Byline Could Sink When Lockup Expires

December 27, 2017 concludes the 180-day lockup period on Byline Bancorp, Inc.(NYSE: BY).

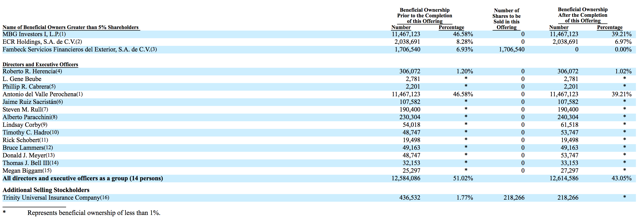

When the lockup period ends for Byline Bancorp, its pre-IPO shareholders, directors, and executives will have the opportunity to sell their 22.69 million currently-restricted shares for the first time. Currently, just a small number of the total shares outstanding - approximately 5.7 million - are currently freely transferable.

The potential for a sudden increase in stock traded on the secondary market may cause a significant decline in the price of Byline Bancorp shares in the short-term.

This group of pre-IPO shareholders includes three corporate entities and fourteen individuals.

Currently BY trades in the $21 to $22 range, slightly higher than its IPO price of $19 and its first day closing price of $20.05 on June 30.

Business Overview: Bank Holding Company

Byline Bancorp operates as a bank holding company for Byline Bank that offers banking products and services to commercial real estate and financial sponsors, small and medium sized businesses, and consumers in the United States. It offers certificates of deposit, time deposits, money market accounts, savings accounts, non-interest bearing accounts, interest-bearing demand products, and negotiable order of withdrawal accounts. In addition, Byline Bank offer commercial loan products and services such as revolving lines of credit, term loans, construction loans, treasury management products, small business administration loans; consumer lending products such as home equity loans, mortgage loans, and other consumer loans; and small ticket equipment leasing services. Its banking services are available directly, online and through mobile devices. As of March 2017, the company had 56 branch offices in the Chicago metropolitan area and one branch office in Wisconsin. The company was formerly known as Metropolitan Bank Group, Inc. and changed its name to Byline Bancorp, Inc. in 2015. Byline Bancorp, Inc. was incorporated in 1978 and is headquartered in Chicago, Illinois.

(Source: https://www.bylinebank.com/)

As of March 31, 2017, Byline Bancorp had consolidated total assets of $3.3 billion, total gross loans and leases outstanding of $2.1 billion, total deposits of $2.6 billion and total stockholders’ equity of $389.7 million.

Since 2013, Byline Bancorp notes in its SEC filing that it improved its asset quality while adding $1.3 billion in net originated loans and leases to create a more diversified and balanced loan and lease portfolio. The company the level of troubled loans and other real estate owned in its portfolio, and its non-performing assets, as a percentage of loans and real estate owned, declined to 1.0% as of March 31, 2017 from 28.2% as of March 31, 2013.

Financial Highlights

Byline Bancorp reported its 2017 financial highlights for the period ended September 30:

-

Net income of $9.8 million

-

Net interest margin improved to 4.18%

-

Loan originations of $135.8 million

-

Return on average assets improved to 1.17%

-

Loan to deposit ratio increased to 88.01%

-

Net interest income for the third quarter of 2017 was $31.4 million, an increase of $1.6 million from $29.8 million for the second quarter of 2017.

-

Net interest margin for the third quarter of 2017 was 4.18%, an increase of 16 basis points from the second quarter of 2017.

-

Non-interest income for the third quarter of 2017 was $11.9 million, a decrease of $1.3 million from $13.2 million for the second quarter of 2017.

Management Team

President, CEO, and Director Alberto Paracchini has served Byline Bancorp since 2013. His previous financial institution experience comes from Midwest Bank and Trust, Popular Financial Holdings, E-Loan, and Banco Popular North America. Mr. Paracchini holds a bachelor’s degree from Marquette University and an MBA from the University of Chicago Booth School of Business.

Chief Credit Officer Timothy Hadro has served Byline Bancorp since 2015. He has been with Byline Bank since 2013. Prior to joining Byline, Mr Hadro was co-founding principal and co-owner of Loan Management Solutions and served as its Managing Partner. He spent 31 years with JP Morgan Chase and its predecessor organizations. Mr. Hadro holds a bachelor’s degree in mathematics and economics from Macalester College in St. Paul, Minnesota and an M.B.A. from the University of Chicago Booth School of Business.

Competition: J.P. Morgan Chase, Bank of America, Wells Fargo, Citigroup

Byline Bancorp faces competition from national, regional and local financial institutions, including the largest banks in the U.S., which are J.P. Morgan Chase (JPM), Bank of America (BAC), Wells Fargo (WFC), and Citigroup (C). Morningstar lists the company’s peers as U.S. Bancorp (USB), PNC Financial Services (PNC), BB&T (BBT), Suntrust Banks (STI), M&T Banks (MTB), and Fifth Third Bancorp (FITB).

|

Market Cap (mil) |

Net Income (mil) |

P/B |

P/E |

|

|

Byline Bancorp |

$620.0 |

$86.0 |

1.4 |

6.8 |

|

U.S. Bancorp |

$89,861.0 |

$6,014.0 |

2.1 |

16.1 |

|

PNC Financial Services |

$68,025.0 |

$4,283.0 |

1.5 |

17.5 |

|

BB&T |

$38,633.0 |

$2,372.0 |

1.4 |

18.2 |

|

Industry Average |

$1,655.0 |

$62.0 |

1.6 |

18.4 |

Early Market Performance

Byline Bancorp’s IPO priced at $19 per share, at the low end of its expected price range of $19 to $21. The stock closed on the first day of trading at $20.05. Since then, the stock reached a high of $21.57 on September 12 before declining to a low of $19.45 on November 15. Beginning on November 27, the stock experienced a significant run-up to reach $23.17 on December 5. The stock currently trades around $21.50.

Conclusion: Short Shares of BY Before IPO Lockup Expiration

When the 180 day lockup period expires on December 27th, we believe that currently restricted shareholders will be eager to cash in on some of their gains. BY has a solid return from IPO of 11.4%.

If just a portion of these currently-restricted shareholders - a group that includes three corporate entities and 14 individuals - sell a portion of their 22.69 million restricted shares, the market could be flooded with these shares and BY's share price could experience a sharp, short-term dip.

Short-term risk tolerant investors should consider shorting shares of BY ahead of the stock's December 27th lockup expiration. Interested investors should cover these short positions either late in the trading day on December 27th or during the trading day on December 28th.

Disclosure: I am/we are short BY.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more