Buffett Is Shortsighted On Airlines: LUV Is A Steal At This Price

Warren Buffett famously advised “be greedy when others are fearful”, and we think he should follow his own advice – assuming he is still a long-term investor. Those overlooking Southwest Airlines Company (LUV: $27.56/share), Warren Buffett included, are in the Danger Zone. Those willing to see through the dip should consider adding this Long Idea to their portfolios.

Best in Business Poised for Long-Term Growth

LUV is not only undervalued relative to the S&P 500, but its underlying business is also strong and poised to rebound after the dip. We first made LUV a Long Idea in July 2016. Since then, LUV has underperformed the market (down 36% vs S&P 500 up 31%). However, given its steep decline in 2020, LUV now presents an even better buying opportunity.

Warren Buffett recently made headlines at Berkshire Hathaway’s (BRK-A) annual shareholder meeting when he disclosed the firm sold its shares in the four largest U.S. airlines, citing that “the world changed for airlines”. While no one can argue with Buffett’s statement in the short term, i.e. 6-12 months, we disagree over the long term. Anything better than a worst-case scenario and LUV presents an excellent risk/reward at its current price.

In addition to the advantages outlined in our original report (largest domestic operator, superior record of profitability, smart investments in technology), LUV has a very strong balance sheet, ample liquidity, and is the only U.S. airline to receive an “investment-grade rating by all three rating agencies,” which increases its flexibility to raise additional capital should the need arise. There will be some carnage in the airline industry, but LUV is best-positioned not only to survive but also to further widen its advantages over the competition.

LUV’s History of Profit Growth

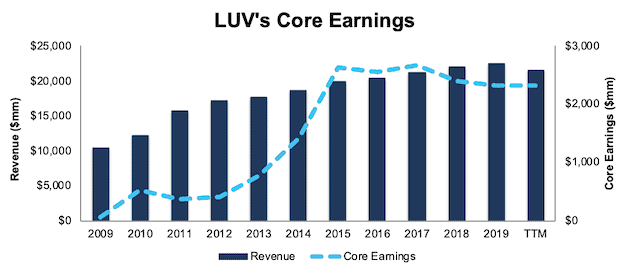

LUV has a strong history of generating consistent profits. Since 2009, LUV has grown revenue by 8% compounded annually and core earnings[1] by 43% compounded annually, per Figure 1. Longer term, LUV has grown core earnings by 8% compounded annually over the past two decades. The firm increased its core earnings margin from 1% in 2009 to 9% in the trailing-twelve-month period (TTM).

Figure 1: LUV’s Core Earnings & Revenue Growth Since 2009

Sources: New Constructs, LLC and company filings.

LUV’s profitability helps the business generate significant free cash flow (FCF). The company generated positive FCF in nine of the past ten years and a cumulative $14.6 billion (92% of market cap) over the past five years. LUV’s $2.1 billion in FCF over the TTM period equates to a 10% FCF yield, which is significantly higher than the Industrials sector average of 2%.

Executive Compensation Plan Incentivizes Prudent Capital Stewardship

No matter the macro environment, investors should look for companies with executive compensation plans that directly align executives’ interests with shareholders’ interests. Quality corporate governance holds executives accountable to shareholders by incentivizing them to allocate capital prudently.

In fiscal 2019, performance shares made up 50% of LUV’s long-term incentive program. These performance shares are tied to the company’s return on invested capital (ROIC). Though ROIC has declined from 15% in 2019 to 12% over the TTM, the focus on improving ROIC aligns the interests of executives and shareholders and helps to ensure quality capital allocation.

Southwest’s Balance Sheet Provides Ample Liquidity to Survive the Crisis

LUV has taken steps in recent weeks to ensure it has the cash to survive the current disruption to operations. After issuing debt and drawing down its credit line, the firm had $9 billion in cash on hand by the time of its earnings call in late April.

On May 1, 2020, the firm completed a $2.3 billion public offering of senior notes and a $2.3 billion share offering. In total, LUV has nearly $14 billion in cash on hand, which includes half of the $3.3 billion in relief aid the firm has already received through the government’s Coronavirus Aid, Relief, and Economic Security (CARES) Act. The CARES Act also offers LUV the option to accept an additional $2.8 billion loan by September 30, 2020, should the firm so choose.

During its earnings call, the firm estimated that its daily cash burn was $30 to $35 million per day. In a worst-case scenario where LUV pays down its current debt, generates no revenue, and incurs expenses of $35 million per day, LUV could operate for over fourteen months with its current cash balance and pending $1.6 billion of remaining CARES Act relief before needing additional capital. It seems unlikely that LUV’s revenue would go to zero since the firm is currently operating (albeit at a diminished rate) flights. Additionally, LUV would be able to reduce some of its operating expense should a worst-case scenario emerge.

LUV’s Profitability Helps Survive the Crisis and Grow During the Recovery

COVID-driven disruptions may drive some weaker airline operators out of business for good. However, LUV’s profitability was superior to its competitors before the crisis, and the firm is well-positioned to grow profits when the economy recovers.

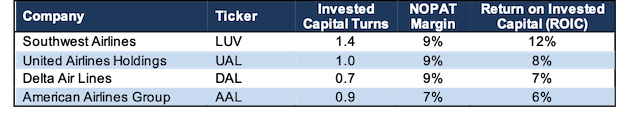

LUV’s invested capital turns, a measure of balance sheet efficiency, rank highest among the four largest U.S. airlines, which include LUV, Delta Air Lines, Inc. (DAL), United Airlines Holdings, Inc. (UAL), and American Airlines (AAL). LUV’s net operating profit after-tax (NOPAT) margin ranks second amongst this group as well.

High margins and invested capital turns drive LUV’s leading return on invested capital (ROIC). Per Figure 2, LUV’s current ROIC of 12% ranks well above each of the other largest U.S. airlines.

Figure 2: LUV’s Superior Profitability vs. Competitors

Sources: New Constructs, LLC and company filings.

Well-Positioned to Take More Market Share Once Growth Returns

LUV has a proven track record of taking and keeping market share. It became the U.S.’s largest domestic air carrier in 2003 and has maintained that ranking through 2019 according to the most recent reporting of domestic originating passengers boarded by the U.S. Department of Transportation. While bad economic conditions may force some airlines out of business, LUV is well-positioned to once again come through a crisis.

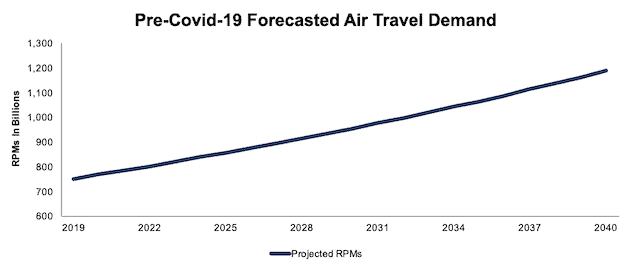

We believe the current drop off in economic activity is temporary and expect the airline industry to recover over the long-term. Before the pandemic, the Federal Aviation Administration (FAA) forecasted revenue passenger miles (RPMs) – a measure of air-travel demand – to increase by an average of 2.2% per year for the next 20 years. Figure 3 shows the expected increase in RPMs, from 752 billion in 2019 to 1,188 billion in 2040. While RPMs should fall in short-term, long-term demand for air travel should remain strong.

Figure 3: FAA’s Pre-Covid-19 Revenue Passenger Miles (RPM) Forecast

Sources: New Constructs, LLC and FAA.

Furthermore, the International Monetary Fund (IMF) and nearly every economist in the world believe the global economy will grow strongly in 2021. The IMF estimates the global economy will expand by 5.8%, and the U.S. economy by 4.7%, in 2021. The overall growth in the economy should lead to a rebound in the airline industry. For comparison, within three years of the World Trade Center attacks on 9/11/01, the number of passengers travelling by air had recovered to pre 9/11 highs.

LUV Trades at Cheapest Level in History

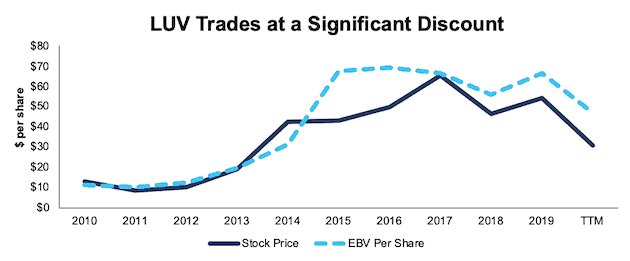

After falling 49% YTD to $27.56/share (closing price as of May 4, 2020), and adjusting for the dilutive financing since the close of the first quarter noted above, LUV now trades at its cheapest PEBV ratio (0.6) in the history of our model. This ratio means the market expects LUV’s NOPAT to permanently decline by 40%. This expectation seems overly pessimistic over the long term.

LUV’s current economic book value, or no-growth value, after accounting for its dilutive financing activities, is $47/share – a 74% upside to the current price.

Figure 4: LUV’s Stock Price vs. Economic Book Value (EBV)

Sources: New Constructs, LLC and company filings.

LUV’s Current Price Implies No Economic Recovery

Below, we use our reverse DCF model to quantify the cash flow expectations baked into LUV’s current stock price. Then, we analyze the implied value of the stock based on different assumptions about COVID-19’s impact on the airline industry and LUV’s future growth in cash flows.

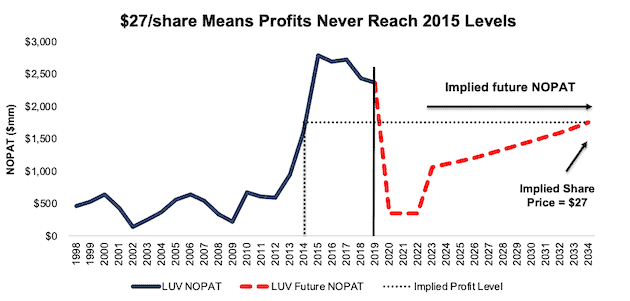

Scenario 1: Using recent projections for revenue declines, historical margins, and average historical GDP growth rates, we can model the worst-case scenario already implied by LUV’s current stock price. In this scenario, we assume:

- NOPAT margins fall to 3% (company average from 2002-2003) from 2020 to 2022 (vs. 11% 2019) and increase to 10% (below five-year company average of 12%) in 2023 and each year thereafter

- Revenue falls 55% (in line with recent global revenue decline projections) in 2020 and does not grow in 2021 or 2022

- Sales begin growing again in 2023, but only at 5% a year, which is below LUV’s revenue CAGR over the past two decades (8%)

In this scenario, where LUV’s NOPAT declines 47% compounded annually from 2019 to 2022 and 2% compounded annually over the next 15 years, the stock is worth $27.25 share today – or nearly equal to the current stock price. This scenario accounts for the dilutive share offering, debt issuance, and relief aid received from the CARES Act. We assume this capital will be used to cover LUV’s operating losses and do not treat it as excess cash. See the math behind this reverse DCF scenario.

For reference, LUV’s NOPAT declined by 53% compounded annually from 2000 to 2002 before growing by 14% compounded annually over the next decade (2003-2013).

Figure 5 compares the stock’s implied future NOPAT to the firm’s historical NOPAT in this scenario. This worst-case scenario implies LUV’s NOPAT 15 years from now will be 26% below its 2019 NOPAT. In other words, this scenario implies that 15 years after the COVID-19 pandemic, LUV’s profits will have only recovered to ~2014 levels. In any scenario better than this one, LUV holds significant upside potential, as we’ll show below.

Figure 5: Current Valuation Implies Severe, Long-Term Decline in Profits: Scenario 1

Sources: New Constructs, LLC and company filings.

Scenario 2: Long-term View Could Be Very Profitable

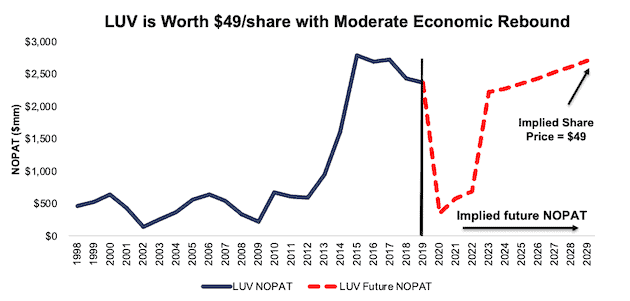

If we assume, as does the IMF and nearly every economist in the world, that the global economy rebounds and returns to growth starting in 2021, LUV is highly undervalued.

In this scenario, we assume:

- NOPAT margins fall to 3% (company average from 2002 to 2003) from 2020 to 2022 (vs. 11% in 2019) and increase to 10% (below five-year company average of 12%) in 2023 and each year thereafter

- Revenue falls 55% (in line with recent global revenue decline projections) in 2020

- Revenue meets consensus expectations in 2021, 2022, and 2023 (+65%, +19%, and +12%) and 3.5% thereafter, which equals the average global GDP growth rate since 1961

In this scenario, LUV’s NOPAT falls 85% in 2020 and grows by 1% compounded annually over the next decade, and the stock is worth $49/share today – a 78% upside to the current price. This scenario also accounts for the dilutive share offering, debt issuance, and relief aid received from the CARES Act. We assume this capital will be used cover LUV’s operating losses and do not treat it as excess cash on the balance sheet. See the math behind this reverse DCF scenario.

For comparison, LUV has grown NOPAT by 8% compounded annually over the past five years and 26% compounded annually over the past decade.

It’s not often investors get the opportunity to buy an industry leader at such a discounted price.

Figure 6 compares the stock’s implied future NOPAT to the firm’s historical NOPAT in scenario 2.

Figure 6: Implied Profits Assuming Global Recovery Starts in 2021: Scenario 2

Sources: New Constructs, LLC and company filings.

Sustainable Competitive Advantages Will Drive Shareholder Value Creation

Here’s a summary of why we think the moat around LUV’s business will enable it to continue to generate higher NOPAT than the current market valuation implies. The following competitive advantages help LUV survive the downturn and return to growth as the economy grows again:

- Ample liquidity to survive the dip

- Most market share among U.S. airlines

- Most profitable among the largest U.S. airlines

What Noise Traders Miss with LUV

These days, fewer investors focus on finding quality capital allocators with shareholder-friendly corporate governance. Instead, due to the proliferation of noise traders, the focus is on short-term technical trading trends while high-quality fundamental research is overlooked. Here’s a quick summary of what noise traders are missing:

- Consistent core earnings growth over the past decade

- LUV’s ability to grow market-share throughout economic cycles

- Valuation implies the airline industry never recovers from COVID-19

Dividend and Buybacks Suspended in the Near-Term

By accepting financing under the CARES Act, LUV is prohibited from repurchasing shares and paying dividends until September 30, 2021. Prior to the pandemic, LUV’s quarterly dividend provided a 2.5% yield, and the firm had increased its dividend in each of the last eight years. Should LUV’s business return to any sort of normalcy, we would expect the suspension to be temporary, and for LUV to return capital to shareholders again.

In the past five years, LUV generated far more in free cash flow ($14.6 billion) than it has paid out in dividends ($1.4 billion), or an average $2.6 billion surplus each year.

Firms with cash flows greater than dividend payments have a higher likelihood to maintain and grow dividends. While LUV is required to suspend its dividend in the short term, investors buying at current prices could get a nice yield with upside potential if LUV reinstates the dividend over the long term.

In addition to dividends, LUV returned capital to shareholders through share repurchases. LUV repurchased $2 billion worth of shares in both 2018 and 2019. Prior to the suspension, LUV had an additional $889 million remaining under its current authorization. Should the firm resume share repurchases once the CARES Act prohibition ends, the yield for investors will only increase.

A Consensus Beat or Signs of Recovery Could Send Shares Higher

According to Zacks, consensus estimates at the end of February pegged LUV’s 2020 EPS at $4.58/share. Jump forward to May 1, and consensus estimates for LUV’s 2020 EPS have fallen to -$4.24/share.

Though the COVID shutdowns are crushing near-term profits, these lowered expectations provide a great opportunity for a strong business, such as LUV, to beat consensus, if not this quarter, then maybe the next. Though our current Earnings Distortion Score for LUV is “In-Line”, LUV beat EPS estimates in 11 of the past 12 quarters, and doing so again, in the midst of such market turmoil, could send shares higher.

Additionally, any signs of a recovery in air travel would send shares higher. Southwest CEO Gary Kelly has already signaled that the worst may be behind the firm.In an interview with CBS on May 3, 2020, Mr. Kelly said he thinks the first week of April was the worst period for LUV and “business should pick up from here.”Specifically, he noted “each week after the first week of April has gotten successively better.”

Insider Trading and Short Interest Trends

Over the past twelve, months, insiders have bought a total of 867 thousand shares and sold 2.9 million shares for a net effect of 2 million shares sold. These sales represent less than 1% of shares outstanding.

There are currently 8.4 million shares sold short, which equates to 1% of shares outstanding and 1 day to cover. Short interest is down 13% from the prior month. Clearly investors aren’t willing to bet on the downturn implied by LUV’s current stock price and expect the firm to survive the crisis.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings as shown in the Harvard Business School and MIT Sloan paper, "Core Earnings: New Data and Evidence”.

Below are specifics on the adjustments we make based on Robo-Analyst findings in Southwest Airlines Company’s 2019 10-K:

Income Statement: we made $323 million of adjustments with a net effect of removing $61 million in non-operating expenses (<1% of revenue). See all adjustments made to LUV’s income statement here.

Balance Sheet: we made $5.6 billion of adjustments to calculate invested capital with a net decrease of $581 million. One of the most notable adjustments was $255 million (2% of reported net assets) in other comprehensive income. See all adjustments to LUV’s balance sheet here.

Valuation: we made $13.8 billion of adjustments with a net effect of decreasing shareholder value by $4.9 billion. Apart from total debt, the most notable adjustment to shareholder value was $2.3 billion in deferred tax liabilities. This adjustment represents 15% of LUV’s market cap. See all adjustments to LUV’s valuation here.

Attractive Funds That Hold LUV

The following funds receive our Attractive-or-better rating and allocate significantly to Southwest Airlines.

- U.S. Global Jets ETF (JETS) – 13.1% allocation and Very Attractive rating.

- Fidelity Air Transportation Portfolio (FSAIX) – 7.2% allocation and Very Attractive rating.

- Invesco Dynamic Leisure & Entertainment ETF (PEJ) – 4.8% allocation and Attractive rating.

- Provident Trust Strategy Fund (PROVX) – 4.7% allocation and Very Attractive rating.

- Fuller & Thaler Behavioral Unconstrained Equity Fund (FTZIX) – 4.1% allocation and Very Attractive rating.

- Vanguard PrimeCap Core Fund (VPCCX) – 4.0% allocation and Very Attractive rating.

- First Trust NASDAQ Transportation ETF (FTXR) – 4.0% allocation and Very Attractive rating.

[1] Our core earnings are a superior measure of profits, as demonstrated in In Core Earnings: New Data & Evidence a paper by professors at Harvard Business School (HBS) & MIT Sloan. The paper empirically shows that our data is superior to “Income Before Special Items” from Compustat, owned by S&P Global (SPGI).

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.