Cisco Stock: Why It’s Not A Buy Yet

Cisco Systems (CSCO) is one of the largest technology companies in the world. Over the last couple of years, it has managed to achieve a strong dividend growth track record, which is why the stock is part of many retail investors’ portfolios.

Cisco stock has a current dividend yield of 2.5%. It is among the Dow 30 stocks that pays a dividend to shareholders.

At the current price, Cisco’s shares look substantially overvalued, though, which is why we believe that it is not a good time for investors to enter or expand a position right now.

The company is attractive fundamentally, though, and it has a solid growth outlook over the coming years, which is why Cisco would be a buy at or below our fair value estimate of $45 per share.

Business Overview and Recent Events

Cisco is a technology company that designs, manufactures, and sells networking and products as well as other communications related products around the globe. Its main offerings include switching and routing products, data center equipment, wireless access points for a number of different technologies such as voice and video, and products that are related to the emerging Internet of Things.

On top of that Cisco has been building out other businesses over the last couple of years, partially via acquisitions, including security products such as network and data center security, threat protection, web security, and more.

Cisco was founded in 1984 and is headquartered in San Jose, California. Cisco’s share price has risen substantially over the last year, but shares still trade well below the highs that the company’s stock reached during the “dot.com” bubble of the late 1990s and early 2000s.

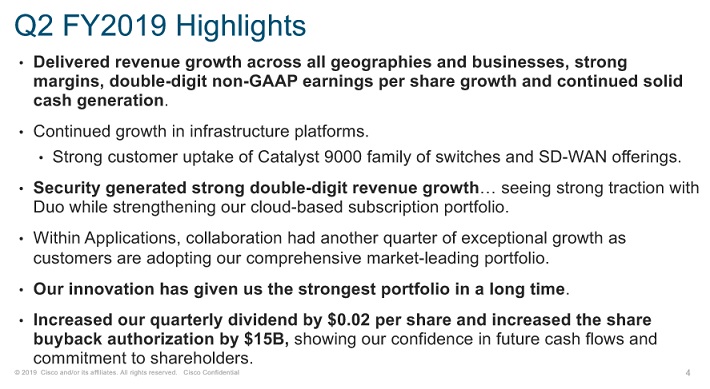

Cisco reported its second quarter (fiscal year 2019) earnings results on February 13. The company reported that it had generated revenues of $12.5 billion during the quarter, which beat the analyst consensus and represented a growth rate of 4.7% versus the previous year’s quarter.

Cisco continued to generate the vast majority of its revenues with product sales, which made up $9.3 billion, or roughly three-quarters of the company’s sales, while service revenues totaled $3.2 billion during the quarter.

(Click on image to enlarge)

Source: Cisco investor presentation

Cisco points out that growth during the second quarter was broad-based, as the company was able to grow across all geographies and business units. Cisco’s security business, in which the company has invested billions of dollars through acquisitions over the last couple of years, grew by an impressive 18% during the second quarter. Growth in security shows that management’s decision to prioritize this high-growth market with its M&A strategy was justified.

Adjusted for the divestment of its Service Provider Video Software Solutions business (SPVSS), which Cisco has divested in October 2018, Cisco has managed to grow its company-wide revenues at an even faster pace of 7% compared to the prior year’s quarter.

Cisco’s growth was highly profitable, as the revenue growth rate of ~5% translated into an operating earnings growth rate of 7%, while earnings-per-share grew at an even more attractive rate of 16% versus the previous year’s quarter. Earnings growth came on the back of a substantially lower share count, thanks to Cisco’s fast pace of share repurchases throughout the last year. Cisco’s earnings-per-share totaled $0.73 during the second quarter.

Guidance for the third quarter of fiscal 2019 is positive, as Cisco expects revenues of $12.9 billion to $13.2 billion, which would represent a growth rate of 4%-6% versus Q3 of fiscal 2018. Earnings-per-share, meanwhile, are forecasted in a range of $0.76 to $0.78 for the third quarter. All in all, Cisco’s second quarter was strong, and management’s comments about what to expect from the third quarter earnings report were very positive as well.

Cisco also raised its dividend from $0.33 per share to $0.35 per share in February, which represents a 6.1% growth rate. This was a reduction in the company’s dividend growth rate relative to the 13.8% and 11.6% hikes that the company announced during 2018 and 2017, respectively.

Growth Outlook

With the majority of its revenues still coming from connectivity products such as routers and switches, Cisco’s growth is still heavily dependent on how these markets perform over the next couple of years. The secular megatrends are favorable for Cisco.

An increasing amount of people around the globe use an ever-growing amount of devices and tech products that have access to the Internet, and smartphones become ever more important in our daily lives. This means that the underlying demand for connectivity solutions remains very strong, and this will likely remain true going forward.

Cisco is the market leader in the switching and routing industry, although competitors such as Arista Networks (ANET) have been gaining market share in some product segments over the last couple of years.

The strong underlying demand for connectivity products such as switches and routers is reflected in the fact that the Ethernet switching and routing market recently climbed to an all-time high. Cisco owns more than half of this market, the company’s very strong market position will likely mean that Cisco will be able to benefit from ongoing market growth to a significant degree.

Analysts forecast that the commercial router market will grow by 7% annually, between 2017 and 2021, which bodes well for Cisco’s future revenue growth in this product segment. The data center switching market is forecasted to grow at a meaningful page of ~5% annually between 2018 and 2023 as well, which means that it looks like Cisco should be able to continue its growth across these business segments.

Cisco’s security business is significantly smaller than its products businesses, but security is a highly attractive growth market, where market participants can count on compelling market growth rates. The global cybersecurity market is forecasted to grow from $153 billion in 2018 to $248 billion in 2023, which represents a growth rate of more than 10% annually.

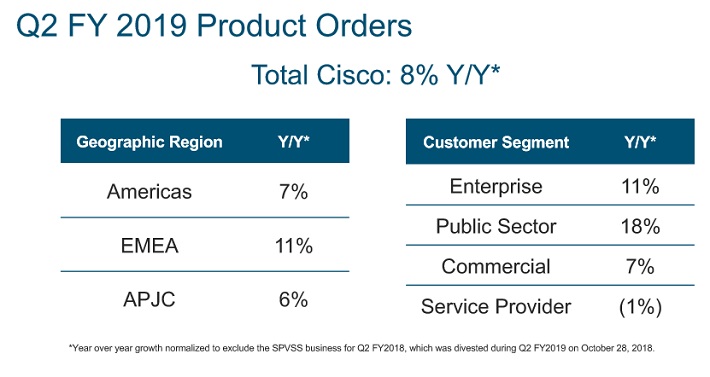

With Cisco’s dominance in the switching and routing markets, which will continue to grow, and with its exposure to the higher-growth security market, the long-term growth outlook is promising. The short-term outlook is also positive, as evidenced by the following image:

(Click on image to enlarge)

Source: Cisco investor presentation

Cisco has achieved highly compelling order growth rates during Q2, which should result in substantial revenue growth during the foreseeable future, as this increased order intake is converted into sales. When we also factor in management’s guidance for Q3, it looks like the second half of fiscal 2019 could be a highly successful one for Cisco.

Cash Generation And Shareholder Returns

In recent years, Cisco’s earnings-per-share growth has not only rested on business growth, but the company has also shrunken its share count substantially during that time frame. In 2009, Cisco had 5.8 billion shares outstanding. That number fell to 4.7 billion shares at the end of fiscal 2018.

The approximately 20% reduction of the company’s share count has increased each share’s portion of the company’s net earnings by ~25% during that time frame, which equates to an annual tailwind of roughly 2.5% to the company’s earnings-per-share over those nine years.

(Click on image to enlarge)

Source: Cisco investor presentation

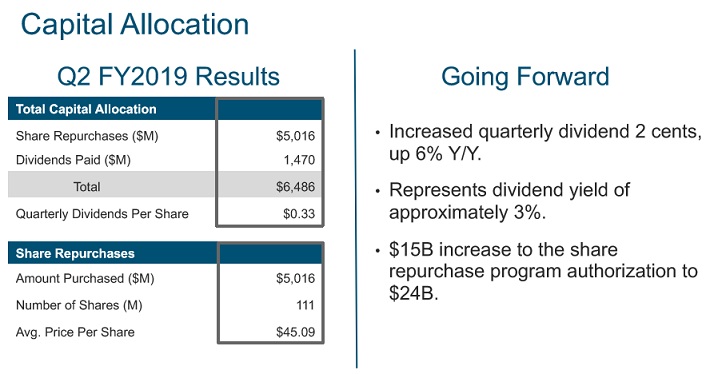

Cisco continues to repurchase shares at a substantial pace, just in February the company has announced that its current share repurchase authorization would be expanded by $15 billion, to $24 billion. $24 billion in share repurchases equate to almost 10% of the company’s market capitalization, which shows that Cisco’s shareholder return program is quite large relative to the company’s size.

One should note that not all shares that Cisco buys back do really lower the company’s share count, though, as Cisco also issues a large number of shares to its employees and executives regularly. According to the company’s most recent 10-K filing, the current stock incentive plan allows for the issuance of up to 694 million, or roughly 15% of the company’s share count (over a time frame of more than one decade, though).

This still shows that Cisco has to spend several billion dollars a year just to keep the share count from rising, which is why numbers such as the $5.0 billion that Cisco has spent on share repurchases during the most recent quarter should be taken with a grain of salt.

Cisco does not only return cash to its owners via share repurchases, but the company also pays a steadily rising dividend to its owners. Cisco started to make dividend payments in 2011. Since then, the dividend has been increased by several hundred percents. At a level of $0.35 per share per quarter, Cisco’s stock offers a dividend yield of 2.5% right now.

This is more than what investors can get from the broad market and many other technology stocks, yet still, this alone is not a reason to buy Cisco’s shares, especially when we account for the fact that Cisco’s shares have been yielding almost 4% just a couple of years ago. During the last couple of years, Cisco’s share price has risen at a faster pace than its dividend, which has made the dividend yield decline substantially during that time frame.

Valuation And Expected Returns

Cisco will earn about $3.00 during the current fiscal year, according to our estimates. With shares trading for $56 right now, this means that Cisco’s stock is valued at 18.7 times this year’s profits right here. This is not a low valuation in absolute terms, and it is also not a low valuation at all, relative to how Cisco’s shares were valued in the past.

Over the last decade, Cisco’s stock has been trading at a low-teens price to earnings multiple mostly. Thanks to the fact that the company’s growth has accelerated during the recent past, partially due to Cisco’s exposure to the security market, we believe that a somewhat higher valuation of 15 times the company’s net profits would be justified. This still means that shares are substantially overvalued right here, though as Cisco trades 25% above our fair value estimate of $45, which would be in line with a 15 times earnings multiple.

If Cisco’s valuation declines to a 15 times earnings multiple over the coming five years, this would have a negative impact of 4.3% on Cisco’s annual total returns. Cisco’s valuation, which is well above the norm right now, could pose a substantial headwind to shareholder returns in the coming years.

Our forecast sees Cisco’s earnings-per-share growing at a pace of 6% annually going forward, which will be somewhat offset by a declining valuation multiple. Combined with a dividend that yields 2.5% right now, investors can thus expect annual total returns of 4%-5% over the coming five years.

This would not represent a poor return at all, yet this is also not what we deem an attractive proposition, even when we account for the fact that Cisco looks like a low-risk investment. After all, Cisco is an established company that is active across diverse geographic markets, that benefits from secular megatrends, and that has a grade, low-risk balance sheet with a cash position of more than $40 billion.

If Cisco’s share price declined to $45, investors could purchase at that level, and we would expect annual total returns in the high single digits from there, as multiple compression would not be a headwind, while earnings-per-share growth of 6% and a higher initial dividend yield of 3.1% would allow for total returns of ~9% a year. This is a total return pace that we deem attractive, especially when accounting for Cisco’s low-risk nature.

Final Thoughts

Cisco has been a high-flyer during the dot.com bubble, after that the stock languished for a very long time. More recently its share price has been growing at a compelling pace, partially driven by the fact that Cisco’s earnings growth has accelerated and that its move to a subscription model (for software revenues) has been highly successful.

The earnings growth outlook is positive, but due to the fact that Cisco’s shares look quite expensive right here, we do not deem Cisco a buy right now. We rate Cisco a hold for those that want a low-risk investment with a strong balance sheet, but we believe that investors should buy Cisco if its share price declines below $45.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more