CGC: Better Safe Than Sorry

Canopy Growth

*Source: Bloomberg

Is the cannabis market a bubble or is it a worthy long-term investment? As a brand new industry I see the market relying more on future hopes than the underlying value of most companies today.

With that said, I see Canopy Growth (NYSE: CGC), as an overvalued company caught in the market’s craze over the “new big thing”. I have found the company to be overvalued by at least 30%, I think the market has incorrectly overemphasized the future growth of the company as well as the possible medicinal properties of cannabis and worldwide economic stability. Additionally even if growth in the cannabis segment speeds up, by legalization in the US at faster-than-expected rates, I think there is still at least a 30% - 35% downside in the stock.

Catalysts supporting a possible future drop in share price include the increasing market share of the black market, economic slowdown, uncertainties surrounding federal legalization in the US and overemphasizing the Canopy – Acreage deal.

Company Background and Overview

Canopy Growth Corporation, formerly Tweed Marijuana Inc., is a cannabis company based in Smiths Falls, Ontario. In May 2018, Canopy became the first cannabis-producing company to be listed on the New York Stock Exchange.

CGC is the largest cannabis company in the world with a market capitalization of $11.5 billion. It produces diversified products in the medical and recreational markets. To date, Canopy Growth has secured the necessary regulatory approvals to export cannabis or cannabis materials to Australia, Brazil, Chile, Czech Republic, Denmark, Germany, Jamaica, Lesotho, Poland, Spain, South Africa, the United Kingdom, and the United States.

*Picture taken from the latest 10Q presentation

Investment Thesis

Macro outlook

According to various market studies, the cannabis industry is expected to grow between 23.9% and 37% CAGR by 2024-25. This growth is fueled mainly by the growing medicinal properties of marijuana, various recreational uses, faster-than-expected state legalization and advances in genetic development. The research I have done shows that the biggest growth expectations in the industry rely on the growth of the US market, this is why I have tied the company’s future growth to the country’s expected economic performance and marijuana usage.

As the US has started to dramatically increase its hemp licenses and promote hemp as an agricultural commodity, companies have begun to take advantage. In January 2019, Canopy Growth was granted a hemp processing and production license by New York State, with the plant set to open this fall, with this I expect the company to extend its reach in the US, thus increasing market share and getting ahead on some of its competition. On top of all this the future plans of the company include opening new hemp processing facilities in seven other states. By 2022, legal cannabis revenue in the U.S. market is projected to hit $23.4 billion (73% of the global market).

Souce: BusinessInsider

Even though the number of states where recreational and/or medical marijuana is increasing, economy has begun to slow down. With the US-China trade war continuing and corporate earnings and investments sliding, negative effects on growth in the marijuana industry could follow.

With that said as legal business grows, so does the threat of the black market. The illegal market totals about $70 billion in sales in the US in 2019. In 2016 these numbers were $46.4 billion which means that the black market has grown by 51% for 3 years. For comparison in 2018 legal marijuana sales in the US were only $10.4 billion. This makes the illegal market 7 times bigger, mainly driven by two things, lower price points and despite government supply regulations, selling unlimited amounts of cannabis. If this trend extends it could continuously stagnate the growth of the industry for the next years to come.

Despite the emerging marijuana market in the US, I think there is significantly more downside in CGCs revenue growth in future years than the market has priced in. Even with a more positive outlook, as the economy slows down and black market is on the rise, I expect CGC’s revenues to suffer in the future. Factoring lower-than-projected average growth rates of 44.27% per year for the next 10 years, my analysis implies a valuation of ~$11-$12 at best vs CGC’s current share price of $28.

Reinvestments

As Canopy growth invests in acquisitions and infrastructure it has continued burning cash going down to $1.8 billion. For growth to take place, reinvestments have to be made, this is why here I have explored the possible returns and risks in the investments Canopy made in the last twelve months.

Earlier this year CGC acquired Europe's largest cannabinoid-based pharmaceuticals company, C3. The company specializes in manufacturing and distributing Dronabinol. The drug is an appetite stimulant, antiemetic, and sleep apnea reliever, approved by the FDA as effective against HIV/AIDS-induced anorexia and chemotherapy-induced nausea and vomiting. Despite this acquisition increasing CGC’s footprint in Europe it bets on an uncertain future, slow gains and also opens itself to competition rivalry from big pharma. With companies like Novartis looking into medical marijuana it will be harder for C3 to make a long-lasting footprint on the market.

Later CGC acquired the well-being company This Works, which offers natural skincare and sleep solution products. The company is in a highly competitive industry which includes companies like Johnson & Johnson (JNJ), Kao Corporation (TYO: 4452), Procter and Gamble (NYSE:PG) and L’Oréal (EPA: OR). This may put the company at a disadvantage as I expect bigger companies to start offering CBD based skincare and wellness products, lowering prices and thus shrinking the margins of This Works in the future. Another issue may be the limited patent possibility. Right now recreational and medical cannabis is still illegal in many places and patenting such products may be difficult, thus leading to a patent war in the future.

The most important step that Canopy Growth made is a market expansion deal with Acreage. The companies agreed that Canopy Growth will pay $3,400 million to acquire Acreage Holdings a Canadian holdings company headquartered in New York. The deal will be finalized if and when the production and sale of cannabis becomes federally-permissible in the United States. Despite the big synergy between the companies the cash spent today I think will hinder the company’s ability to grow in the US more rapidly until the deal comes to fruition.

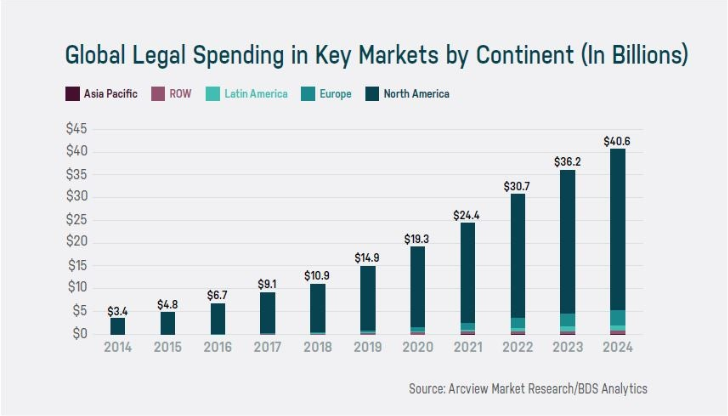

The company also reported increased infrastructure spending, CGC spent C$212 million to improve production in Europe. I do find this as a good move in a more long-term perspective, as the European market grows, but as you can see below according to the legal spending forecast, Europe will be just a small fraction of the Global market:

Source: Greenentrepreneur

Despite the stock reaching its 12 month lows, with so much burnt cash, there could still be potential for downside in the coming future. I do not see any short term (3-5 years) gain and I expect the rapid acquisition policy to hinder the short term ability of the company to increase its cash position.

In order to keep up with competition I expect the company to continue aggressively increasing its reinvestments. This could effectively slow down their sales to capital ratio growth, thus resulting in an increase from 0.08 in year 1 to 0.48 in year 10, which is way below the US median of 0.7 for the pharma industry.

Operating Expenses

In the last quarter CGC reported a lower gross margin which the company attributed to operating expenses for facilities not yet cultivating or processing cannabis. Despite this the company expects gross margins to surpass 40% by the end of the fiscal year. According to their TTM numbers the company right now has a gross margin of 53% and I think management’s expectation are very probable. Despite all this I expect operating margins to continue in negative territory for at least the next 5 years as I do not expect reinvestments in R&D and marketing to have any significant short-term return.

In regards to marketing ROI, while other companies have billboard, online or TV ads, recreational marijuana brands and producers do not have the same luxury, due to the Cannabis Act. The act prohibits most of the promotional activities, thus limiting the mass awareness the campaigns try to achieve. This will lead companies to spend double or triple the amount to achieve the same effect alcohol companies have on their customers.

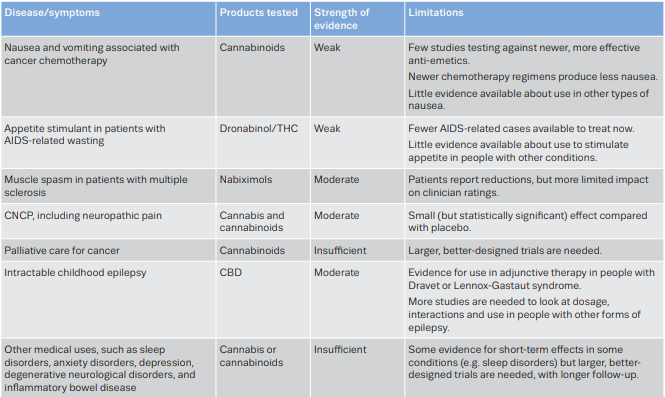

In regards to R&D ROI, according to a research done by the European Monitoring Centre for Drugs and Drug Addiction, the current evidence on the effectiveness of cannabis and cannabinoids as medicine is quite limited and fragmented and cannabinoids are usually used as adjunctive treatments.

Source: EMCDDA

This will put expanding R&D investments of CGC (like in Beckley Research’s clinical trials) under risk as returns from such ventures are limited positioned in an uncertain market.

As more markets approve the use of cannabis based products, R&D and marketing costs will continue to increase. I expect this to weigh heavily on margins and the company to continue enduring operating losses for at least the next 5 years.

Catalysts

Black Market Growth and economic slowdown

The growth of the black market coupled with economic slowdown could have a devastating effect on stock prices in the future.

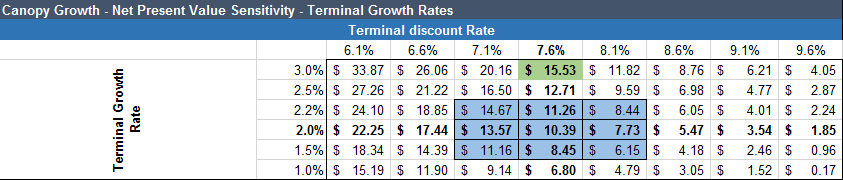

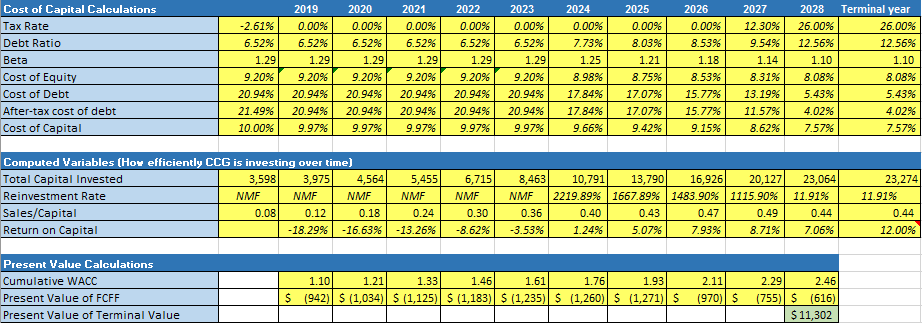

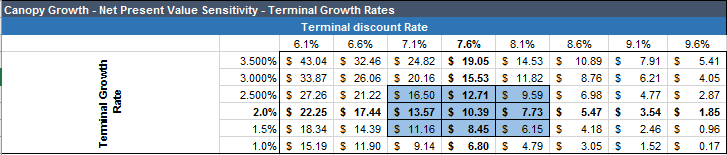

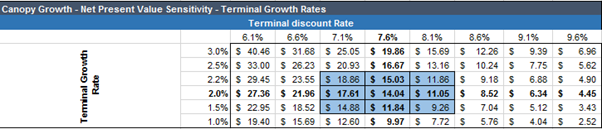

These 2 catalysts may result in terminal losses for legal cannabis growers. The indefinite growth of the black market can make a difference of over 5$ per share in the base case assumption in this analysis (terminal discount rate of 7.6%, revenue growth at 70% initially, falling to 3% by FY 2028 and terminal Revenue growth rate of 2%):.

With the growth of the black market, CGC’s implied share price is in the $8 - $11 range:

*Source: Author’s own estimates

Even if this catalyst doesn’t come to fruition the initial price of ~$14 - $15 per share still sits way below the market price.

Slower than expected state legalization

The slowing down in legalization can have a very big effect on CGC. A slowdown in expected revenue growth will slow down the reinvestment rate of the company, which in turn will force the company to lose market share to its competitors on the market.

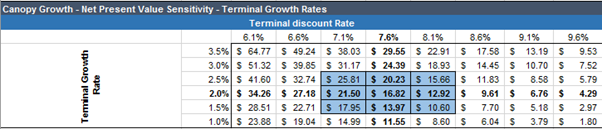

*Source: Author’s own estimates

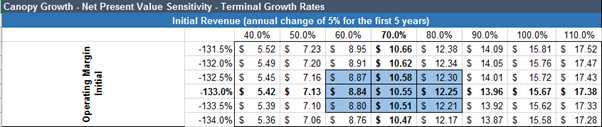

While this table does not directly show the impact of cumulative revenue and revenue growth over 10 years, you can see the impact of even a 10% change in initial revenue growth in FY 2019: approximately 10% in extra revenue growth translates into around $1.71 in extra per share value.

Even if slower than expected interstate legalization doesn’t happen, I believe a 70% revenue growth, falling by 5% per year to 50% in year 5 is reasonable, which would imply valuations of $10 - $12 per share tops.

Acreage acquisition

In the last TTM Acreage had an operating loss of $123 million. Using the DCF method I got an equity value of $902.8 million and a share price of $10.5 per share with fully diluted shares outstanding of 85.640 million. For the analysis I have used the assumptions listed below:

- An average WACC for the next 10 years of 9% - This WACC represents an ERP of 5.93% representative of the US market, a levered beta for the US Pharma industry of 1.39 reaching 1.10 in mature growth

- An average revenue growth for the next 10 years of 47.9% per year and 2% terminal growth – This assumption takes into account that more and more US states will continue legalizing both medical and recreational marijuana use. It also represents the growing black market which represents 7 times the sales of legal marijuana and the expected slowdown of the economy.

- Operating margin starting negative and reaching 23% at the terminal year – This represents lower costs in the future as the company continues optimizing its operations.

- Sales to capital ratio starting at 0.08 and reaching 0.62 at year 10 – This assumption represents a lower reinvestment rate in stable growth years (from year 6 to year 10) I assume that in these years the company will start reaping the benefits of its investments made in the past (in the high growth years).

If this acquisition was to happen today, and I add the company’s equity value to Canopy, CGC’s stock price would look like this:

*Source: Author’s own estimates

This does not seem impressive and CGC still seems overvalued. The company’s first earnings announcement post-acquisition here will be significant, mainly because the market may overreact and send the stock price hgher than expected.

Catalyst Summary: All of the above represent catalysts that could lower CGC’s stock price to my targeted $8-$11 per share in the next 24 months. Even if one or more is false, I think there is still potential downside in the stock, but it will be reduced to the higher range.

Valuation

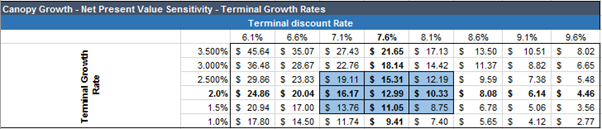

I have valued Canopy Growth using the DCF analysis.

The discounted cash flow analysis uses the following “base case” assumptions:

- An average WACC for the next 10 years of 9,32% - This WACC represents an ERP of 5.93% representative of the US market, a levered beta for the US Pharma industry of 1.39 reaching 1.10 in mature growth

- An average revenue growth for the next 10 years of 44% per year and 2% terminal growth – This assumption takes into account the continued legalization of both medical and recreational marijuana use in Europe and the US. It also represents the growing black market which represents 7 times the sales of legal marijuana and the expected slowdown of the economy in both US and Europe.

- Operating margin at an average of -23% for the next 10 years (starting negative, reaching a positive number at year 6 of 2.46% and reaching 23% at the terminal year) – This represents lower costs in the future as the company continues optimizing its operations. But it also takes into account the slower than expected benefits from both R&D and marketing.

- Sales to capital ratio starting at 0.09 and reaching 0.46 at year 10 – This assumption represents a lower reinvestment rate in stable growth years (from year 6 to year 10). I do not expect the company to reach the average US sales to capital of 0.7 for the pharma industry, due to the rapid acquisition and reinvestment policy and the growing competition in the market. I expect these three things combined to hinder CGC’s revenue growth if they stop their continued reinvestment.

*Source: Author’s own estimates

Please keep in mind that the analysis is highly sensitive to the revenue growth, operating margin and reinvestment policy. However I think these numbers are quite fair, I have set the capital expenditure number to lag revenue growth by 2 years, since I do take into account the fact that the big reinvestments made today are going to bring benefits in the future.

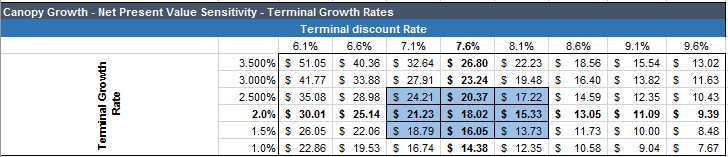

Here are the most relevant sensitivity tables based on key variables in this analysis, such as the discount rate, terminal growth rate, and revenue growth and margins:

Source: Author’s own estimates

If of course my revenue growth assumption misses the mark, I take into account an average of 5% higher revenue growth per year for the first 5 years. The stock price of CGC would look like this:

*Source: Author’s own estimates

Which still puts it bellow its share price of ~$28 today. From the table above it can be seen that the potential downside exceeds the potential upside of the stock.

The key takeaway from this analysis is that, due to macroeconomics, high operating expenses and growth of the black market, even if one or more catalysts turn out to be false it will be almost irrelevant to the share price and that additional possible upside from Acreage doesn’t contribute substantially to implied valuation.

Risks

Faster than expected Federal legalization

Faster-than-expected Federal legalization could have a very positive effect on all cannabis stocks and the numbers shown in the investment thesis are very dependent on this. If this comes to fruition the company might grow revenues closer to an average of 80% for the first 5 years and it will make the deal between Acreage and CGC come to fruition. In reality this will also force the company to reinvest more money earlier in order to grow and surpass competition, which in terms will not change the underlying value of the stock by much and it will stay arguably in the same range of $10 - $13 per share.

A faster-than-expected Federal legalization might also help lower the company’s marketing expenses since it could also waver off the Cannabis Act limitation on commercialization. Even if this happens companies will still have to compete with one another for an open and free market which in turn will continue to keep marketing expenses at a higher than average percentage.

Of course there is a chance that the market may overreact to the news and send the price sky high. I find the chances of this to be very slim, since Congress hasn’t really made significant progress on the issue in the past 9 months.

Acreage/CGC taking bigger than expected market share

As shown above the investment thesis is heavily dependent on competition and if both Acreage and/or CGC are able to surpass competition the numbers in the investment thesis could change.

It is possible that Acreage retail locations surpass their competition like Green Thumb Industries (GTI) and bring better-than-expected value. It is also possible that the expansion in Europe and US brings better-than-expected results. If either of these assumptions come to fruition I expect the per share value to be closer to $17 – $26 per share in the case where initial revenue growth goes to an average of 66% per year for the first 5 years, rather than the 60% I’ve assumed:

*Source: Author’s own estimates

Operating costs improvement

As shown in the analysis, the numbers are highly dependent on a slow operating margin recovery. Due to several acquisitions made it is possible that the company improves its operations faster-than-expected, this in turn will lower costs as a percentage of revenues and will increase operating margin recovery. This is what the numbers would like if I set operating margins at an average of -0.38%(becoming positive after year 3 rather than year 6, everything else being equal as shown in the “Valuation tab”):

*Source: Author’s own estimates

At the higher end of this valuation you could argue that the company is fairly valued today. I find this scenario highly unlikely, with the expected construction of seven new hemp processing facilities in other states and increased marketing expenses.

Key Takeaways

As the cannabis industry is new, trendy and volatile sharp and unexpected price changes I think are bound to happen at some points. I find the industry to be generally overvalued and would expect big tobacco to hold the major share of the market.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I have no ...

more