'Buffett Indicator' Extremes Expose "Remarkable Mania" In US Equities

"It is growing increasingly clear to me that global stock markets are in the process of making a speculative move (driven by global liquidity) that may even compare to the advances that culminated in the seminal market tops in the Fall of 1987 and in the Spring of 2000."

Doug Kass' words echo around every corner of the world's markets - from junk bond yields at record lows (amid record leverage) to soaring commodity prices, and from 2000%-plus decentralized short-squeezes in worthless stocks to Dogecoin exuberance.

And the latest of these extreme market indications comes from The Oracle Of Omaha, whose favorite stock market valuation indicator flashes redder than ever before.

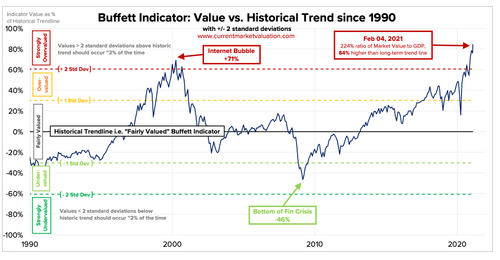

A glance at the chart below and Buffett’s most-famous catchphrases comes to mind: Investors should “be fearful when others are greedy.”

The "Buffett Indicator" is a simple ratio: The total market capitalization of U.S. stocks divided by the total dollar value of the nation’s gross domestic product. It first crossed above its previous dot-com era peak in 2019.

And now, as Bloomberg reports, with U.S. market cap more than double the level of estimated GDP for the current quarter, the ratio has surged to the highest-ever reading above its long-term trend, according to an analysis by the blog Current Market Valuation, suggesting a “strongly overvalued” situation.

This detachment of the Buffett indicator from its long-term trend joins an assortment of other valuation metrics that have exceeded their previous records in the rebound from the pandemic-induced bear market last year - if not years earlier.

Price-to-earnings, price-to-sales and price-to-tangible-book value are among the metrics firmly above dot-com era levels that many investors assumed were once-in-a-lifetime peaks.

“It highlights the remarkable mania we are witnessing in the U.S. equity market,” said Michael O’Rourke, chief market strategist at JonesTrading.

“Even if one expected those (Fed) policies to be permanent, which they should not be, it still would not justify paying two times the 25-year average for stocks.”

As Doug Kass previously noted:

No longer is the market hostage to the real economy or sales and profit growth – stuff I have spent four decades analyzing. Instead, liquidity is seen as an overriding influence, actually it has become the sine quo non.

As such, historical valuations become increasingly irrelevant, and price momentum is the lodestar."

And for those who continue to claim that "valuations don't matter, low rates mean 'There Is No Alternative' than stocks", some fact-checking may be in order... 30Y Treasury yields are at their 'cheapest' to stocks since July 2019...

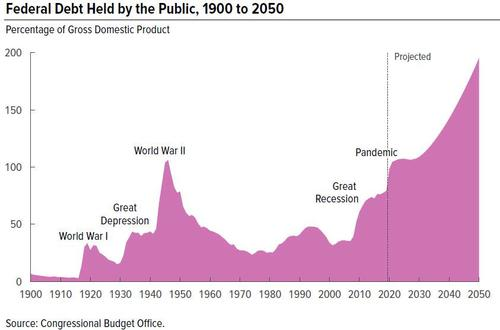

But, just this week, Fed Chair Powell reiterated the central bank's extreme emergency manic-panic-frantic stimulative policies will not be reeled in anytime soon... if ever... because, how else will the government afford all this malarkey?

We given the last word to Artemis Capital's Chris Cole, who correctly notes that there's "no margin for error" in these markets.

High yield credit spreads at all-time lows (~3.2%) + Corporate Debt-to-GDP at all-time highs (51%)

— Christopher Cole (@vol_christopher) February 10, 2021

2% inflation is a narrow line between a ROCK (pension default due to low rates) and a HARD PLACE (corporations default if they can't roll debt at low rates)

No margin for error pic.twitter.com/p2EDteduNj

Former Dallas Fed president Richard Fisher warned in 2016 that then Yellen's Fed was "living in a constant fear of a market reaction. This is not how the way you manage central bank policy"... that situation is now so conditioned into investors' minds that The Fed is even more cornered (by their own hand). As Fisher stunned CNBC last year:

"The Fed has created this dependency and there's an entire generation of money-managers who weren't around in '74, '87, the end of the '90s, and even 2007-2009.. and have only seen a one-way street... of course they're nervous."

"The question is - do you want to feed that hunger? Keep applying that opioid of cheap and abundant money?"

For now, the answer is yes. But when will the OD occur?

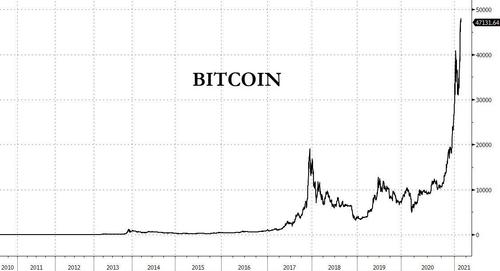

Maybe there is an asset (beyond centralized establishment control) that is signaling the OD is already here?

Or, as The FT questions - is this just another 'digital' tulip?

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more