Chart Review: Stock Market Fades Weigh Heavily On ACIA, MTCH, UPS

The S&P 500 (SPY) yesterday opened the trading day strong but spent the rest of the day fading to a much smaller gain. (The percentage of stocks trading above their respective 40-day moving averages (DMAs), T2108 (AT40), ended the day with an ominous loss that leaves it hanging below the 70% overbought threshold). This near day-long fading action likely had an exaggerated impact on some stocks of interest and highlighted weaknesses in other stocks that I have pointed out in earlier posts. This fade created some interesting opportunities.

Acacia Communications (ACIA)

The Trump administration has lately caused a lot of churn and turbulence for some businesses as the administration’s latest round of trade and economic policies pick distinct winners and losers. This turmoil creates fresh trading opportunities. ACIA was a large victim when the administration denied Chinese telecom equipment maker ZTE the ability to buy U.S. technology for 7 years. In an apparent about face, President Trump tweeted about making ZTE whole. Accordingly, ACIA raced higher and almost finished reversing its loss from the anti-ZTE news. At its high, ACIA turned a bullish 50DMA breakout into an 18.6% gain. By the close however, the stock faded sharply enough to end with less than half that gain at 8.7% and the end of the breakout.

I tried to fade with puts when ACIA first rose into the gap down. I took another swing today as a potential “sell on the news” that the market seemed to anticipate with the steady recovery from the lows. At best, the good news from Trump puts ACIA back on course with its 20-month downtrend and/or the more recent trading range. On the upside, if ACIA manages to close above today’s intraday high, the stock could next break out above 200DMA resistance.

Acacia Communications (ACIA) experienced a gap and crap that turned a 50DMA breakout into a potential fakeout

Match (MTCH)

I just finished outlining the short-term bullish opportunity for MTCH. The momentum seemed to continue apace after the open until MTCH traded just under its downtrending 20DMA. The stock proceeded to sell off the rest of the day for a 6.0% loss on high volume. With no explanatory new news (none that I could find anyway), this reversal looks ominous. I was tempted to start accumulating shares but instead chose to go for a hedged trade of fistfuls of calls and puts on the assumption that some kind of big move lies ahead: a sharp reversal on no news or a continued implosion on the revelation of some big news.

Match (MTCH) hit its downtrending 20DMA and sold off for a 6.0% decline on the day.

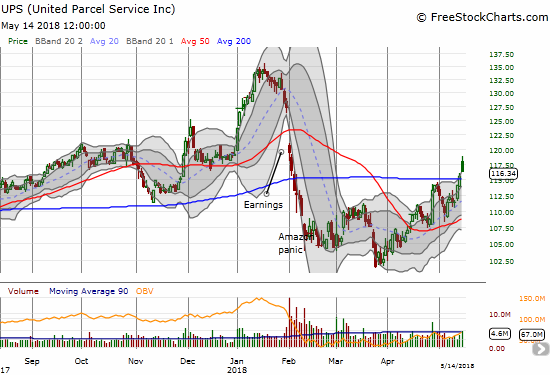

United Parcel Service (UPS)

An Amazon.com Panic sparked my interest in UPS. I eventually bought long-term calls to play out an eventual fade of the panic and a resumption of the secular long-term trends that support package delivery. Today, UPS finally broke out above its 200DMA in a very bullish move. The stock was able to muster up just enough stamina to prevent the fades in the market from pressing the stock out of its breakout. While there is a risk of a headfake here, I like the steady progress UPS is making off the lows. Under most other circumstances I would consider today’s breakout to be a bullish confirmation of the trade.

United Parcel Service (UPS) broke out above its 200DMA but faded from its highs.

Source for charts: FreeStockCharts.com

Disclosure: Long ACIA puts, long UPS calls, long MTCH calls and puts.

Follow Dr. Duru’s commentary on financial markets via more