Caterpillar Looks Set To Be A Winner

Caterpillar (CAT) is a stock I’ve posted an analysis on many times before, partly for its ability to act as a bellwether for major construction projects and the housing market in general. It was also one I studied both pre and post the Trump win of four years ago and one which has delivered consistently over the longer term. Now with the election dust settling and spending about to begin, this stock could be one of the big winners once again.

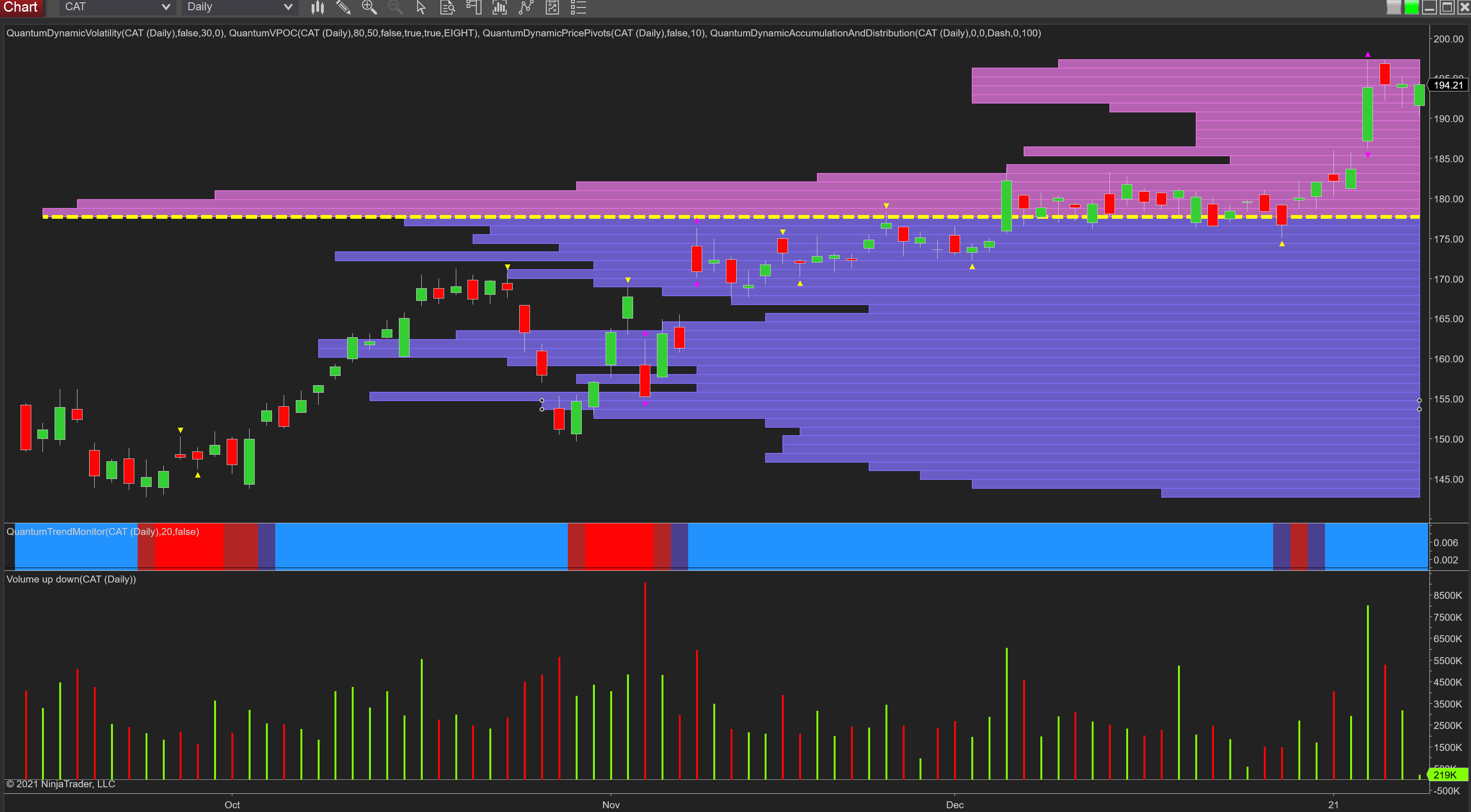

The daily chart is perhaps the most revealing for the shorter term and intraday trader, as the price action and volume of the 6th January sent a strong signal of what to expect over the following days with the volatility trigger in evidence and as such signaling a possible reversal or at the very least congestion within the spread of the candle. The volatility indicator is premised on the average true range, and therefore judges when price action has exceeded this parameter for the history set. However, it is the volume which then confirms the presence of the market makers who have spiked the price higher on excellent volume, drawing investors in, before selling heavily into the latecomers to the party and revealed in the upper wick of the candle, before reversing the price action into the spread of the candle over the following days. Patience is now required as we can expect to see price oscillate around the $195 per dollar share, and for the longer-term bullish momentum to continue, it is a clearance of the high of the volatility candle at $197.28 which will then open the way for an attack of the $200 per share level and on higher in the longer term.

However, we are of course entering earnings season and the next quarter release for Caterpillar is due on the 27th of January with an ES estimate of $1.46 per share and with the previous quarter coming in better than expected and surprising the markets, we could be in for a repeat performance this time around. Too early to benefit from any major infrastructure spending by the incoming administration, but longer-term certainly one to watch.

(Click on image to enlarge)

Disclaimer: Futures, stocks, and spot currency trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in ...

more