Can Tesla Catch Facebook?

Small Caps Rebound

This is low volume trading at the end of the year which doesn’t mean much. Obviously, if you are taking profits and buying stocks, the prices are real, but we shouldn’t use this action to make conclusions about how January will go.

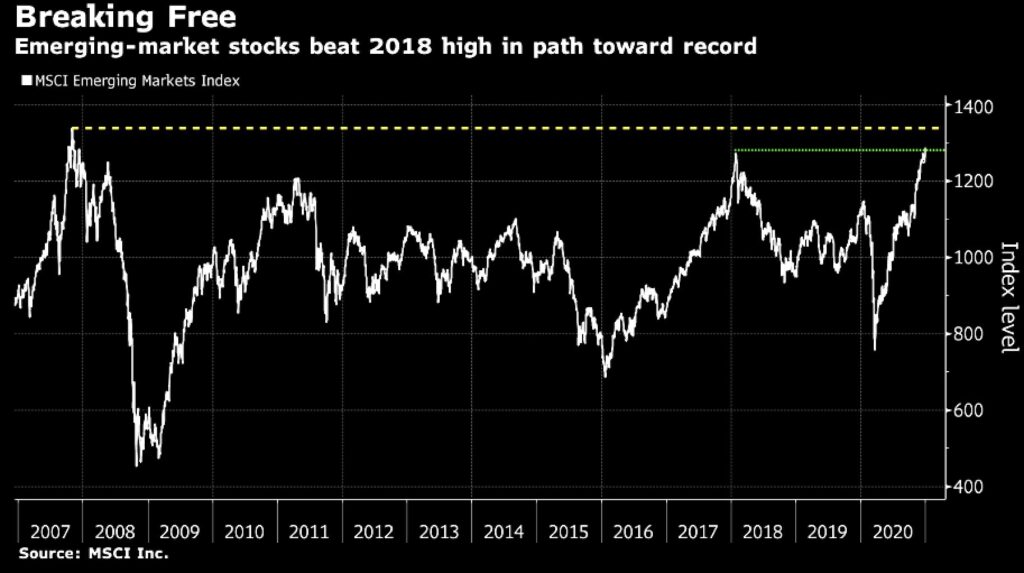

As you can see from the chart below, the MSCI emerging markets index is at its early 2018 high which is when overall market sentiment last was this optimistic. Some are quite bearish on secular growth stocks, but bullish on emerging market value stocks. The VWO emerging markets index was up 1.39%. The next stop is the late 2007 high. What a terrible run it has been for these stocks as they have provided no returns for about 13 years.

(Click on image to enlarge)

Maybe this isn’t a correction for small cap growth stocks as they increased 1.13% on Wednesday. The overall small cap index was up 1.05%. This time small cap growth beat the Nasdaq as the Nasdaq was only up 15 basis points. FANG stocks sagged as Facebook FB fell 1.77% and all the others (including Microsoft) fell.

Tesla (TSLA) lifted the large cap tech index on its own as it rose 4.32% which put it 22 cents away from the record high it hit because of the index buying. It helped lift the Nasdaq 100 which was up less than a basis point.

As you can see from the chart below, the gap between Facebook and Tesla’s market cap is shrinking. Tesla has a market cap of $657 billion and Facebook is at $774.5 billion. If you include stock options, Tesla is already above Facebook. It's good to add up Tesla and bitcoin to measure the speculation in the market.

Bitcoin’s market cap is now $536 billion and the entire crypto space is worth $760 billion. This is well over a $1 trillion bubble when you just add up these parts of markets.

(Click on image to enlarge)

Top Funds Don’t Stay The Same

The top funds are usually lauded when they are doing well. The media chases the top performers just like investors do. It takes intelligence to determine if the fund manager actually has a good process or if their outperformance is cyclical. Obviously, no one can outperform the market every year, but when the cyclical shift occurs, the leaders dramatically underperform. These aren’t small shifts.

The best performing fund managers press their luck in certain trends and when the trends reverse, they go down with the ship. If your goal is to make a lot of money and you don’t care about the long term results of your investors, it’s very easy to ride the trend higher. You can buy the stocks with the most growth and the highest beta. The fees managers make on great performance over the years make it so that even if they lose their job when the run ends, they are financially secure.

Furthermore, towards the end of the run, the winning fund managers start to believe their own stories. They think since it has gone on for so long that they are actually brilliant. You’re never as brilliant as you think you are when it comes to investing.

As you can see from the chart above, the top 20 funds per decade didn’t outperform the next decade (1970s to 1990s). The other aspect of this is that when a fund does well, it attracts a lot of capital which makes it difficult to invest the same way. Furthermore, their process gets copied so their alpha goes away. It’s much better to invest on your own or put your money in index funds than it is to chase the best performing managers.

By the time you get to the hottest funds, most of their gains will likely have already been realized. While fund managers only need a few years of great performance to get rich themselves, you can lose a great deal of your money if you follow the trend. You can never get that money back. If you lose half your money, you will eventually get it back. The problem is you won’t ever get the profits you could have made had you not lost the money in the first place.

Long Term Cycles

The crazy thing about the past few years is managers could have (some did) held the biggest tech stocks, mimicking the Nasdaq 100, and beaten the S&P 500 handily. Collectively, the gains are large and the strategy is very easy to execute. It takes practically no work. These are called index huggers.

They pretend to actively manage funds, but they just buy FAMNG stocks and call it a day. That’s not to say FAMNG stocks are bad investments. They have worked very well. However, when the cycle turns, these FAMNG addicted managers will be the last to sell the winners and move on to the new winners.

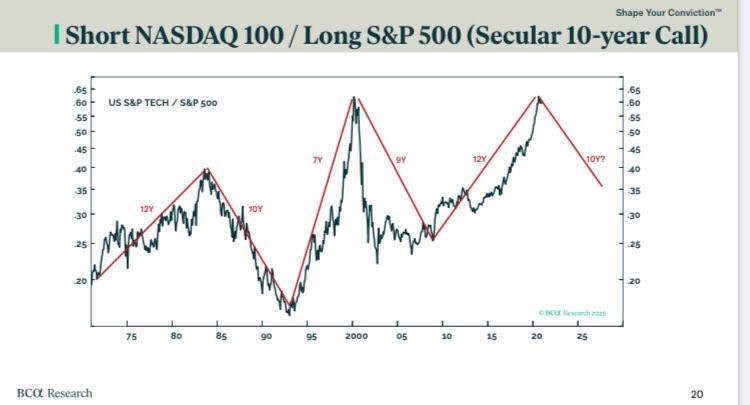

(Click on image to enlarge)

As you can see from the chart above, the Nasdaq 100 outperformed the S&P 500 for 12 years in the 1970s and early 1980s. Then it underperformed the market for 10 years. Next, we had the tech bubble in the 1990s in which the Nasdaq 100 dominated the market.

Then the tech bubble burst and the Nasdaq 100 underperformed for 8 years. Finally, we have had the past 12 years where the Nasdaq 100 has won big. The Nasdaq has been up 40% or more in the past 2 years for the first time since the late 1990s.

Conclusion

Tesla is on the verge of passing Facebook in market cap. That would make Tesla the 5th largest company in America. Tesla speculators have become rich using options. Normally risky strategies have worked out big. The bubble is over $1 trillion even if you just include the crypto space and Tesla. That doesn’t even include the other bubbles.

The fund managers who have done the best in the past 10 years will not do the next in the next 10. They won’t care because they will be rich anyway. However, if you have your money with them, you won’t get it back. We are about to see another cyclical shift where the Nasdaq underperforms.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more