Buying The Right Stocks Is More Important Than Paying The Right Price

Investors are always facing unavoidable trade-offs in the market. Simply speaking, you can go for companies with high quality and superior growth prospects or you can go for low valuation ratios.

Investments should always be assessed from a holistic perspective that considers both the quality of the business and its price tag. Ideally, you want to invest in companies that offer attractive potential when considering both quality and price together.

However, the quality versus price trade-off has always been there and will always be. A high-quality business will always trade at above-average valuation levels, that is just how markets work, and there is no reason to expect this to change in the future.

There are many different ways to do well in the market, and depending on your own time frame and overall style, you can give different weightings to quality and price when making investment decisions.

However, when investing in growth stocks over long periods of time, buying the right company is far more important than paying a low price.

Price, Quality, And Time

Assuming that the stock pays no dividends, your returns will depend on how the price of the stock changes over time. The changes in price will depend on the changes in earnings and the changes in the price-to-earnings ratio.

Here comes a very important distinction, if you buy a low growth stock and you hold it over a short period of time, valuation is of utmost importance. If the company's earnings increased by 5% in a year, but the price-to-earnings ratio declined by 6%, then you are down in the year in spite of the fact that earnings are growing. It is very hard to know how valuation ratios will evolve, especially in the short term, so this makes returns very hard to predict.

On the other hand, let's assume that the company's earnings are growing at 15-20% over the years and decades. If you also hold on to the stock over long periods of time, the compounded increase in earnings will be much more important than any variation in the price-to-earnings ratio.

Again, high growth and a long-term horizon make a huge difference in the relative importance of business quality versus valuation as return drivers.

In the words of Charlie Munger himself:

We've really made the money out of high quality businesses. In some cases, we bought the whole business. And in some cases, we just bought a big block of stock. But when you analyze what happened, the big money's been made in the high quality businesses. And most of the other people who've made a lot of money have done so in high quality businesses.

Over the long term, it's hard for a stock to earn a much better return than the business which underlies it earns. If the business earns 6% on capital over 40 years and you hold it for that 40 years, you're not going to make much different than a 6% return-even if you originally buy it at a huge discount. Conversely, if a business earns 18% on capital over 20 or 30 years, even if you pay an expensive looking price, you'll end up with a fine result.

So the trick is getting into better businesses. And that involves all of these advantages of scale that you could consider momentum effects.

How do you get into these great companies? One method is what I'd call the method of finding them small get 'em when they're little. For example, buy Wal-Mart when Sam Walton first goes public and so forth. And a lot of people try to do just that. And it's a very beguiling idea. If I were a young man, I might actually go into it.

Focus On What Really Matters For Your Own Time Frame

Many high-growth stocks are currently expensive, meaning that they trade at elevated valuation ratios when looking at price-to-sales ratios or similar metrics. This is understandably generating concerns among investors, and rightfully so.

Being cautious and discerning at times when valuations are high is a much sounder approach than simply chasing stocks at whatever prices are available. That being acknowledged, we also need to understand that a high valuation ratio does not mean that the stock is overvalued.

A high valuation ratio means that the market is expecting strong growth from the company in the future. When the valuation is elevated this reduces the room for error and you need to be especially careful regarding the quality of the business in these kinds of expensive stocks.

But expensive and overvalued are two different things. We could say that a Ferrari is an expensive car because it has a much higher price than other vehicles in the market. But you need to really understand the technology and the design in order to say if a Ferrari is overvalued or perhaps undervalued in spite of its high price.

Cheap or expensive is about comparing the valuation of a stock versus other stocks in the market, but undervalued or overvalued is about comparing the price of a stock versus the company's quality and its long-term cash flow generation capabilities.

The valuation ratio reflects forward-looking expectations, and the best companies in the world can keep beating expectations year after year, so they can still be undervalued at high valuation ratios.

In fact, elevated valuations many times provide the proverbial wall of worry for stocks to climb higher. Many investors are afraid of buying expensive stocks, so only the investors with superior tolerance for risk and volatility benefit from superior returns. There are lots of examples of stocks that have delivered outstanding returns while still looking expensive at first sight.

Ideally, you want to buy companies that can substantially outperform expectations by building new growth engines over the years. For example, Amazon (AMZN) has expanded from an online bookstore in 1999 to the market leader in online retail and cloud computing infrastructure today, and the company is now expanding into digital content, logistics, advertising, and so forth. When this happens, the returns can be astronomical.

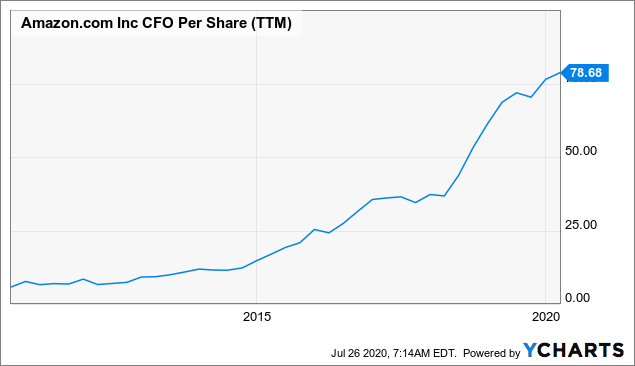

The chart below shows how Amazon's cash flow per share has evolved over the past several years.

Data by YCharts

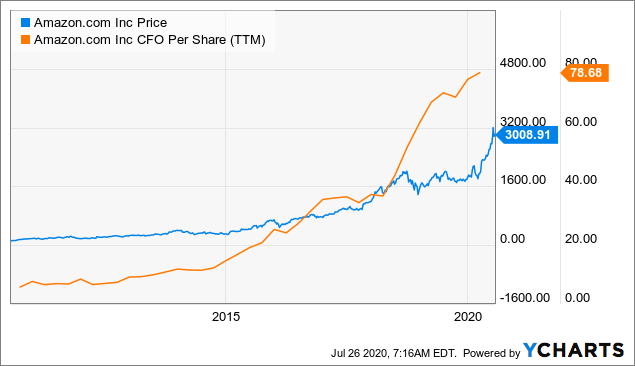

The relationship between price and cash flows, meaning the valuation, can be unstable and fluctuating. However, over the long term, price and cash flows tend to move in the same direction.

Data by YCharts

Speaking of which, on February 27, 2020, I published an article entitled Unpopular Opinion: Amazon Is Undervalued. The thesis from that article is that the price-to-earnings ratio is not a good metric to assess Amazon because the company is aggressively investing for growth and that the stock was too cheap based on future cash flow generation capabilities.

From such an article:

In a nutshell, Amazon may look expensive based on earnings, but cash flow is a far more appropriate metric to assess valuation, and the stock looks very reasonably priced in terms of current cash flows. Even better, when you project Amazon's cash flows going forward, the stock looks downright undervalued.

Amazon stock is now up by almost 60% from that time. Accelerating demand due to the pandemic certainly helped, but it is also fair to say that valuation was providing room for upside at the end of February.

But the point is that Amazon stock was trading at a price-to-earnings ratio of 69 when the article was published, and many investors and research firms considered the stock overvalued at the time.

In order to find good valuations among high-quality stocks, sometimes you need to look at what the market is not seeing. Focusing on valuation ratios alone and dismissing stocks that look to expensive is a too simplistic and myopic approach.

Again, I am not saying that valuations should be disregarded, and some high-growth stocks in the market are currently trading at levels that look clearly concerning to me.

However, when you invest in high-quality stocks with plenty of potential for growth and you hold the position for the long term, selecting the right company is far more important than paying a low price for it.

Disclosure: I am/we are long AMZN.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with ...

more