Chip Stocks Soar To Record After Taiwan Semi Unveils $28BN Spending Blitz

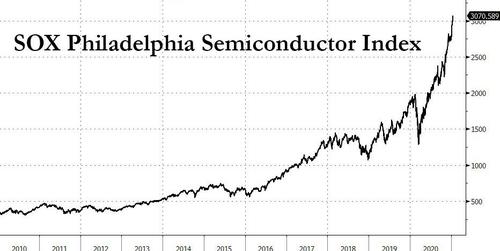

Chip equipment stocks soared on Thursday, and the Philly Semiconductor index surging to a new all-time high, after Taiwan Semiconductor Manufacturing (TSMC), the world’s largest contract chipmaker, disclosed massive capital spending plans up to $28 billion into capital spending this year which Bloomberg called "a staggering sum", aimed at expanding its technological lead and constructing a plant in Arizona to serve key American customers.

(Click on image to enlarge)

The company announced that its capital spending for 2021 would be between $25 billion to $28 billion, compared with $17.2 billion the previous year. About 80% of the outlay will be devoted to advanced processor technologies, suggesting TSMC anticipates a surge in business for cutting-edge chipmaking. One reason for this is that Intel, which on Wednesday announced a new CEO, is said to be contemplating a departure from tradition and outsourcing manufacture to the likes of TSMC.

For the December quarter, the company reported net income of NT$142.8 billion ($5.1 billion), up 23%, and well above expectations of NT$137.2 billion. That contributed to a 50% increase in full-year profit, the speediest rate of expansion since 2010. Sales in the December quarter climbed 14% to a record NT$361.5 billion, according to previously disclosed monthly numbers, helped in part by robust demand for Apple’s new 5G iPhones.

TSMC also expects revenue of $12.7 billion to $13 billion this quarter, well ahead of the $12.4 billion average of analyst estimates. According to Bloomberg calculations, that will power mid-teens sales growth this year, though that’s roughly half the pace of the increase in 2020.

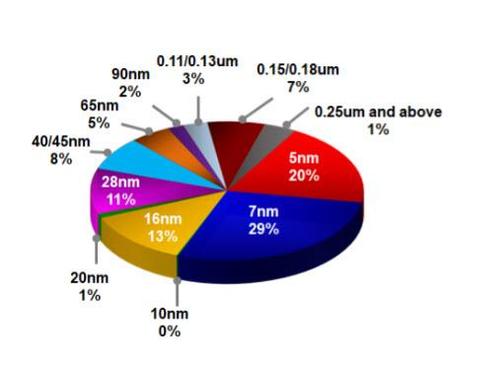

The fourth-quarter results revealed growing contributions from TSMC’s most-advanced 5-nanometer process technology, which is used to make Apple’s A14 chips. That accounted for about 20% of total revenue during the quarter, more than doubling its share from the previous three months, while 7nm represented 29%. By segment, TSMC’s smartphone business contributed about 51% to revenue, while HPC was at 31%.

(Click on image to enlarge)

As Bloomberg reports, "the massive scale of TSMC’s envisioned capex plans -- more than half its projected revenue for the year - underscores TSMC’s determination to maintain its dominance and supply its biggest American clients from Apple Inc. to Qualcomm Inc."

At 52% of projected 2021 revenue, the chipmaker’s planned spending would be the sixth-highest among all companies with a value of more than $10 billion, according to data compiled by Bloomberg. The outlay may also ramp up pressure on Intel, whose budget for 2020 was roughly $14.5 billion.

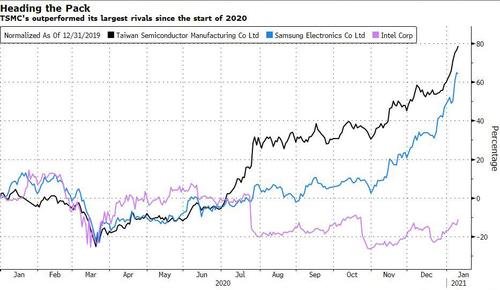

TSMC’s ADRs jumped as much as 11% on Thursday. Supplier ASML Holding NV rose as much as 5.6% on Thursday.

(Click on image to enlarge)

TSMC's strong spending plans served to lift most public chipmaker stocks: KLA, Applied Materials gained more than 7% on Thursday, while Lam Research, MKS Instruments, ASML, and Brooks Automation rose more than 5%

“There is a very high level of confidence in potential demand in future years for TSMC to commit as it has for 2021 (and likely 2022 as well),” Stifel analyst Patrick Ho wrote in a research note, in which he called the spending plan “really big.” According to Ho, equipment stocks with some of the highest exposure to the chipmaker include Applied Materials, KLA, and Nova Measuring Instruments. Entegris is also well exposed on the materials side and 5G strength should benefit back-end stocks like Teradyne and FormFactor, he said.

TSMC execs didn’t address reports about potential orders from Intel on Thursday, saying that they don’t discuss specific customers. Intel had held talks with the Asian firm after a series of in-house technology slip-ups, people familiar have said, though it’s unclear whether the company may pivot after the appointment of a new CEO.

Meanwhile, exec reiterated that construction on a planned $12 billion plant in Arizona will begin this year, without specifying how much of the planned budget for this year will be allocated to the project. The factory will be completed by 2024, with initial target output of 20,000 wafers per month, though the company envisions having a “mega scale production site” over the long term, Chairman Mark Liu said.

Even as TSMC grows, foundries such as TSMC, UMC, and Globalfoundries aren’t expanding fast enough to meet the pandemic-induced spike in demand for gadgets. Those bottlenecks snarled the flow of chips not just to cars, but also Xboxes and PlayStations and even certain iPhones. TSMC is by far the most advanced of the foundries responsible for making a significant portion of the world’s semiconductors, serving the likes of Qualcomm and NXP Semiconductors NV, which also supply the mobile and auto industries.

Indeed, as rivals like United Microelectronics fall behind and Semiconductor Manufacturing International Corp. struggles with American sanctions, TSMC’s pivotal role is likely to expand in 2021. The company has been racing to meet demand from larger-volume electronics clients, exacerbating a severe shortage of automotive chips that’s forcing firms like Honda Motor Co. and Volkswagen AG to curtail production, according to Bloomberg.

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more