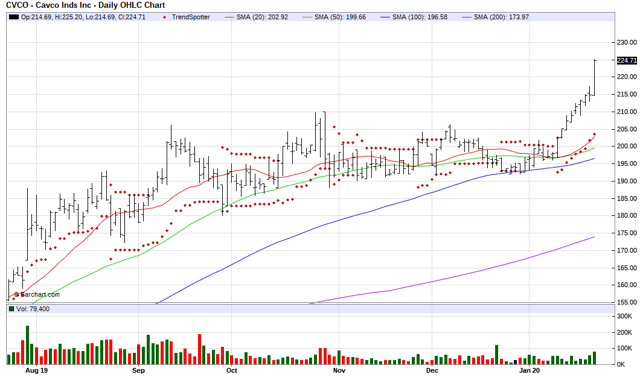

Cavco Industries - Chart Of The Day

The Barchart Chart of the Day belongs to the mobile home company Cavco Industries (CVCO). I found the stock by using Barchart's powerful screening tools to find the stocks with the highest Weighted Alpha and technical buy signals then sorted that list by the most frequent number of new highs in the last month. Next, I used the Flipchart feature to review the chars for consistent price appreciation. Since the Trend Spotter signaled a buy on 1/13 the stock gained 9.54%.

Cavco Industries, Inc. designs and produces factory-built housing products primarily distributed through a network of independent and Company-owned retailers. The Company is one of the largest producers of manufactured homes in the United States, based on reported wholesale shipments, marketed under a variety of brand names including Cavco Homes, Fleetwood Homes, Palm Harbor Homes, Fairmont Homes, and Chariot Eagle. The Company is also a leading producer of park model RVs, vacation cabins, and systems-built commercial structures. Cavco Industries is focused on building quality, energy-efficient homes for the modern-day home buyer. Green building involves the creation of an energy-efficient envelope including higher utilization of renewable materials. These homes provide environmentally-friendly maintenance requirements, high indoor air quality, specially designed ventilation systems, best use of space, and passive solar orientation.

Barchart's Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can, therefore, change during the day as the market fluctuates. The indicator numbers are shown below, therefore, may not match what you see live on the Barchart.com website when you read this report.

Barchart technical indicators:

- 100% technical buy signals

- 51.10+ Weighted Alpha

- 53.41% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 16 new highs and up 16.41% in the last month

- Relative Strength index 83.62%

- Technical support level at 217.87

- Recently traded at 224.71 with a 50 day moving average of 199.66

Fundamental factors:

- Market Cap $2.01 billion

- P/E 26.26

- Revenue expected to grow 9.60% this year and another 7.70% next year

- Earnings estimated to increase 13.20% this year, an additional 11.60% next year and continue to compound at an annual rate of 30.00% for the next 5 years

- Wall Street analysts issued 1 strong buy and 1 buy recommendation on the stock

- The individual investors following the stock on Motley Fool voted 59 to 22 that the stock will beat the market

- 848 investors are monitoring the stock on Seeking Alpha

Disclosure: None.