Buy Jounce For A Bounce

Jounce Therapeutics (JNCE) is about to get crushed thanks to an update to its ICONIC study, in which, 46 patients were enrolled into six cohorts to study its leading drug candidate, JTX-2011. This drug is being tested for anti-tumor and anti-cancer activity. Let us discuss what is going on here.

Two cohorts received escalating doses of JTX-2011 as a monotherapy every three weeks and four cohorts received escalating doses of the drug candidate in combination with nivolumab 240 mg IV every three weeks. The 0.3 mg/kg dose was chosen as the recommended Phase 2 dose for JTX-2011 monotherapy, while it should be noted that 75% (9/12) of patients on the recommended Phase 2 dose and 83% (10/12) of patients on combination therapy (all dose levels) continue on the study. Shares have been crushed ahead of the presentation of data in two weeks from now:

Source: BAD BEAT Investing

We believe the selloff in shares knocking it down to the $11.55 level at the time of this writing is a severe overreaction. Why? The company announced that it will present results, and this is causing shockwaves. There is no indication that the data is poor, but we have the abstract below. What we do know is that:

"Jounce has met its target enrollment for the Phase 1/2 ICONIC trial in its combination cohorts across four solid tumor types: gastric cancer, triple negative breast cancer (TNBC), head and neck squamous cell cancer (HNSCC) and non-small cell lung cancer (NSCLC), with most patients completing at least one efficacy assessment. Updated results, including preliminary efficacy data on all evaluable patients in the trial, will be presented at ASCO."

The stock is dropping massively as it announced that data from this ongoing Phase 1/2 trial evaluating JTX-2011 monotherapy and in combination with nivolumab, will be the subject of an oral presentation at the upcoming 2018 American Society of Clinical Oncology, or ASCO, Annual Meeting in Chicago, IL on June 1-5, 2018.

The abstract published today for the presentation online reflects data as of January 27, 2018, and updated results will be presented on June 2, 2018.

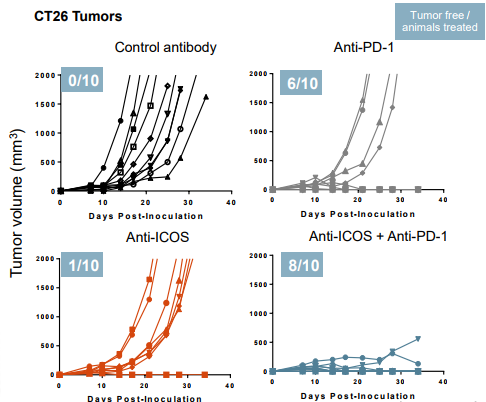

The Phase 2 portion of the study is testing JTX-2011 as a monotherapy as well as in solid tumors (HNSCC, NSCLC, triple negative breast cancer, melanoma, gastric cancer) and in combination with nivolumab. These indications were previously identified as having high percentages of ICOS-expressing infiltrating immune cells. Also, the company is stratifying individuals for the ICOS biomarker to make sure each cohort is sufficiently enriched with patients likely to respond:

Source: Jounce Therapeutics Bioefficacy data JTX-2011

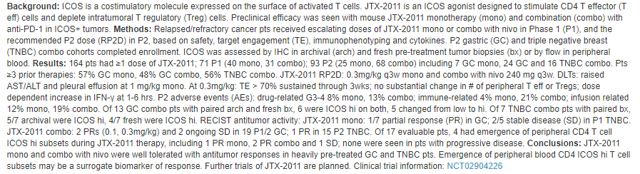

The snippet of results shows some efficacy in a few patients. We went to the ASCO annual meeting site and pulled the abstract:

Source: ASCO Conference Abstract, Jounce Therapeutics

The key takeaway here: " JTX-2011 mono and combo with nivo were well tolerated with antitumor responses in heavily pre-treated GC and TNBC pts. Emergence of peripheral blood CD4 ICOS hi T cell subsets may be a surrogate biomarker of response. Further trials of JTX-2011 are planned."

This tells us that in this early phase, there is evidence to support biological activity of the drug, and that it is well tolerated. With future studies planned, a massive 35% haircut seems overblown.

Fiscally, the company is on solid footing, has some revenues, but is, of course, burning cash. As for its cash position, as of March 31, 2018, cash, cash equivalents and investments were $237.2 million, compared to $257.9 million as of December 31, 2017. This decrease was due to operating costs incurred during the quarter reported last week.

Collaboration revenue was $11.2 million for the first quarter of 2018, compared to $20.3 million for the same period in 2017. Collaboration revenue represents revenue recognition relating to the $225.0 million upfront payment received in July 2016 upon the execution of Jounce’s global strategic collaboration with Celgene.

So where is the company burning cash? In Research and Development (R&D) Expenses. R&D expenses were $18.2 million for the first quarter of 2018, compared to $15.0 million for the same period in 2017. The increase in R&D expenses was primarily due to $1.4 million in increased employee compensation costs related to increased headcount, $0.8 million in increased clinical and regulatory costs related to the Phase 1/2 ICONIC study of JTX-2011 and $0.7 million in increased external research and development costs, primarily attributable to IND enabling activities related to JTX-4014. General and administrative expenses were $6.8 million for the first quarter of 2018, compared to $5.6 million for the same period in 2017. The increase in G&A expenses was primarily due to $0.9 million in increased employee compensation costs primarily related to stock-based compensation expense and $0.4 million in increased professional services fees primarily attributable to operating as a public company.

All told for Q1, net loss was $13.0 million for the first quarter of 2018, or a basic and diluted net loss per share attributable to common stockholders of $0.40.

Looking ahead, we expect cash burn. Based on its current plans, Jounce should see 2018 expenditures of approximately $80.0 million to $100.0 million and expects to record approximately $50.0 million to $60.0 million in collaboration revenue in 2018 from the recognition of the Celgene upfront payment received in 2016.

Given the strength of its balance sheet, Jounce expects its existing cash, cash equivalents, and investments to be sufficient to enable the funding of its operating expenses and capital expenditure requirements for at least the next 24 months. Therefore there will be no capital raises anytime soon.

Overall, we see this selloff as an overreaction, and one we can take a gamble on.

Disclosure: BAD BEAT Investing and Quad 7 Capital is long JNCE

Quad 7 Capital is a leading contributor with various financial outlets, and pioneer of the BAD BEAT Investing philosophy. If you like ...

more