Cadence Is A Strong Buy

Event Overview

The quiet period for Cadence Bancorporation (Pending:CADE) is set to expire on May 8.

Our firm has extensively covered stock price movement around the IPO quiet period expirations, which is a period of time post a company's IPO, in which its underwriters are unable to release reports or recommendations on the stock. We have found that underwriters are often eager to release positive reports once restrictions are lifted, and these reports lead to a temporary boost in stock price. Our firm has found above-market positive returns of 2-3% in a short window of time surrounding the expiration.

The likelihood of a stock bump around QP expirations are greater if: a strong team of underwriters backed the IPO and the stock price is up since its debut. Cadence Bancorporation's notable team of underwriters included: Goldman Sachs, J.P. Morgan, Sandler O'Neill, Keefe Bruyette Woods, Baird, Raymond James, Stephens Inc., SunTrust Robinson Humphrey, Tudor, Pickering, Holt & Co. Additionally, the stock has received a warm welcoming, up 13% from its IPO price. (pre-market session 5.1).

We recommend investing in Cadence Bancorporation ahead of Monday, the 5.8 expiration date, to benefit from the expected price increase.

We first covered Cadence Bancorporation on our IPO Insights Platform. Although the deal, was low profile, we were optimistic about the company and recommended investing.

Company Background

Texas-based commercial bank which offers a broad range of banking and wealth management services to: businesses, high net worth individuals, and business owners. It was formed in 2009 and completed three major acquisitions, including Cadence Bank (2011), the franchise of Superior Bank (2011), and Encore Bank (2012). As of its IPO, the bank had 66 branches in Alabama, Texas, Florida, Mississippi, and Tennessee. As of December 31, 2016, it had $9.5 billion of assets, $8.0 billion in deposits and $1.1 billion in shareholder's equity.

IPO Performance

The company went public on April 12, 2017, offering 7.5M at $20 per share, the midpoint of its estimated price range. It was the first bank to list in the US since September 2016 and the stock jumped 7% on its first day of trading. Since then it has remained relatively flat, and currently trades at $22.50 (Market Close 5.1).

Executive Management

Paul Murphy serves as Chairman and CEO, positions he has held since 2010. Previous work experience includes senior level positions at: Amegy Bank of Texas, Zions Bancorp, and Superior Bank FSB. Murphy received his bachelors from Mississippi State University and M.B.A. from the University of Texas at Austin.

Valerie Toalson serves as CFO and EVP. Previous experience includes: senior positions at: BankAtlantic, BOK Financial Corporation, Bank of Oklahoma, and Price Waterhouse.

Financial Highlights

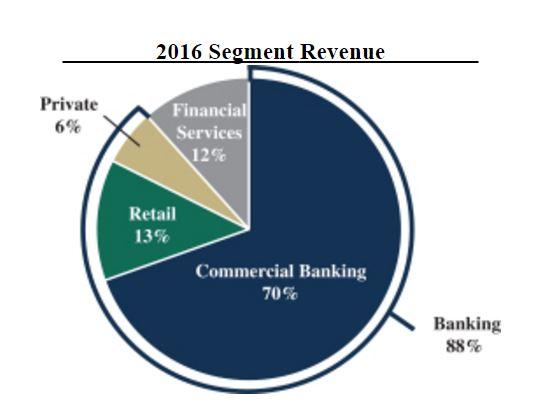

The majority of its revenue comes from its commercial banking activities. In 2016, commercial banking activities accounted for 70% of revenue.

(Click on image to enlarge)

(S-1/A)

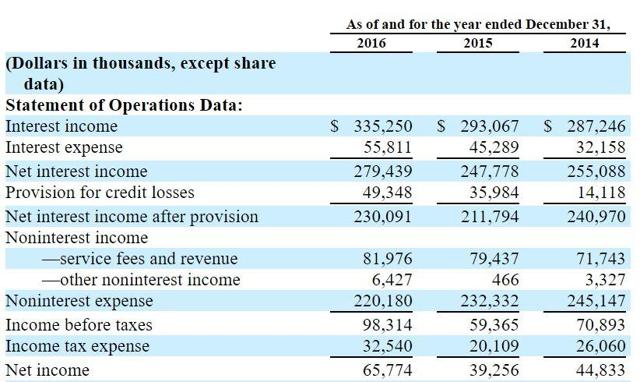

The company generated net interest income of $279.4M in 2016 versus $247.8M in 2015. Net income was: $65.8 million and $39.3 million in 2015 and 2016, respectively.

(Click on image to enlarge)

(S-1/A)

Conclusion: Buy Ahead Of 5.8

We were initially bullish on Cadence Bancorporation ahead of its IPO due to its strong fundamentals and view now as another buying opportunity. One of our hesitations on investing in the IPO was the deal was somewhat low profile and would get less coverage than other big deals going on that month.

We predict underwriters will be eager to make sure this stock isn't overlooked by publishing detailed positive reports and strong buy recommendations on the company.

We expect these reports to lead to a stock price increase in a short window of time surrounding the May 8 quiet period expiration, and we recommend making an investment prior to that date.

Disclosure: I am/we are long CADE.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with ...

more