Buy My Top 2 High-Yield Dividend Picks For 2020

Each year I am asked by the MoneyShow folks to submit two stock picks for the new year. My picks are published on the MoneyShow website and mainstream financial websites, such as Forbes. I put out an aggressive stock pick and a conservative one. Since I am the Dividend Hunter, both stocks will be higher yield dividend paying companies. This year I have a turnaround play for the aggressive stock. The conservative stock doesn’t require you to watch the share price: just collect the big dividends for as many years as you want to own the shares.

My aggressive stock pick for 2020

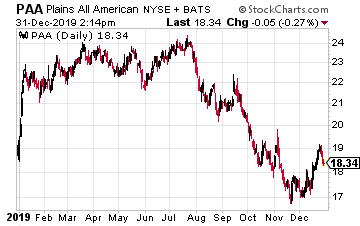

Plains All American Pipelines LP (PAA) is an energy midstream services company that should provide a strong move up in 2020. Plains GP Holdings LP (PAGP) is the 1099 reporting equivalent to the traditional PAA MLP units.

Plains has suffered tremendously from the energy sector bear market that started in September 2014. In September 2014, PAA was trading for over $60 per unit. Now it is less than $19. The quarterly dividend is down by half from mid-2016, at a current $0.36 per unit, compared to $0.70, two-and-a-half years ago. So, what makes me think that 2020 will be the turnaround year for Plains All American Pipelines? The reasons started two years ago, near the end of 2017.

Plains is a crude oil pipeline and storage company. The pipeline network stretches from Canada to the U.S. Gulf Coast. The company is a major transporter out of the Permian Basin and is one of the largest owners of storage in Cushing, OK. Plains handles 6 million barrels of crude oil or natural gas liquids (NGLs) every day.

In August 2017 Plains announced a leverage reduction plan, to put the company into a more secure financial situation. At that time, the quarterly dividend was reduced from $0.55 per unit down to $0.30, a 45% slashing. The reduction retained $1.1 billion in cash flow over the next six quarters.

The company sold about $1 billion in assets, and the combination of sales and cash retention reduced the total corporate debt from $11.15 billion down to a current $9.2 billion. More importantly, the long-term debt to EBITDA leverage ratio dropped from 5.1 times in Q3 2017 down to a current 2.8 times.

Plains continued to grow its business over the last two years. Net income climbed from $1.10 per share in 2017 to a forecast of $2.35 in 2019. Distributable cash flow (DCF) climbed from $1.82 per share in 2017 to a forecast of $2.85/share for full-year 2019. Think about this, at $18 per share, PAA is trading at 6.3 times free cash flow. Flipped over, the stock has a 15.8% cash flow yield.

Plains increased its quarterly dividend by 25% after the first quarter of 2019. The current DCF gives 2.0 times the coverage of the current distribution rate. That is huge in the MLP world, where 1.3 to 1.5 times coverage is the norm for high-quality MLPs.

Plains continues to grow, with at least four capital projects coming online over the next year. At the same time, management has stated they are targeting distribution coverage of at least 1.3 times. The coverage is currently at 2.0 times.

There is tremendous room for a large dividend increase in 2020, or for the company to restart a program of quarterly dividend increases. With continued EBITDA and cash flow growth, plus solid to great dividend increases in 2020, I expect PAA to be a $30 stock by the end of 2020.

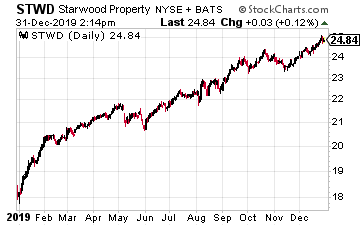

My Conservative stock pick

Starwood Property Trust, Inc. (STWD) is a finance REIT whose primary business is the origination of commercial property mortgages. As one of the largest players in the field, Starwood Property trust focuses on making large loans with specialized terms. This gives them a competitive advantage over banks and smaller commercial finance REITs.

Over the last several years, the company has diversified its business, branching into commercial mortgage servicing, acquiring real equity properties with long term revenue stability, and recently a portfolio of energy project finance debt. This diversification will allow Starwood Property Trust to thrive and continue to pay the big dividend in any financial environment.

In the commercial loan business, over 95% of the commercial mortgage portfolio has adjustable interest rates. This means that when the Fed increases interest rates, Starwood’s net income per share will grow. This REIT provides an excellent hedge against rising rates.

Starwood has acquired the largest commercial mortgage servicing firm. That arm of the business handles servicing, foreclosure workouts (for fees), and the packaging of smaller commercial mortgages into mortgage-backed securities. This business segment would see the fees increase exponentially in the event of a recession where commercial property owners were forced to let go back to the lenders.

In addition to the finance side of the company, Starwood has acquired selected real properties, including apartments, regular office buildings, and medical office campuses. According to STWD’s CEO, “All of the wholly-owned assets in this segment continues to perform well with blended cash-on-cash yields increasing to 11.4%, and weighted average occupancy remains steady at 98%.”

The property segment provides assets with long-life revenue streams to offset the shorter-term rollover schedule of the commercial mortgage portfolio. Real assets also add depreciation to the income statement, shielding cash flow.

In mid-2018, the company acquired a $2.5 billion energy finance business from General Electric. The loan book is non-recourse to Starwood Property Trust. Starwood Capital, the private equity manager of STWD, already had energy finance experts in house. This business segment has significant potential for growth.

This diversification of business segments by Starwood Property Trust is what separates this commercial finance REIT from its more narrowly focused peers. STWD has paid a $0.48 per share quarterly dividend since the 2014 first quarter. My investment expectation is that the dividend is secure, and I want to earn a 7.5% to 8.0% dividend year-after-year.

STWD was one of my MoneyShow stock picks for 2019. Through December 15, 2019, the stock had produced a year-to-date total return of 33.8%. Going forward, I would not be surprised for the share price to continue to appreciate, pushing the yield down from the current 7.8%.

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more