Cisco Systems Stock Is A Great Long-Term Investment

Cisco Systems (CSCO) has done very well in the last few years, and its stock has outperformed the market by a significant margin. In fact, since the beginning of 2014, CSCO's stock has gained 52.5% while the S&P index has increased only 28.1% in the same period. What's more, the company has a compelling valuation and is paying a generous dividend yielding 3.39% after increasing its quarterly dividend by 12% to $0.29 in February 2017.

I see high long-term growth prospects for the company. Cisco is continuing to focus on earnings growth which is driven by its plan to shift toward software and subscription-based product & services model.

Latest Quarter Results

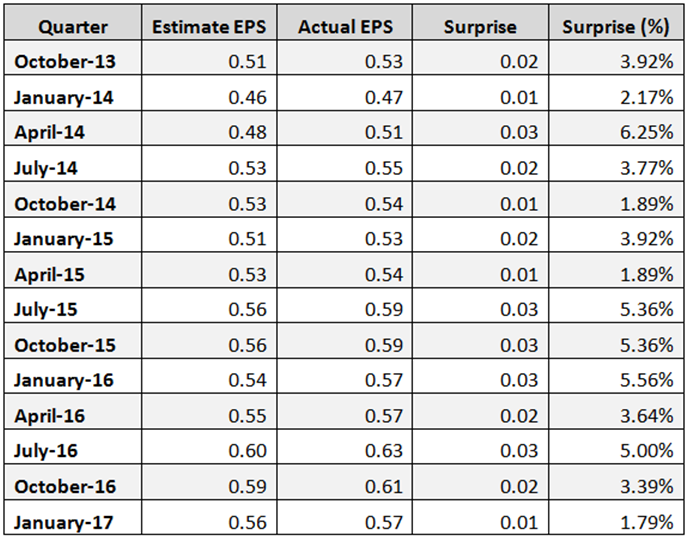

On February 14, Cisco reported its second-quarter fiscal 2017 financial results, which beat EPS expectations by $0.01 (1.8%). Cisco has shown earnings per share surprise in all its last fourteen quarters, as shown in the table below.

(Click on image to enlarge)

During its second fiscal quarter, the company returned about $2.3 billion to shareholders by $1.3 billion in dividend payments and $1.0 billion in share repurchases.

In the report, Chuck Robbins, Cisco CEO, said:

"We are pleased with the quarter and the continued customer momentum as we help them drive security, automation and intelligence across the network and into the cloud. This quarter we announced our intent to acquire AppDynamics which, combined with Cisco's networking analytics, will provide customers with unprecedented insights into business performance. We will remain focused on accelerating innovation across our portfolio as we continue to deliver value to customers and shareholders."

Cisco Stock Performance

CSCO's stock has outperformed the market in the last few years. Since the beginning of the year, CSCO's stock is up 13.2% while the S&P 500 Index has increased 5.8%, and the Nasdaq Composite Index has gained 8.4%. Moreover, since the beginning of 2014, CSCO's stock has gained 52.5%. In this period, the S&P 500 Index has increased 28.1%, and the Nasdaq Composite Index has risen 39.7%. According to TipRanks, the average target price of the top analysts is at $35.89, representing an upside of 5% from its March 7 close price of $34.20, however, in my opinion, shares could go much higher.

CSCO Daily Chart

(Click on image to enlarge)

CSCO Weekly Chart

(Click on image to enlarge)

Charts: TradeStation Group, Inc.

Valuation

Cisco's valuation metrics are good, the trailing P/E is at 17.60, and the forward P/E is low at 13.71. The quick ratio is extremely high at 3.60, and the price to cash ratio is exceptionally low at 2.39. Furthermore, its Enterprise Value/EBITDA ratio is low at 9.22, and the PEG ratio is at 1.42.

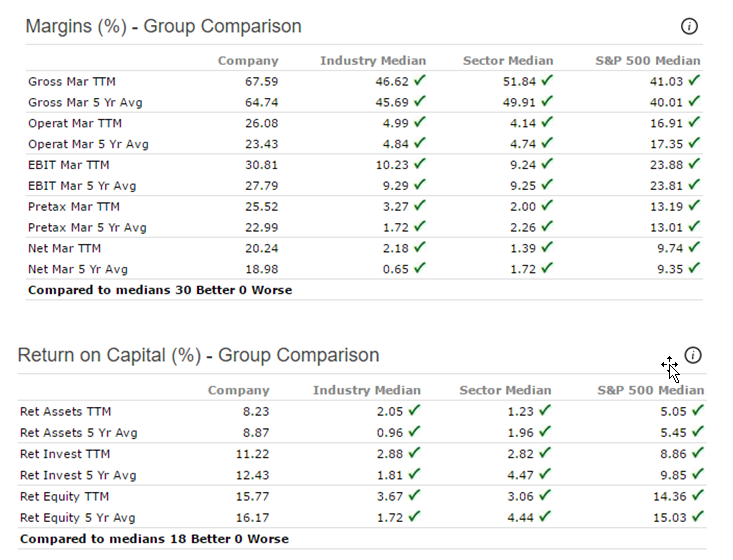

In addition, CSCO's Margins and Return on Capital parameters have been much better than its industry median, its sector median and the S&P 500 median as shown in the tables below.

(Click on image to enlarge)

Source: Portfolio123

Dividend and Share Repurchase

In the second quarter of fiscal 2017, Cisco paid about of $1.3 billion in cash dividends. What's more, the company repurchased about 33 million shares under its stock repurchase program at an average price of $30.33 per share for an aggregate purchase price of $1.0 billion.

Cisco has been paying uninterrupted dividends since 2011. The forward annual dividend yield is pretty high at 3.39%, and the payout ratio is at 50.6%. The annual rate of dividend growth over the past three years was high at 18.9%, and over the last five years was very high at 49.3%.

To summarize, considering Cisco's compelling valuation its high growth prospects and the generous dividend, CSCO's stock is a smart long-term investment. The average target price of the top analysts is at $35.89, representing an upside of 5% from its March 7 close price of $34.20, however, in my opinion, shares could go much higher.

Disclosure: I am long CSCO stock.