CarMax In 2019

By Quad 7 Capital and Bad Beat Investing staff

CarMax (KMX) operates in a highly competitive market, and is involved in selling a range of used vehicles in the United States. Carmax was once a growth stock, but with the pace of growth slowing, we look at the name as more of a value proposition these days. Even better from our firm's perspective, the stock has been a magnificent trading stock, with very clear swings up and down, allowing the savvy traders among our membership to trade this name frequently. From a longer-term investment standpoint the stock really remains a 'market perform' type investment. After the recent market malaise the stock has flirted with trading in the high $50 range, and we think you are getting a fair price at those levels based on forward expectations. In the upper $50 range, the stock is attractive both from a trader's perspective and in the medium-term. In this column, we will discuss recent performance trends and our expectations for 2019 and beyond.

The chart

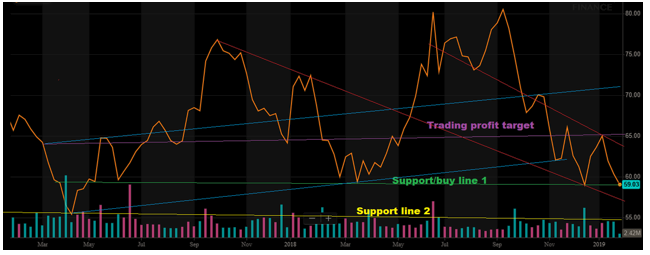

The reason this has been a favorable stock for traders is that shares of CarMax are volatile. In the last year two years shares have really been in a $60-$75 trading range:

Source: BAD BEAT Investing

Our team at BAD BEAT Investing provided this chart, and highlights in simple fashion the lines to really look for. With shares below $60, and considering the performance of the name, we think the stock has upside. We see $58 as a support and buy line with a longer-term support just under $55.

While traders continue to scalp profits thanks to swings in price, for longer-term investors there is no doubt that the action has been a bit frustrating of late. For our followers, we think money can be made in this name, by buying in the high $50 range and selling at around $65. Longer-term, we see a return to $70, based on valuation. This is where performance comes in. The company continues to grow, but a bit more slowly than in the past. At this point we see the competition as heavy, but there is some value here. Let us discuss performance and key issues surrounding the name.

The biggest risk to the company is the sector it operates in

CarMax sells used cars. That is the business. The company is profitable, and sales are growing over time, but this is a crowded market. Carmax has to battle for market share with major auto dealerships, local/independent used lots, and even online sales of cars with home delivery. CarMax has done an outstanding job by branding itself and increasing sales year-after-year.

Now, to further bring in revenue, the company also sells vehicles that do not meet its retail standards for consumers to licensed dealers through on-site wholesale auctions. It also sells some new vehicles under special franchise arrangements. Another source of revenue comes in the form of offering financing alternatives through its own finance operations, where higher rates versus local banks are often possible to achieve. The company also dabbles in other high margin services like offering appraisals, vehicle repairs, and offering extended warranties.

While the company has been successful, just about everything it does is performed by countless competitors. So, that is the market risk here in this name. The larger question here of course is whether the performance and future expectations warrant a purchase below $60 per share.

Revenue growth

Let's talk performance. CarMax recently reported that its Q3 revenues were up, thanks to growing net sales and operating revenues. While the pace of sales growth had been slowing somewhat in recent quarters, the growth is still very positive. This comes despite the saturated operating environment. Total revenues were $4.30 billion, just missing consensus by $20 million, and increasing 4.6% from last year:

We say that growth is slowing because the company used to put up consistent double-digit sales increases in past years. That said, Q3 revenues have recently perked up. {C} In terms of underlying performance, the company saw certain points of weakness that you should be aware of. Let us delve a bit more into the sales to understand where the revenues are being generated.

Digging into sales

Total used vehicle unit sales grew 2.3%, but comparable store used unit sales fell 1.2% versus the prior year's third quarter. This latter figure caught us slightly by surprise. So what happened? Well, the comp number was driven by strong performance last year that was a result of Hurricane Harvey. While there was slightly lower store traffic and slightly higher sales conversion this quarter, back in Q3 2017, a handful of Houston-area stores drove comparable store used unit sales following Hurricane Harvey. If we back out these stores adjusted comparable store used unit sales would have grown by 2.3%. That makes more sense given the overall volume.

We do have some concerns with traffic. Recently we had seen declines in store traffic in past quarters and this decline in traffic has continued. This is something to be aware of. Where the company really delivered was converting the traffic it did see into actual sales, which is why we stated there was better conversion. Further, the wholesale business remains solid. Wholesale vehicle unit sales were up 10%, following up a strong Q1 and Q2 which saw sales rise 10% and 14%, respectively. Note, these sales had been flat in most quarters of 2016 into 2017.

The higher margin sections of the business are also performing well. We are talking about the service plans and financing side of the business. Here, revenues were up 12.1% year-over-year. Extended protection plan revenues increased a strong 11.1% versus the prior-year level, reflecting growth in used volumes, as well as declines in costs from the plan providers. Net third-party finance fees which had been pressured for many quarters even rose thanks to a better sales mix, and were up $4.4 million from the year-ago period. From a revenue standpoint, this was a pretty solid quarter. How did earnings look?

Earnings commentary

Increasing sales are welcomed, but what about the costs to generate them? Well, considering basic cost expenses, total gross profit increased a strong 5.6% to $569.2 million in the quarter. This was a result of profit growth across all of Carmax's operating segments. Used vehicle gross profit was a bit light in terms of growth as it rose 1.5%. This increase was entirely driven by volume. We say this because used vehicle gross profit per unit fell from the prior-year period, coming in at $2,133 per vehicle, down from $2,148 last year. While this is relatively stable, it adds up over many sales. Wholesale vehicle gross profit was up 11.9% driven by volumes. We were pleased to see profit per unit rise as well. It came in at $949 versus $933 last year. Our 2019 goal is to see an average for used units at $2,180 and $960 for wholesale in terms of gross profit. This would go a long way toward a profitable 2019.

To generate higher sales, expenses rose. Although gross profit was up we should also look at other lines of expenses. Selling, general and administrative expenses increased 2.5% to $409.5 million, primarily reflecting the 11% increase in the company's store base in a year's time. Advertising expenses continue to be high but we believe these ad campaigns and car inventories are helping move volumes. Interest expense rose to $18.8 million from $17.4 million in the prior year's quarter. However, compensation expenses fell 2.5%. Factoring these issues in, EBIT rose 5.8% to $247 million. When factoring in a more favorable tax rate and the better top line, the bottom line surpassed expectations. Net earnings widened to $190.3 million, while earnings per share were up to $1.09. This is growth of 35% from last year, which is why we like shares here; earnings are growing.

We like the stock under $60 in 2019

The chart is supportive and the oscillation of the stock suggests we are getting a good entry point. But the performance results have us bullish, so long as the performance can continue. Sales are increasing, even if the pace of increases has slowed from year's past. There are still weaknesses to look for like declining profit per unit sold in some cases, and growing expense lines, but we like what we see here.

What about value? From a valuation perspective, we need to examine price relative to forward expectations. Looking ahead, we see earnings per share coming in around $4.70 for the current fiscal year based on the current trajectory of the company, growth in store count, mildly positive comps, and factoring in comparable growth in expenses.

At $58.01 the stock is trading at just 12.3 times forward earnings with one quarter to go. That is not cheap, relatively speaking to the market, the sector as a whole, and for this company itself. When trading we have always wanted to purchase the name at less than 14-15 times forward earnings. From this perspective, shares are really attractive. Returning to the chart above, that is a level that also has a technical support as well. As for an early look to the next fiscal year, assuming the current growth trajectory remains, factoring in another 10% growth in new stores and a 1.5%-3% increase in comparable store sales, we think revenues could hit $19.3-$19.8 billion. From an earnings per share basis, this would be growth from $4.70 to some where between $5.100 and $5.20 not counting share repurchases.

We should also factor in the ongoing share repurchase program. While we are not factoring in future repurchases to our expectation for earnings, we will point out that during the quarter, CarMax repurchased 3.7 million shares of common stock for $254.3 million. Coming into Q4, the company reauthorized another $2 billion in repurchases, so it has around $2.38 billion to spend on these. As such, we can expect earnings per share to benefit slightly from repurchases moving forward.

Take home

The name has been a great vehicle for trading, while investments in the last year or so have mostly moved sideways. In either case however, we think the name is set to move higher and getting shares here at $58.01 is great proposition.

No positions in any stock mentioned