Buying Opportunity In Disney

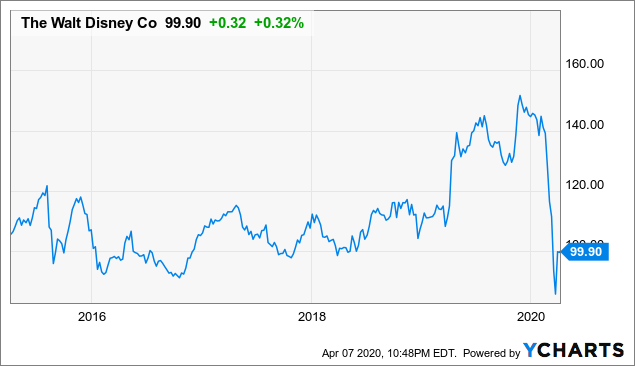

Disney (NYSE: DIS) stock is down by 35% from its highs of the year due to the coronavirus crisis and its negative impact on the business. In fact, the stock is currently back to levels from 5 years ago.

(Click on image to enlarge)

Data by YCharts

Investors in Disney need to be prepared to face substantial volatility in the near term, but chances are that the coronavirus crisis is creating a buying opportunity for long-term investors in the company.

Focus On The Big Picture

Disney is taking a considerable hit due to the COVID-19 crisis. The company has closed its parks and hotels, and it still faces significant costs in these areas while it generates zero revenue from them. With movie theaters being closed, this segment is also under pressure, and advertising revenue in the TV business can also be expected to decline during a recession. At first sight, there are not many reasons to consider a position in Disney in the short term.

However, the main point is that the bullish thesis for Disney is based on long-term considerations. Investors could miss the forest for the trees if they focus too much on the current impact of the COVID-19 pandemic, and they overlook the business fundamentals.

Content is king in the industry, and Disney owns intellectual rights to many of the most valuable franchises and characters. The company builds brands around its intellectual properties, monetizing them via multiple platforms at the same time: movies, TV shows, toys, entertainment parks, online games, etc.

Importantly, direct distribution with Disney + will allow Disney to eliminate intermediaries in order to better control the customer experience and potentially increase profitability levels. A successful subscription service with a loyal customer base can be remarkably valuable in terms of generating consistent revenue growth over the long term.

Besides, the subscription business model allows for exceptional profitability when the revenue base is big enough. Once you are already covering the costs of providing the service, each new subscriber has a marginally low impact on expenses. For this reason, the marginal profit contribution of every new subscriber is quite elevated once the business is big enough.

An Attractive Entry Price

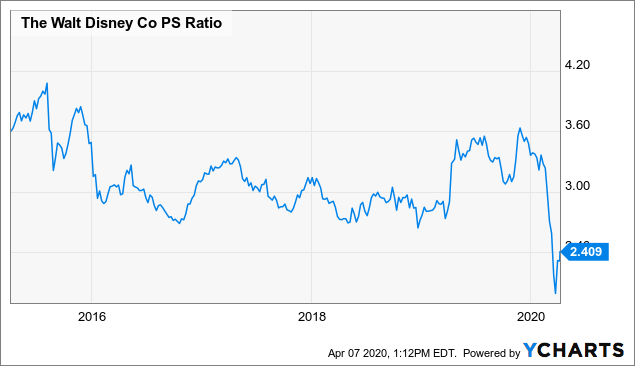

Over the past several years, Disney has mostly traded at a price to sales ratio in the range of 3.0 to 3.5. This was during a period in which investors were deeply concerned about the impact of the cord-cutting revolution and its negative consequences for Disney. Then the company successfully launched Disney + and the stock price made new historical highs above $150 per share as the streaming service was well received.

Just when it looked like Disney was moving back into the offensive with the successful launch of Disney + and the 21st Century Fox acquisition, the coronavirus crisis sent the stock back down from $150 to nearly $100 per share. The good news is that valuation is looking quite attractive by historical standards for the company right now.

(Click on image to enlarge)

Data by YCharts

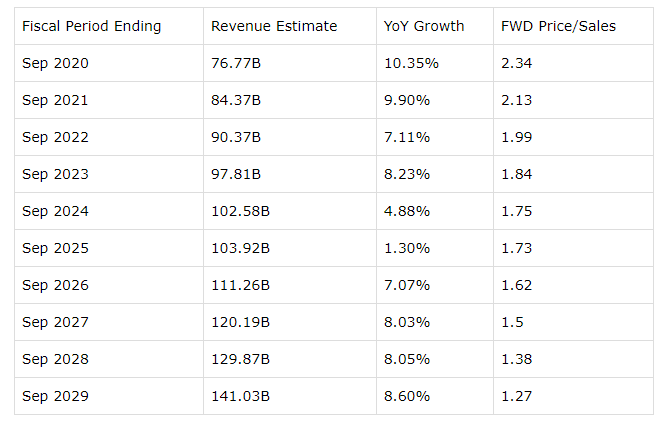

Moving forward, the table below shows the average revenue estimate for Disney in the years ahead and the forward price to sales ratio implied by those estimates. Even under conservative assumptions for long-term growth, Disney stock looks quite attractively valued.

(Click on image to enlarge)

Revenue estimates always carry a large margin of error, and especially more in the current context. It wouldn't be much of a surprise to see these estimates decline in the coming weeks if the coronavirus crisis turns for the worse.

However, the main point in these kinds of exercises is not to accurately forecast future revenue, which cannot be done with much precision anyways. The idea is to assess if the stock is attractively valued or not based on reasonable assumptions for long-term financial performance.

In this particular case, shares of Disney are good entry price over the long term, since the stock is down by nearly 35% from its highs of the year and trading at valuation ratios that are at the low end of the company's valuation history.

Another way to think about valuation is by inverting the process, which would mean looking at the value estimates from Wall Street and assessing if those estimates are reasonable or not. The average estimate among the sell-side analysts following Disney currently stands at $136, which would imply a price to sales ratio of 3.1, hardly excessive for such a strong company as Disney.

In other words, even under moderate valuation assumptions, Disney could be undervalued by 35% according to the price estimates from the sell-side analysts following the company.

Uncertainty And Opportunity

Leaving aside the current economic uncertainty, Disney is one of the strongest companies in the entertainment industry on a global scale. You rarely get an opportunity to buy a world-class business at a discounted valuation, and when you do, it is because there is plenty of uncertainty surrounding the company.

In this particular case, Disney is taking a big hit in the parks and movie studios divisions, and these divisions together account for roughly 50% of revenue. The parks business is particularly concerning since this segment is especially vulnerable to a prolonged sanitary crisis. It is reasonable to assume that the parks will remain closed for the rest of 2020, while revenue in this segment during 2021 could still be below 2019 levels.

This coronavirus setback comes at a bad time for Disney, as the company is integrating the 21st Century Fox acquisition, and it assumed $13.7 billion in debt with the purchase. It is hard to tell for how long the current crisis is going to affect the economy in general and Disney in particular, and the stock market hates uncertainty.

However, we do know that this crisis is going to be temporary as opposed to permanent. Even if there are new waves of contagion in the years ahead, the world will be much better prepared with the necessary measures to slow down the spread and with much stronger tools when it comes to drugs, treatments, and the overall capacity of the healthcare system to deal with the coronavirus.

Importantly, there are unprecedented sums of money and unlimited human brainpower being put to work in finding a vaccine all over the world. Considering the massive amounts of effort allocated to this task, it is highly probable that a vaccine will be available in the not so distant future.

It all depends on what your timeframe is when assessing a position in Disney. Over the next 1 to 3 months, anything can happen to the stock price, and the overall evolution of the coronavirus crisis will be a major driver of returns over this period. Over the next 1 to 3 years, on the other hand, there is a big chance that the coronavirus crisis will be in the past, and Disney stock will deliver attractive returns from current prices.

Personally, I own a 2.5% position in Disney stock, and I am saving plenty of cash to buy at lower prices in case the crisis gets worse before it gets better. Disney is already offering an attractive entry price, and the lower the price goes, the bigger the opportunity for investors with a long-term horizon in Disney stock.

Disclosure: I am/we are long DIS.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more