Cannabis Central: Canopy Growth Reports Q1 Revenue Up 249% But Net Loss Up 1,308% - Stock Tanks

Canopy Growth Corporation (TSX: WEED; NYSE: CGC) announced its financial results for the first quarter ended June 30, 2019 on Wednesday after the market closed and the market did not take kindly to what it reported as the stock has dropped 20%. Nevertheless, the Company believes that the pre-revenue investments in the works are necessary to position the Company to generate a significant and sustained increase in shareholder value over the long-term.

Q1 Financial Highlights

All financial information below is in Canadian dollars unless otherwise indicated.

- Net Revenue increased by 249% to $90.5 million coming from the following segments:

- Cdn. Recreational Business-to-Business: 55.7%

- Cdn. Recreational Business-to-Consumer: 11.7%

- Total Cdn. Recreational Revenue increased by 94% over Q4 2019

- Cdn. Medical Revenue declined by 38% to a 14.5% share of total net revenue

- Total Cdn. Net Revenue increased by 248% to 81.9% of total net revenue

- Int'l Medical increased by 209% to 11.7% of total net revenue

- Other Revenue increased by 1467% to 6.4% of total net revenue

- Gross Margin declined 28% to 15% primarily due to:

- the impact of operating costs related to facilities not yet cultivating cannabis or producing cannabis-related products, or which had under-utilized capacity that resulted in adjustments related to the net realizable value of inventory.

- a shift in product mix away from higher-margin, advanced manufactured products.

- Operating Expenses increased by 215% as:

- Marketing & Sales expenses increased by 161% due to:

- increased staffing in retail stores in Canada;

- increased number of employees in marketing and sales functions supporting our domestic and international markets;

- increased investments aimed at driving brand awareness and educating consumers through various marketing and promotional campaigns in preparation of the launch of the second phase of recreational cannabis consumer products in Canada, as well as CBD products in the United States, both expected later this year.

- R&D expenses increased by 963% due to:

- the hiring of advanced-degree researchers and engineers, in areas of vape R&D, plant genetics, applied technology and cannabis-based medical therapy clinical research;

- higher compensation costs associated with the teams conducting research and development activities;

- costs associated with advanced product and system development and testing and

- costs associated with conducting external laboratory testing and clinical trials for CBD-based human and animal health products.

- General & Admin expenses increased by 218% due to increased costs associated with:

- enhancing finance and information technology capabilities,

- higher public company compliance and regulatory requirements, and

- administrative costs associated with expanding operations.

- Acquisition-related costs increased by 595% due to:

- higher merger and acquisition activity during the current period, most notably entering into and implementing the plan of arrangement with Acreage and

- closing the acquisitions of C3 and This Works.

- Share-based compensation expenses increased by 190% as a result of:

- the continued increase in the number of stock options granted to employees, which is primarily related to the increase in the number of employees of the Company from approximately 1,400 at June 30, 2018 to approximately 3,850 at June 30, 2019.

- Outstanding stock options increased from 19.0 million at June 30, 2018 to 30.7 million at June 30, 2019 and

- the grant date fair value of the stock options has increased over the past year, which is primarily attributable to the Company's higher stock price.

- the continued increase in the number of stock options granted to employees, which is primarily related to the increase in the number of employees of the Company from approximately 1,400 at June 30, 2018 to approximately 3,850 at June 30, 2019.

- Depreciation & Amortization expenses increased 327%

- Marketing & Sales expenses increased by 161% due to:

- Adjusted EBITDA loss increased by 309% to $(92.0M) and up $5.7M versus Q4 2019

- Operations & Corporate Overhead expenses increased by 398%

- Strategic Investments & Business Development expenses increased by 847%

- Non-operating or under-utilized facilities expenses increased by 80%

- Net Loss increased by 1308% primarily as a result of the one-time, non-cash charge on extinguishment of warrant liability.

Additional Business Highlights

- Harvested 40,960 kilograms exceeding expectations in the quarter, an increase of 183% over Q4 2019.

- Filed 56 patent applications in the quarter, bringing the company's patent portfolio to an industry-leading 111 patents and 270 patent applications.

- On track to unveil portfolio of value-add, higher-margin products in various form factors in October 2019.

Events Subsequent to First Quarter Fiscal 2020

- On July 2, 2019 Mark Zekulin was appointed as sole Chief Executive Officer and Rade Kovacevic was appointed President of the Company upon the termination of Bruce Linton as Co-Chief Executive Officer of the Company. A search has commenced to identify Mr. Zekulin's replacement as the Company's Chief Executive Officer.

- On August 9, 2019 the Company announced that it had entered into an agreement to acquire all of the remaining unowned shares in Beckley Canopy Therapeutics, a global cannabinoid-based medical researcher.

About Canopy Growth Corporation

Canopy Growth is a diversified cannabis, hemp and cannabis device company with operations in over a dozen countries across five continents offering:

- distinct brands and curated cannabis varieties in dried, oil and Softgel capsule forms, as well as

- medical devices through the Company's subsidiary, Storz & Bickel GMbH & Co. KG.

The Company operates retail stores across Canada under its award-winning Tweed and Tokyo Smoke banners while its medical division, Spectrum Therapeutics:

- sells a range of full-spectrum products using its colour-coded classification system as well as single cannabinoid Dronabinol under the brand Bionorica Ethics,

- conducts robust clinical research and IP development.

Conclusion

The above Q1 results reflect continuing losses in Canopy Growth's core operations in Canada and Europe as the company transitions into a business serving a completely new sector and this change in direction has required that the company:

- make investments ahead of revenue in many new markets around the world, and

- make investments in R&D to generate future value as they build a portfolio of intellectual property that can be used to generate new profit streams in the future.

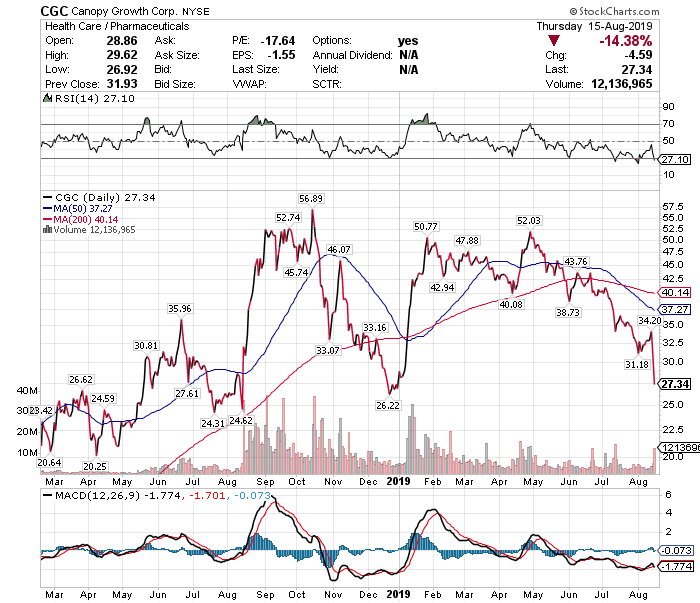

As the chart below shows, the transition has played havoc with its stock price which is down 47% since May 1st and down 20% in the last 2 days as investor react to Canopy Growth's Q1 financial report.

The Company believes, however, that these pre-revenue investments are necessary to position the Company to generate a significant and sustained increase in shareholder value over the long-term.

If you believe in what Canopy is endeavoring to do now might be an ideal time to buy some stock while it is at such a bargain-basement price.