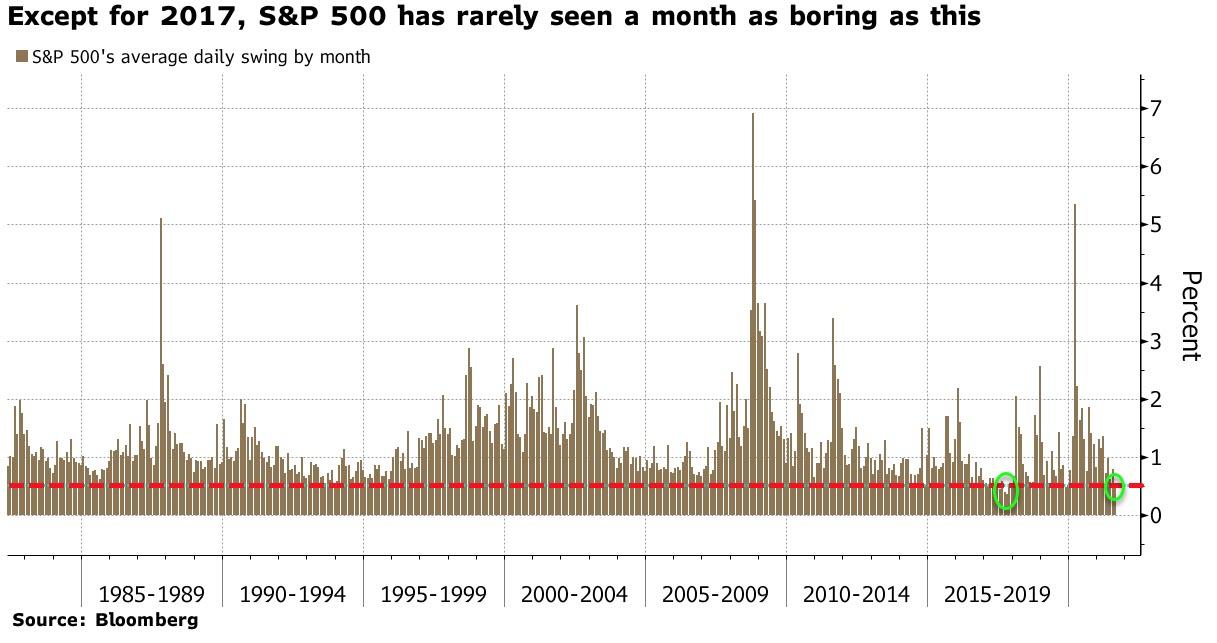

Calm Before The Storm? VVIX/VIX Ratio Hits Level Not Seen Since Before Last Market Crash

At the midpoint of August, the S&P500 appears to be on track for one of the quietest months on record. Despite weak Chinese data, Delta concerns, and the chaos in Afghanistan, stocks are levitated at all-time highs, but under the surface, anxiety is increasing.

Bloomberg points out that the implied volatility in VIX options continues to advance for five out of seven weeks even though VIX has sunk. This has put the ratio VVIX/VIX at a mind-numbing level of 7.5 on Monday, a reading that has preceded market crashes in the last several years.

(Click on image to enlarge)

Going back to 2017, when VVIX/VIX broke above 8, or near today's current level, it didn't end well for stocks.

A report compiled by Chris Murphy, co-head of derivatives strategy at Susquehanna International Group, wrote that since 2006 when the ratio trends higher - about ten days later - the VIX on average would surge by around 16%.

Some of the anxiety building behind the scenes is due to the Jackson Hole meeting of global central bankers next week. There's the possibility the Federal Reserve will announce or at least tell market participants about an upcoming tapering of its monthly $120 billion bond-buying program since the pandemic began.

Susquehanna's Murphy wrote in a note, "this ratio being stretched can be a sign that a subdued VIX does not tell the whole story (volatility expectations for the VIX are actually creeping higher)."

He added, "historically, the VVIX/VIX ratio does not remain this elevated for too long, and when the ratio reverts, the VIX spikes."

Nervousness could also be building as Goldman Sachs Scott Rubner told clients last month that August is the worst seasonal period for markets.

Another Goldman strategist, Christian Mueller-Glissmann, warned it'd been nearly 200 days since major equity indexes have had a 5% drawdown session.

(Click on image to enlarge)

Perhaps the VVIX/VIX ratio is signaling that a correction in S&P500 looms. All that needs to happen is a catalyst, and that could happen at Jackson Hole.

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more

Everyone always says it's going down and it never happens lol