Cathie Wood's Ark Sinks Below $40 Billion As Bloodbath Continues

As tech limps away from its worst market pummeling in months, traders are keeping the pressure on Cathie Wood with PLTR and COIN still under pressure, and ARKK declining below 100. Although Wood has very publicly doubled down, there's been talk that short sellers see blood in the water, and won't let up until Cathie pukes.

Her flagship ARK Innovation fund has fallen 35% from the highs, and the slide continued Thursday, sliding below the key psychological level of $100 thwarting an early rally as it soon emerged that Wood's ARKK fund was spoiling the party for the tech recovery.

For investors who are wondering whether Wood might soon be forced to hit the gas on the selling, here's something to consider: Ark Investment Management just saw the AUM of its ETF lineup drop below $40 billion. Here's Bloomberg.

The founder of Ark Investment Management LLC now controls $39.7 billion in her U.S. exchange-traded funds, down from more than $60 billion at a peak in February, according to data compiled by Bloomberg. The firm is now the 11th largest issuer in the U.S., compared with seventh place earlier this year.

To be sure, practically all of this is due to the decline in many of Ark's top picks, and data shows her army of true-believing retail bagholders are either holding on, or doubling down (just like Cathie did).

ARKK continues to drag down everything

— zerohedge (@zerohedge) May 13, 2021

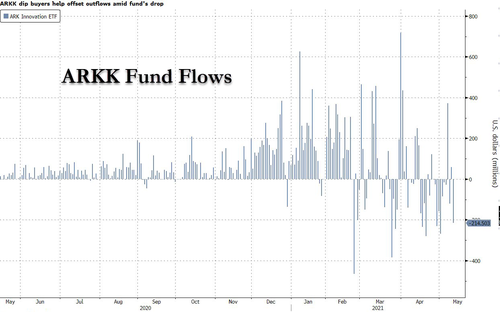

Ark's funds have drawn a large fan base of retail traders who own the fund in their Robinhood or WeBull accounts, and these traders haven't abandoned Cathie en masse like some bears had expected. Only $76M was pulled from the fund in April, and only $301M has followed in May, compared with the $7.1 billion added during the first three months of the year. In fact, the firm’s ETFs have still taken in a net $15.3 billion so far in 2021. The eight-product lineup -- six actively managed funds and two tracking indexes -- has roughly only lost a net $800 million since the end of February.

Of course, if it didn't still have institutional backers, Ark would be in trouble. BBG data confirms that retail money comprises just $1.1 billion of the $28 billion added to the family of funds since November. The rest of that money - the overwhelming bulk of Wood's AUM - is institutional money.

"It appears that investors still believe in Cathie Wood’s philosophy and think possibly the pullback is short term," said Mohit Bajaj, director of ETFs for WallachBeth Capital.

For better or worse, retail traders still believe in Cathie Wood, and many have doubled down. That means if Wood blows up, it won't only be the evil hedge funds who suffer.

"In periods when Ark ETFs have seen large redemptions, retail investors have actually bought the dip, further highlighting the institutional-retail divide," wrote analysts Ben Onatibia and Giacomo Pierantoni.

Wood has stood firm throughout the down turn, repeatedly insisting that she invests with a five-year time horizon, while daring to reveal in a TV interview that Bill Hwang, the founder of Archegos, the family office that imploded evaporating a multibillion-dollar fortune and saddled Credit Suisse and other banks with billions of dollars in losses.

Others are wondering whether it's time to buy the dip. Could ARK really sink lower?

Some are now questioning just how long the funds’ drop will last, especially as dip buyers step in. ARKK rose 1.5% in early trading in New York.

“It has become oversold on a technical basis,” said Matt Maley, chief market strategist at Miller Tabak & Co. “The weak hands have already sold, so we’re now in the ‘wait and see’ mode. If Ark funds can bounce strongly, the all clear flag will be raised.”

Those who are familiar with Wood are likely aware that she has been very public about her Christian faith. Maybe the big man upstairs will soon pay her back in kind?

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more

Doubled Down????

????????????????????????????