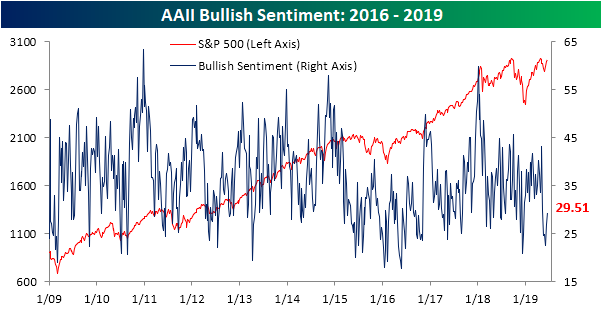

Bullish Sentiment Very Low For A Market At New Highs

The market may be reaching all-time highs today, but sentiment is hardly reflective of that. The AAII weekly sentiment survey continues to see modest improvements in bullish sentiment as it rose 2.7% this week to 29.51%, returning it to its normal range (less than 1 standard deviation from the historical average). But this improvement has not necessarily been at the same pace as the market’s rally off of recent lows. Bullish sentiment is now around 10 percentage points off of where it stood the last time the S&P 500 was at these levels.

(Click on image to enlarge)

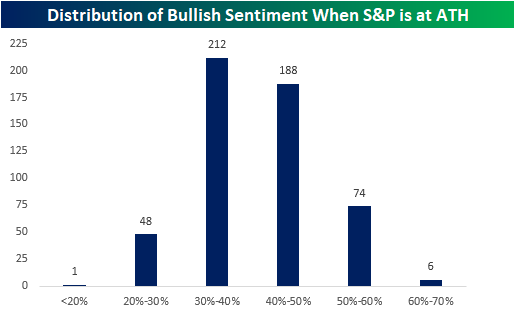

Versus all other times in the history of the survey that the market was at all-time highs, the current reading for bullish sentiment stands in the 8th percentile, so it is very rare to see bullish sentiment this low given the market’s current state. This means individual investors are likely totally caught off guard by recent gains, and there’s plenty of cash on the sidelines that can still be put to work.

(Click on image to enlarge)

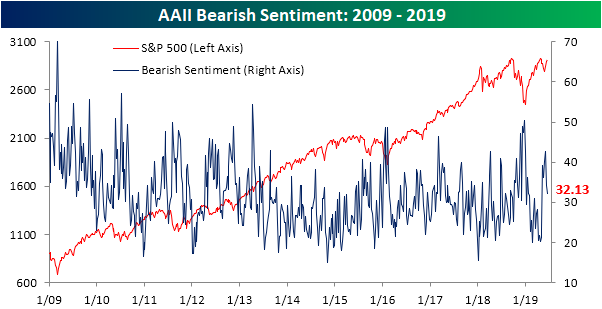

Bearish sentiment saw a similar sized decline to the increase in bullish sentiment. The percentage of investors reporting as bearish fell from 34.2% to 32.13%, a 2.07% decline. That is also about 10% from a high in bearish sentiment of 42.58% that was reached in the first week of the month. This brings this outlook more into a normal range as it is only a little less than two percentage points above the historical average.

(Click on image to enlarge)

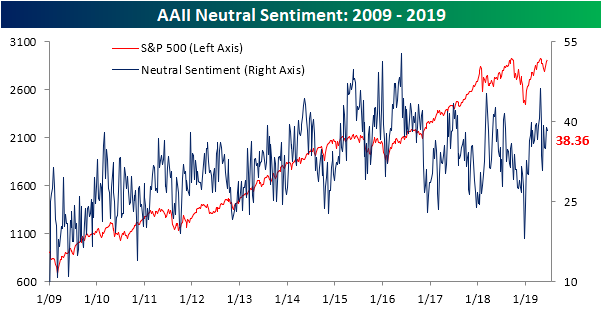

Neutral sentiment still remains at the upper end of the past few years’ range coming in at 38.36% this week, only a minor decrease (0.6%) from last week. As has been the case for most of the past few months, neutral sentiment has been the predominant sentiment reading among surveyed investors.

(Click on image to enlarge)

Start a two-week free trial to one of Bespoke’s three membership levels to access our interactive tools and ...

more