Buying Opportunity In Arista Networks

Arista Networks (ANET) stock is down by over 40% from its highs of the year, mostly due to disappointing sales guidance. However, chances are that the slowdown in growth will only be temporary, and the stock could deliver attractive returns from current price levels over the long term.

A Bump On The Road

Arista actually reported better than expected sales and earnings for the third quarter of 2019, with revenue growing 16.2% year over year and earnings per share amounting to $2.69 and beating expectations by $0.28 per share.

However, the company provided disappointing guidance for the fourth quarter, with revenue expected to amount to $540-$560 million, considerably below the $686.5 million expected by analysts at the time of the report. Management also warned about slowing demand through 2020.

The main reason for this reduced guidance is that one of the cloud titans - most probably Facebook (FB) - has reduced its spending forecasts over the coming quarters. This cloud titan is actually doing two things, they are offering less visibility regarding their spending over the coming quarters, and they are also extending their server assets.

From the conference call:

They are managing the CapEx for networking and modulating the inventory and shifting to more of a just-in-time type forecast. So, typically, they gave us two-quarter visibility, sometimes even three and four, and now, they're moving much more to a real time forecast at quarterly intervals. And the second is, this particular cloud titan is extending their server assets by more than a year. And once the server assets get extended, that is significantly delaying the network spend too.

This raises a major question for investors. If this is just about reduced visibility and delayed spending by a big customer, then the slowdown is only transitory and hence a buying opportunity. On the other hand, if Arista is losing market share versus the competition, then the damage would be much more serious and permanent.

Management addressed this question during the conference call, clearly indicating that the business remains as strong as ever from a competitive perspective.

From our perspective, the competitive dynamics have not changed in the cloud or in general. We always have aggressive competition and we will continue to see aggression there. But, what gives us confidence, the cloud titans are delaying their spend or distributing their CapEx differently is as you know we always pride ourselves in close partnership and relationship with cloud titans. And generally, especially in the case of Facebook and Microsoft, they've been not only a vendor customer relationship but really a co-development that requires the kind of partnership which is engineering to engineering, not just business. So, when you look at that, there is no evidence that competitively or white box wise, there has been any change.

We work very closely with these customers to a point that we're working on the 2021 roadmap along with these customers right now, and quite well aware of the changes they are making to the architecture as well, and have very direct feedback from customers as well that there is no alternate that's displacing us. It's simply that demand has gone down. And we are very confident of our share, when that demand comes back as well, since we collaborate with these customers. So, we're not worried about it and the customers are pretty direct as well. This is not our share going to someone else, their demand reduced.

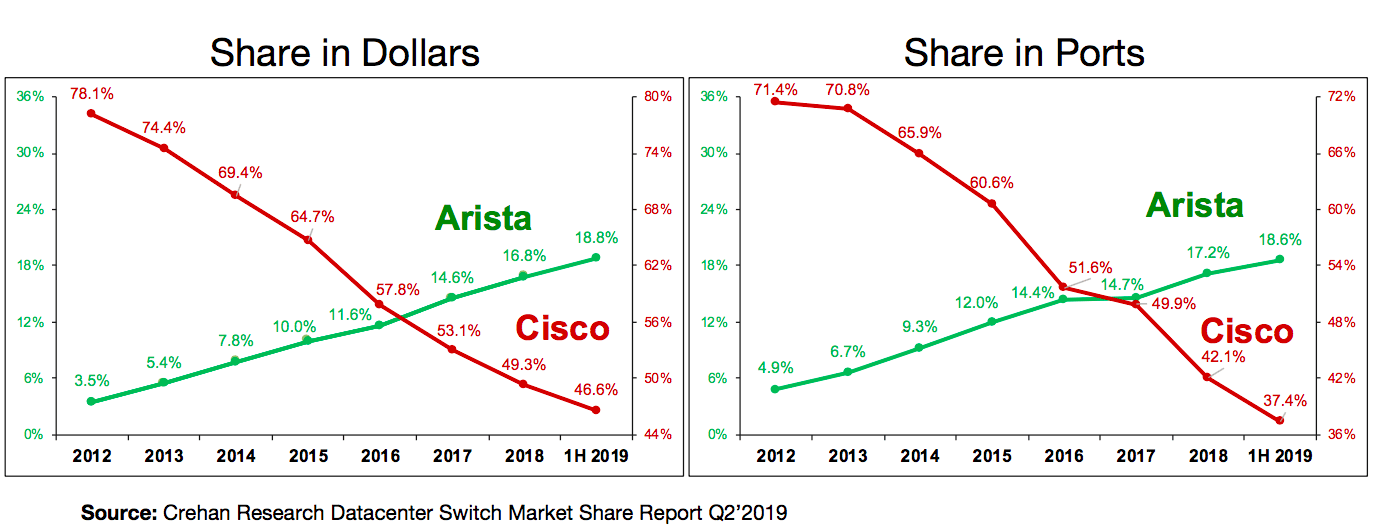

Looking at the evidence, it's important to note that Arista has consistently gained market share versus its largest rival, Cisco (CSCO) over the years.

(Click on image to enlarge)

Source: Arista Networks

In terms of the big picture, initiatives such as 400-gigabit Ethernet and cognitive campus network solutions are still in the first stages, providing plenty of opportunities for growth over the long term.

(Click on image to enlarge)

Source: Arista Networks

Resetting Expectations And Attractive Valuation

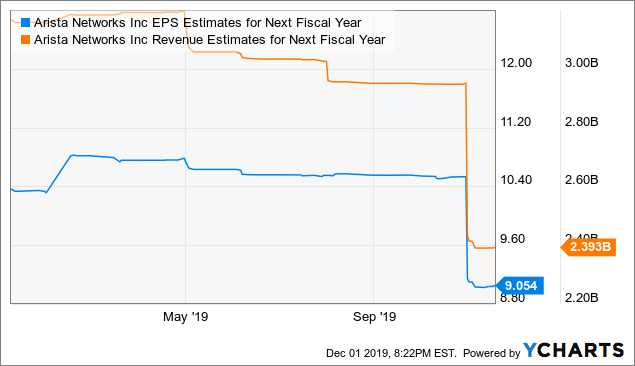

As a response to the reduced guidance from the company, Wall Street analysts have significantly cut their earnings and revenue estimates for Arista Networks in 2020.

(Click on image to enlarge)

Data by YCharts

Based on these reduced expectations, Arista Networks is trading at a forward P/E ratio of 20.46 and a price to sales ratio of 6.23. These valuation levels are more than reasonable, and things get much more interesting when looking at the numbers for 2021 and beyond.

Sales and earnings are expected to accelerate in the years ahead, as the company should get back to its long-term growth trajectory.

(Click on image to enlarge)

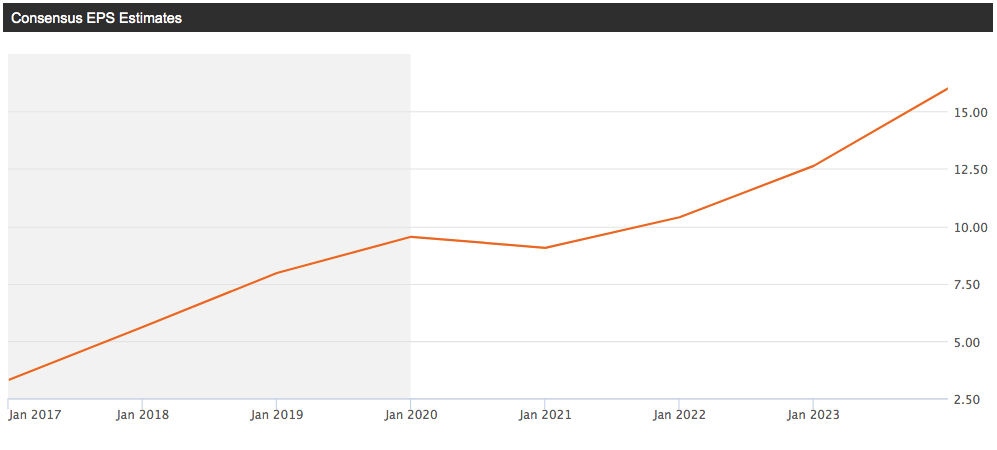

Source: Seeking Alpha Essential

Earnings expectations are expected to move in the same direction, a small contraction in 2020 and then a reacceleration in 2021 and forward.

(Click on image to enlarge)

Source: Seeking Alpha Essential

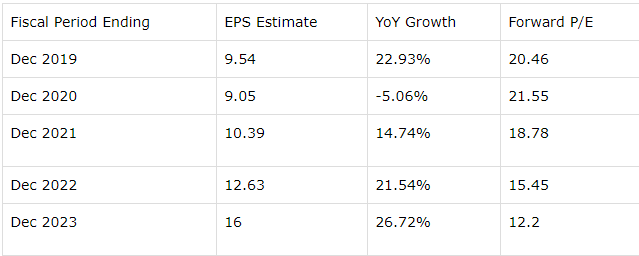

Providing more details, the tables show the average earnings per share estimate, the implied growth rate and the forward P/E ratio based on these estimates over the years ahead.

(Click on image to enlarge)

Source: Seeking Alpha Essential

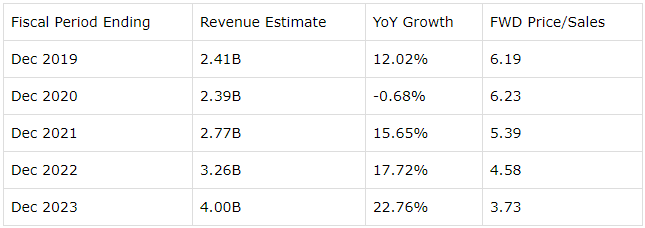

Doing a similar analysis, revenue growth is also expected to regain speed in 2021 and to accelerate further in 2022 and 2023.

(Click on image to enlarge)

Source: Seeking Alpha Essential

For 2021 and 2022, the numbers are showing that Arista Networks would be trading at below-average valuation levels in terms of price to earnings and price to sales while also growing both earnings and sales at a vigorous rate.

A basic strategy could be waiting for the 2020 slowdown to be over and then buying the stock as 2021 approaches with better growth prospects for the company. However, this kind of linear reasoning is too simplistic, and things are not that easy in the stock market.

In the words of JM Keynes, successful investing is anticipating the anticipation of others. If the company is on track to accelerating growth in 2021 and beyond, chances are that the stock price is going to reflect this much sooner than the financial statements. After all, the stock market is a forward-looking mechanism.

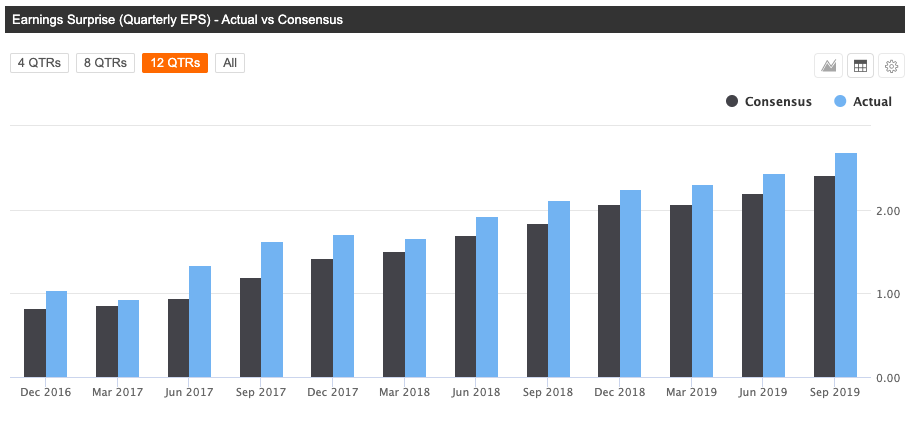

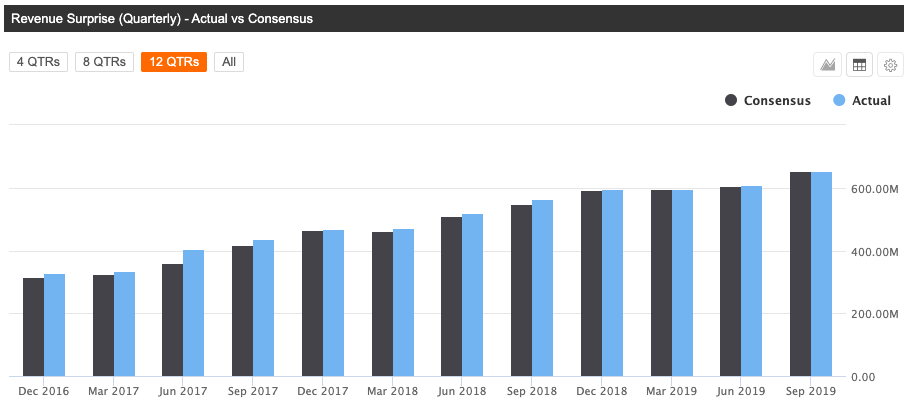

Importantly, Arista Networks has an impeccable track record of delivering both sales and earnings above Wall Street expectations over the long term. The company has not missed earnings or sales numbers in one single quarter in the past 16 quarters. This is quite an outstanding trajectory for a company operating in a cyclical and dynamic market.

(Click on image to enlarge)

Source: Seeking Alpha Essential

(Click on image to enlarge)

Source: Seeking Alpha Essential

Past performance does not guarantee that the company will continue delivering above expectations in the future. However, the hard data shows that management tends to under-promise and over-deliver throughout the years.

If the company continues delivering numbers above Wall Street expectations in the coming quarters, this could be an upside fuel for the stock in 2020, even sales and earnings are declining versus 2019 figures.

Risk And Reward Going Forward

Arista faces tough competition from a larger player such as Cisco, and the industry is prone to technological disruption. The company has done a great job of gaining market share versus the competition over time, but investors still need to keep a close eye on the competitive landscape in order to make sure that Arista is still leading the industry in terms of technological capabilities and revenue growth rates.

Besides, corporate spending is typically quite sensitive to economic conditions. If we get an economic slowdown or even a full-blown recession in the coming quarters, this will probably have a considerable impact on both the company's performance and the stock price. It is only fair to say that Arista Networks carries above-average macroeconomic risk.

Those risks being acknowledged, chances are that the recent pullback in Arista will turn out as a buying opportunity for investors. The company has an attractive potential for growth in the long term, but the growth trajectory is also uneven and fluctuating over different periods. Buying as the company goes through a period of slowing growth can make a lot of sense from a contrarian perspective.

When a high growth company faces a temporary deceleration in growth, this is generally a buying opportunity for long-term investors who can tolerate the uncertainty in the short term. Based on the information currently at hand, there is no reason to believe that Arista can't generate attractive performance over the coming 3 to 5 years.

The slowdown in 2020 is already incorporated into expectations and into the stock price. The market tends to overreact to negative news and a low bar is easier to beat, so I wouldn't be too surprised at all to see Arista outperforming Wall Street Expectations in the coming quarters. If the company gets back on track and growth accelerates in the middle term, then the stock should deliver attractive returns from current price levels.

Disclosure: I am/we are long ANET, FB.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with ...

more