Buy These 4 Stocks That Insiders Love

With the first quarter largely over, the S&P 500’s profit decline so far comes in at just over seven percent, the worse quarterly profit decline since 2009. It is also the first time quarterly profits have fallen for four straight quarters since the third quarter of 2008 kicked off the last “profit recession”

With the S&P roughly flat for the year, it also means that based on earnings the market is more expensive from a multiple perspective than it was to begin 2016; hardly a reassuring thought. I realize this is looking a bit in the rear view mirror, but it hardly gets more assuring looking forward. Earnings in the second quarter are also expected to be down for the S&P 500 for the fifth quarter in a row although to a slightly lesser extent than what was delivered in the first quarter. GDP growth is also expected to pick up, but only to approximately two percent in the second quarter after the first quarter’s dismal .5% GDP reading.

So, where am I finding some value in what I consider an overvalued market right now? One good place to find some ideas to research is to look at what company insiders find enticing and are still buying. Here are a few that look like good values in the current market environment.

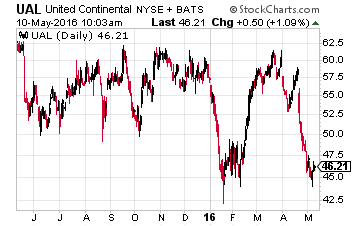

Let’s start with United Continental Holdings (NYSE: UAL), the stock of this airline has fallen from roughly $60.00 a share to around $45.00 over the past few months. That has drawn the interest of myriad insiders who have bought over $5 million worth of stock since March in over 10 separate transactions. Airline stocks have been hit lately on concerns around the growth of capacity and rising oil prices.

However, at four times trailing earnings, a lot of bad news seem baked in the current stock price at the moment. There is also more pricing discipline in the industry as mergers have shrunk the remaining carriers to a handful. The company reported earnings in late April that beat bottom line consensus by a nickel a share. In addition, two activists, PAR Capital and Altimeter Capital Management, have acquired over seven percent of the outstanding float and should ensure management focuses on shareholder value. Finally, with a glut of inventory and anemic worldwide demand, it is hard to see crude spiking from its current levels outside some major geopolitical event, so jet fuel prices should remain under control.

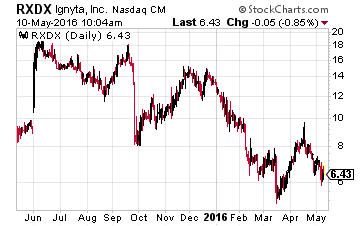

A small biotech called Ignyta (Nasdaq: RXDX) seems to be getting some love after losing two thirds of its value thanks to the huge bear market in biotech and a secondary offering that raised $50 million in developmental funding earlier this year. Three directors and a beneficial owner bought nearly $300,000 worth of shares in March. Insiders have been big believers in this stock making much heavier purchases of the shares at much higher prices in 2015.

This stock soared after its IPO in early 2014, more than doubling from its debut. Thanks to its recent decline the shares are back below its IPO price once again and insiders seem to be taking advantage of that. The company does have a very early stage pipeline that is years away from commercialization. However, this company now has a market capitalization of $200 million thanks to its recent decline. Almost their entire market value is represented by the net cash on the balance sheet. Piper Jaffray offered up a Buy Rating and $32.00 a share price target on RXDX last week, more than five times its current price of just over $6.00 a share. Other analyst price targets generally range from $18.00 to $20.00 a share.

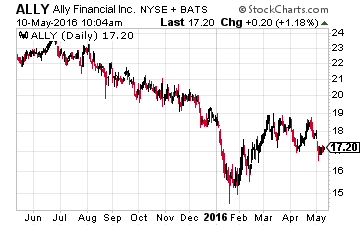

Ally Financial (NYSE: ALLY), the previous financial arm of General Motors (NYSE: GM), saw some insider activity in early May as well. The CEO, CFO, and a director scooped up over $300,000 worth of shares last week. The stock does seem to be offering up good value here. With earnings growth hard to come by in this market, Ally should deliver 10% to 15% profit growth both in FY2016 and FY2017 and the stock goes for under nine times trailing earnings of $2.00 a share.

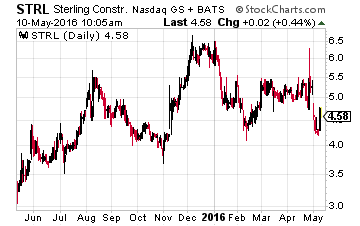

Finally, we end with a small cap (Under $100 million market capitalization) heavy construction firm Sterling Construction (Nasdaq: STRL). The company specializes in transportation and water infrastructure. This is a turnaround play as the company has posted recent losses, due mainly to cost overruns for projects it underbid on between 2010-2012. The company has brought in new management to rectify that situation and has worked through the majority of those projects. As a result, gross margins have shown several successive quarters of improvement.

Last week the CEO stepped up and bought $500,000 of stock. It was the first insider purchase of shares in two years. After posting a significant loss in FY2015, the company posted a profit this year and is projected to earn over 50 cents a share in FY2017. Sterling has almost $900 million in its order backlog and goes for around eight times next year’s projected earnings. The CEO certainly believes it is on its way to recovery given his recent purchase.

Small Cap Gems analyst Bret Jensen has identified his top 3 takeover stocks for 2016. With a knack for finding companies on the verge of buyouts – and massive ...

more