerful screening tools to find the stocks with the highest Weighted Alpha and technical buy signals. After I sorted for the most frequent number of new highs in the last month, I used the Flipchart feature to review the charts for consistent prices appreciation. Since the Trend Spotter signaled a buy on 11/5 the stock gained 66.79%.

Citi Trends, Inc. operates as a value-priced retailer of fashion apparel, accessories, and home goods. The company offers apparel, such as fashion sportswear for men and women, as well as children, including newborns, infants, toddlers, boys, and girls; accessories comprising handbags, jewelry, footwear, belts, intimate apparel, scrubs, and sleepwear; and functional bedroom, bathroom, and kitchen products, as well as beauty products and toys. It provides its products primarily to African-Americans in the United States. As of February 1, 2020, the company operated 571 stores in urban and rural markets in 33 states. The company was formerly known as Allied Fashion, Inc. and changed its name to Citi Trends, Inc. in 2001. Citi Trends, Inc. was founded in 1946 and is headquartered in Savannah, Georgia.

(Click on image to enlarge)

Barchart technical indicators:

- 100% technical buy signals

- 226.50+ Weighted Alpha

- 110.99% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 14 new highs and up 44.13% in the last month

- Relative Strength Index 80.92%

- Technical support level at 46.58

- Recently traded at 48.59 with a 50 day moving average of 35.43

Fundamental factors:

- Market Cap $483 million

- P/E 32.13

- Revenue expected to grow 6.50% this year

- Earnings estimate to increase at a compounded annual rate of 15.00% for the next 5 years

- The Wall Street analysts covering the stock rated it a strong buy

- The individual investors following the stock on Motley Fool voted 171 to 36 that the stock will bat the market

- 1,080 investors are monitoring the stock on Seeking Alpha

The Barchart Chart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stock are extremely volatile and speculative. Should you decide to add one of these stocks to your investment portfolio it is highly suggested you follow a predetermined diversification and moving stop loss discipline that is consistent with your personal investment risk tolerance and reevaluate your stop losses at least on a weekly basis.

Disclosure: None.