Bulls Slowly Return

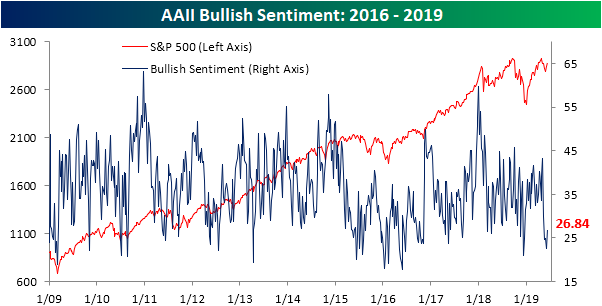

With equities pulling back in May, investor sentiment has held a bearish bias over the past few weeks. Last week’s rally has reversed this build-up of bearish sentiment to a small degree as the percentage of investors reporting as bulls in this week’s AAII survey grew to 26.84% from 22.53% last week. While this is an improvement, investors have been hesitant to rush back as bullish sentiment remains low relative to history. This week’s reading is still over one standard deviation below the historical average of 38.19%. This is a bit of a contrast to the Investors Intelligence survey of newsletter writers, which saw bulls come surging back with the largest increase in the number of respondents reporting as bullish since the first weeks of 2019.

(Click on image to enlarge)

Bearish sentiment, on the other hand, saw a sharper move, falling to 34.2% versus 42.58% last week. That is the largest decline in bearish sentiment since February 7th of this year when it had fallen just under 9% from 31.76% to 22.78%. Similar to bulls, while this is an improvement, bearish sentiment remains elevated above its historical average. Additionally, the bull-bear spread has favored bears for five weeks in a row now. The last time the spread had a streak like this (also five weeks long) was in May of 2016.

(Click on image to enlarge)

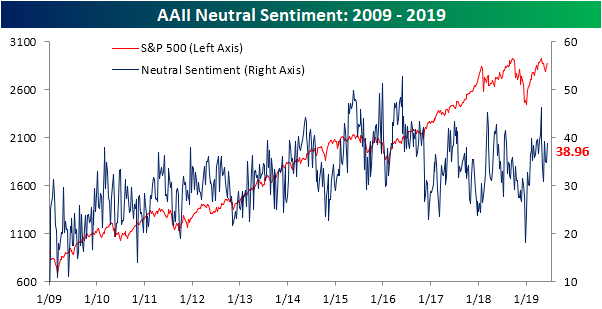

More than anything, investors appear to be hesitant on the current market as neutral sentiment is the predominant sentiment this week. Neutral sentiment is up ~4% this week to 38.96%. While higher than average and elevated, as it has been most of this year, this is not at any sort of extreme reading.

(Click on image to enlarge)

Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much ...

more