Citi Trading Revenues Tumble, But EPS Beats After Aggressive Cost Cuts

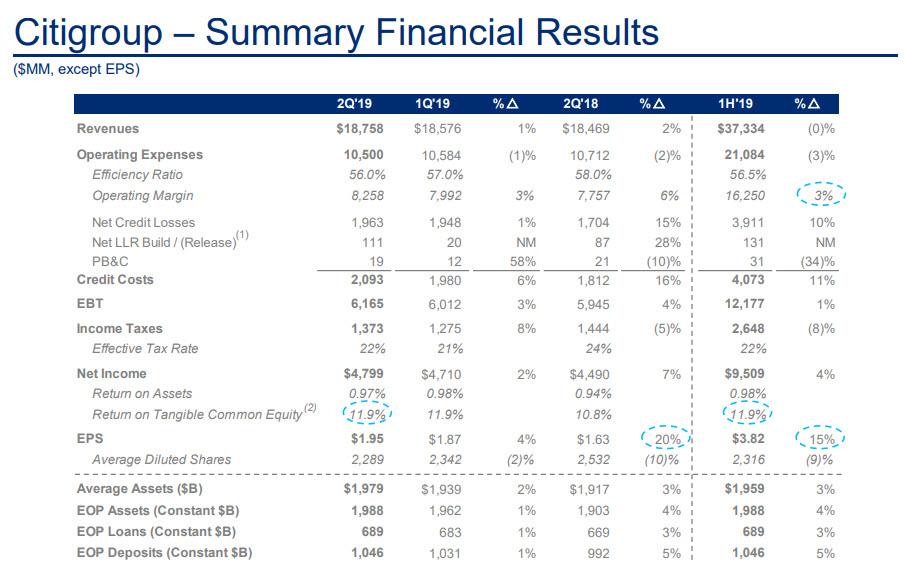

Citigroup kicked off Q2 earnings season with a beat, reporting EPS of $1.83, above the $1.80 expected, on revenues of $18.76BN, up 2% Y/Y, also above the $18.52BN estimate, as a $350m pretax gain on its Tradeweb investment offset continuing declines in Investment Banking and Fixed Income and Equity Markets revenue, and mark-to-market losses on loan hedges.

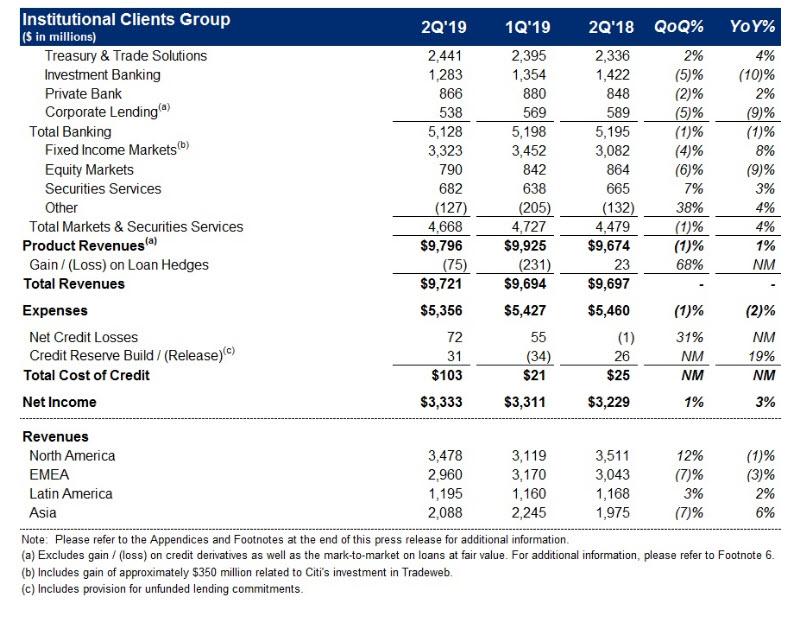

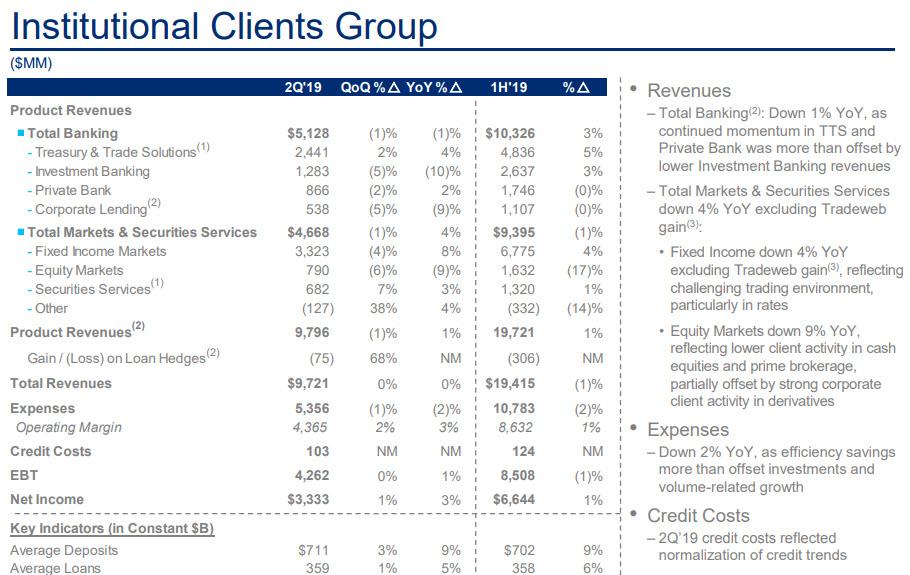

Going straight to the bank's trading results, i.e., Institutional Client Group, the bank reported revenue falling 4% ex-Tradeweb gain y/y to $3.32 billion, driven by a decrease in expenses and a lower effective tax rate partially offset, which nonetheless was enough to beat consensus estimates of $2.99 billion, reflecting a "challenging trading environment, particularly in rates."

Equity markets also slumped, as revenue fell 9% y/y to $790 million, missing estimates of $824 million, "reflecting lower client activity in cash equities and prime finance, particularly offset by strong corporate client activity in derivatives" Meanwhile, investment banking revenue fell 10% y/y to $1.28 billion, roughly in line with estimates of $1.25 billion as Citi reported a surprise 2% gain in fees from underwriting debt to $737MM, but revenue from advising on M&A plunged 36% to $232MM, and equity underwriting dropped 6% to $314MM.

Finally, Treasury and Trade Solutions revenue rose 4% y/y to $2.44 billion, right on top of the $2.44 billion estimate, reflecting continued strong client engagement, with growth in deposits, transaction volumes and trade spreads

Citi's revenue from trading has dropped for three straight quarters compared with year-earlier periods. This time, it slipped roughly 5%, excluding a one-time gain on a stake in Tradeweb Markets Inc., which held an initial public offering. The decline was worse than analysts projected.

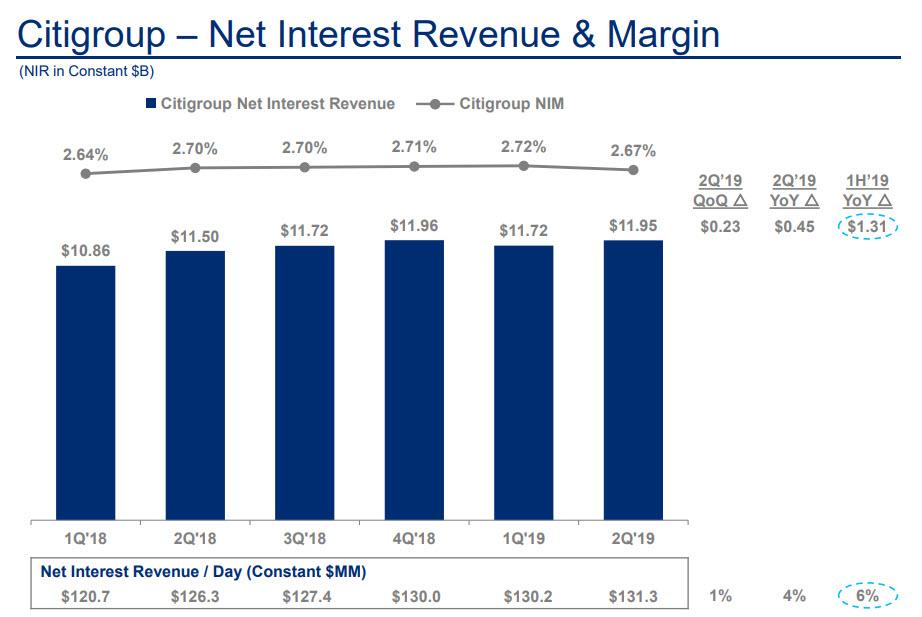

On the net interest income side, the bank reported $11.95 billion in revenue, even as Net Interest Margin dropped from 2.72% to 2.67%, below the 2.70% expected, as rates slumped in the quarter making core bank profitability harder to achieve.

Offsetting the modest gain in overall revenue was a 2% drop in operating expenses, resulting in a 3% Y/Y bump in the bank's operating margin. Citi cut costs deeper than analysts expected while the bank's consumer division posted its strongest second-quarter since 2013. Together, that outshined the firm’s Wall Street operations, where dealmakers eked out a surprise increase in revenue from underwriting debt while traders struggled.

"We have good momentum and solid growth across our consumer franchise, particularly in the US while in the ICG, our industry-leading Treasury and Trade Solutions business continues to perform well and we gained share in market-sensitive products such as Investment Banking", CEO Michael Corbat said Monday in a statement. “We navigated an uncertain environment successfully by executing our strategy.”

Corbat projected Citi can save as much as $600 million annually after investing in technologies to run operations. The second quarter marked progress, with expenses down 2% to $10.5 billion, almost $100 million lower than the average estimate from analysts.

Investors were also happy to hear that the bank had approved to return $21.5B of capital to common shareholders over the next four quarters, as reported initially when the bank once again passed its latest stress test.

As Bloomberg notes, Citi's results underscore how rough it’s getting for traders even with stocks reaching record highs as "markets keep getting jolted by President Donald Trump’s unpredictable threats to ratchet up tariffs on countries such as China and Mexico, as well as the Federal Reserve’s shifting stance on interest rates. That’s sent investing clients to the sidelines, taking a toll on banks matching buyers and sellers."

Citigroup’s ongoing struggle to improve efficiency and earnings from consumers has neem a sore spot for shareholders as the year began. Investors are paying particular attention to costs after companywide revenue climbed less than 1% in 2018. Unable to rein in expenses fast enough, executives missed their own cost target, hurting their credibility with analysts.

Looking at the balance sheet, Citi set aside $2.09 billion to cover the cost of souring loans, a 16% increase that was in line with analysts’ estimates. Citigroup said the increase to additional spending on cards as well as “normalization” in credit quality within the institutional business.

Additionally, Citigroup's allowance for loan losses was $12.5 billion at quarter-end, or 1.82% of total loans, compared to $12.1 billion, or 1.81% of total loans, at the end of the prior-year period. Total non-accrual assets declined 9% from the prior-year period to $3.7 billion. Consumer non-accrual loans declined 7% to $2.2 billion and corporate non-accrual loans declined 13% to $1.4 billion.

Citigroup's end-of-period loans were $689 billion as of quarter-end, up 3% from the prior-year period on both a reported basis and excluding the impact of foreign exchange translation8. The increase on a constant dollar basis was driven by 4% aggregate growth in ICG and GCB, partially offset by the continued wind-down of legacy assets in Corporate / Other.

Meanwhile, Citi's end-of-period deposits were $1.0 trillion as of quarter-end, an increase of 5% from the prior-year period on both a reported and a constant dollar basis. The increase on a constant dollar basis was driven by 6% growth in ICG and 3% growth in GCB.

* * *

Overall, the market was impressed, at least initially with the expense cuts, willing to gloss over the slump in banking revenues, however, after spiking initially, the stock has since recouped much of the upside.

Here is Citi's full investor presentation.

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more