Buy These 2 Small Biotechs With Huge Upside

In Wednesday’s column we discussed the current volatility in the market as well as the high beta areas within equities such as the high-flying biotech sector. Emphasis around this sector was placed on why it is important to have 50% to 75% of one’s biotech portfolio in the large cap growth stocks of the sector depending on the individual investor’s risk tolerances. This will lower the overall volatility of the portfolio and allow one to navigate through these market hiccups that occasionally bring substantial moves to this sector.

In today’s column, we will discuss the small cap area of the biotech sector which is inherently more volatile than the large cap part of the sector. It is also a space that frequently yields “home runs” when things fall right and “strike outs” when trials do not turn out as expected such as the collapse in the stock of once promising Tetraphase Pharmaceuticals (NASDAQ: TTPH) which lost almost 80% of its value last Wednesday once it was announced its main drug candidate flunked a late-stage trial.

This is why investors should employ a few core strategies in the small cap biotech sector. First, it pays to take small stakes in a myriad of speculative but promising small cap companies in this lucrative space. I have long dubbed this “Shotgun Investing” within the biotech sector. These companies should have multiple “shots on goal”, promising pipelines, strong balance sheets, and whenever possible partnerships or collaboration deals with larger players in the biotech/biopharma industry. Investors should get comfortable knowing that it doesn’t matter how good their analytical skills are, they are still going to have the occasional blow up as drug development is just inherently risky. This will be more than made up for over time by the occasional grand slam when a lucrative drug candidate successfully navigates the approval process and/or your small cap company is bought out for a substantial premium by a larger player in the sector.

I have always thought the ideal portfolio should consist of five heavily weighted attractive long-term growth plays such as Gilead Sciences (NASDAQ: GILD) and Amgen (NASDAQ: AMGNAMGN) with approximately 15 tinier stakes in these smaller cap concerns that could soar if they fulfill their promise. This is the configuration I have been using for many years to outperform the market and it is the same strategy I employ within the recently launched Biotech Gems.

I also think it is critical to book some profits in this space when you are fortunate enough to get in on a small cap biotech concern before it rockets up on good news, positive trials, buyout rumors or an analyst upgrade.

My rule of thumb in the small biotech/biopharma space is this:

- If you buy 1,000 shares of stock in a promising-but-speculative play and it quickly moves up by 50%, sell 100 shares.

- If the stock doubles from your entry point, sell another 200 shares.

- If you’re fortunate enough to have the stock triple, cash out another 200 shares.

That leaves you with 500 shares riding on the house’s money, as you’ve already booked a 15% gain on your original position even if your remaining stock falls to zero.

More importantly, this strategy protects you from letting greed or fear prompt you to completely sell out of a position that’s tripled or quadrupled — only to watch the equity go up another 10-fold. That’s an event that can occur frequently in this space, especially if you’re lucky enough to get in early on the next Regeneron Pharmaceuticals (NASDAQ: REGN) or Celgene (NASDAQ: CELGCELG).

So what small cap biotech concerns have I initiated positions in or added to on the recent drop? Here are a couple I think warrant consideration despite the current challenges in the market.

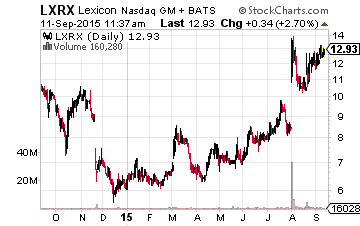

I like and own Lexicon Pharmaceuticals (NASDAQ: LXRX) here. On August 3, the company reported positive results from its TELESTAR Phase 3 clinical trials. Results showed that the oral version of one of its main drugs candidate’s telotristat etiprate or LX1032 delivers a clinical benefit beyond what is possible with the current standard of care in the treatment of carcinoid syndrome patients. This is an addressable market that could see peak sales of $400 million to $550 million. The company also has other “shots on goal” and a market capitalization of just $1.3 billion.

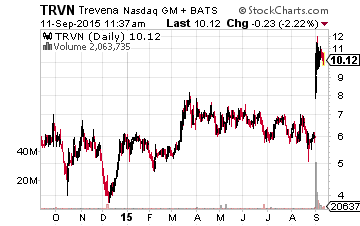

Trevena (NASDAQ: TRVN) is another small cap concern I have purchased over this volatile summer. The company recently disclosed its main drug candidate for pain that has superior traits to widely-used morphine delivered impressive Phase II trial results and demonstrated a statistically significant reduction in pain over 24 hours compared to placebo in patients with moderate-to-severe pain following abdominoplasty surgery.

The drug candidate, TRV130 still has to undergo a successful phase III trial, but its potential is huge. In 2013, 20 million surgical procedures were performed that resulted in reimbursement claims for injectable opioids for pain management. If TRV130 is eventually approved and garners just a small percentage of this market, it could be a significant event for Trevena and its stock. The company has a couple of other promising drugs in development and a market capitalization of less than $500 million.

I like both Lexicon and Trevena as standalone entities, but recent trial results make both more attractive buyout targets as well. They are just the type of small cap companies that belong in the speculative part of one’s diversified biotech portfolio.

Positions: more