Carnage Over?

What a long week it has been. What a long month it has been. What a long year it has been. Can we start over?

Markets continue to be super volatile and that’s expected at the end of massive selling waves which this turned out to be. Remember, a snowball is biggest the second before it hit the bottom. Through Thursday this wave has lasted 31 days which puts it in rarefied air. We usually see selling waves last 18-25 days. Thursday was the first day that stocks closed above where they opened since May 4th. It has been an ugly decline since that date as well as since the wave began on March 30th.

When markets plunge and I am looking for the bottoming process to begin I can always find dozens of indicators and trends to share. The other day, I wrote about Finding a Few Rays of Sunshine.

I remember in March 2020 almost everything I keep track of in my entire universe was signaling to buy and flashing green. To be fair, that began on March 10, 2002, a full 13 days before the bottom and lots more downside pain yet to be felt. In 2018, just a few days before the ultimate low everything was jumping off the screen to buy.

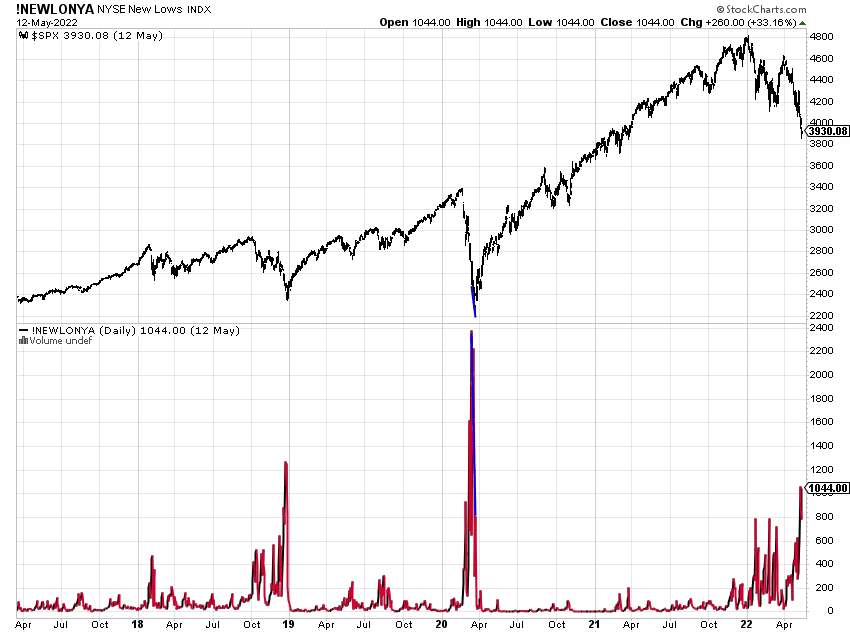

Today, we are in a similar set up. Almost everything I look at is screaming to buy. Let me share a chart of the number of stocks making new lows on the NYSE. You can see in the lower that it hit 1044 on Thursday. I chose to include 2020 and 2018 so no one can excuse me of fitting a narrative. Readings above 1000 are rare and extreme although the chart would be even more accurate if it was on a percentage basis.

Nonetheless, the message is the same. Stocks have fell to historic levels of oversold. In the worst of markets, the stock market is set up for a face-ripping short-covering rally over the coming weeks or so. It is also possible the final bottom has been seen, but that is not something I am counting on right here. The Fed can’t pivot yet although they will later this year. Huge asset sales are still to come.

(Click on image to enlarge)

As I write all the time, the first bounce should see whatever fell the most rally the most. And pre-market indications say that stocks will snapback at the open. If that holds let’s see what leads and how the market reacts after the initial buying binge ends.

On Thursday all five major stock market indices scored a new low. All sectors except for materials, energy, utilities, and staples scored new lows. High yield bonds saw new lows. The NYSE A/D Line was at a new low. In other words, the markets have a create deal of repair left. This will not be a “V” bottom like 2020 and 2018 when the Fed quickly pivoted and “risk on” returned overnight. It is going to take some time.

We heard from Fed Chair Powell last night that 1/2% rate hikes are in line for the next two meetings and taming inflation may require some pain. Well, DUH! What did he think the markets have been telling us? We will see if the elusive soft landing so deftly engineered in 1994 and 2018 remains possible. I still do not think recession is in the cards for 2022. 2023 may be a different story.

I still love bonds from earlier this week and that’s the best risk/reward play for the next few quarters or more. The economy is slowing.

On Wednesday, we bought GIBAX, CBRAX. We sold BMRN, QCOM, ITA, IWM, levered inverse S&P 500, and some levered NDX. On Thursday, we bought AVGO, TLRY, and more QQQ, SOXL, and levered NDX.

Real spring has finally hit New England. Let’s hope the sun and 60s-70s last a while. I had a little bit of ankle cleanup the other day so my golf game will have to wait a few weeks. Instead, I get to drive the little guy to baseball in central MA for a Saturday doubleheader and then Sunday games back in CT. If all goes well I will get a video out by Monday.

Please see HC's full disclosure here.