Bristol-Myers Squibb Is Undervalued

Bristol-Myers Squibb (BMY) is under considerable pressure, the stock has declined by more than 25% from its highs of the year due to generalized negativity towards the drug manufacturing sector and the uncertainty produced by the Celgene (CELG) acquisition.

On the other hand, the business remains fundamentally solid, and the stock is attractively valued at current levels. The risk versus reward trade-off in Bristol-Myers Squibb looks clearly convenient going forward.

The Fundamentals Remain Solid

In spite of the risk factors affecting Bristol-Myers Squibb in the middle term, the most recent financial report from the company confirms that the business keeps firing on all cylinders. Bristol-Myers Squibb delivered both revenue and earnings above market expectations last quarter, and the business looks healthy across the board.

Total revenue reached $6.3 billion during the quarter, an increase of 10% versus the same quarter in the prior year. U.S. revenues increased by 14% to $3.7 billion, and international revenues grew 5%. When adjusted for foreign exchange impact, international revenues increased by 12%. Non-GAAP earnings per share increased by a vigorous 17% year over year.

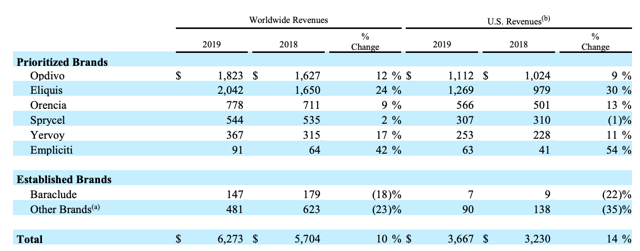

Taking a look at the company's different products, Bristol-Myers Squibb is doing well in its leading drugs, which bodes well in terms of evaluating potential performance going forward.

(Click on image to enlarge)

Source: SEC filings

The Celgene acquisition will necessarily carry some integration risks, but the deal makes sense from both a strategic and financial perspective. According to management, the combined company will be the top player in oncology and cardiovascular and one of the top five in immunology and inflammation. The new company will have nine blockbusters and six near-term launch candidates and more than 50 Phase 1 and 2 clinical programs.

Based on calculations from Bristol-Myers Squibb, the Celgene acquisition will be 40% accretive to earnings per share in year one and 10% accretive each year thereafter through 2025.

Management estimates about the potential impact of acquisitions should always be taken with a grain of salt, and there are several moving parts to consider when evaluating financial performance going forward. Patent expirations and increasing competition are obvious considerations, and there is increasing political pressure for more regulations to reduce drug costs lately.

Nevertheless, even when incorporating these risk factors, chances are that Bristol-Myers Squibb will continue delivering solid revenue and earnings for shareholders in the years ahead.

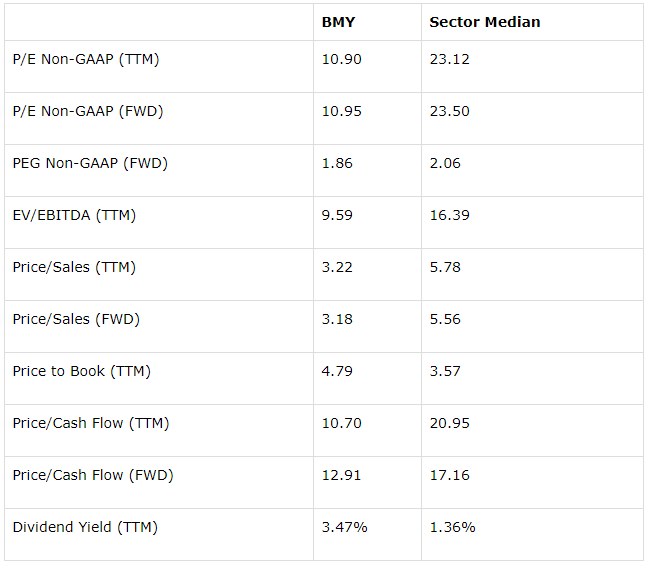

Attractive Valuation Ratios

The table below compares a wide variety of valuation metrics for Bristol-Myers Squibb versus the median values in the sector. The numbers are quite eloquent, and the stock is materially undervalued in comparison to the sector.

(Click on image to enlarge)

Data Source: Seeking Alpha Essential

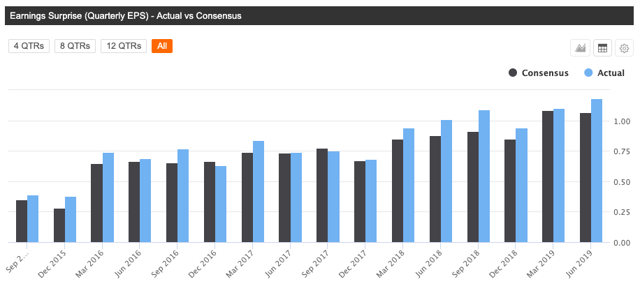

It is important to keep in mind that valuation is a dynamic as opposed to a static concept. When a company consistently delivers earnings numbers above expectations, this drives forward-looking expectations higher. In order for the valuation to remain stable, the stock price needs to increase to reflect those higher expectations.

Bristol-Myers Squibb has delivered earnings numbers above Wall Street expectations in 14 of the past 16 quarters, quite an impressive track record of consistent outperformance.

(Click on image to enlarge)

Source: Seeking Alpha Essential

Fundamental momentum is a pervasive phenomenon, meaning that companies that typically deliver above expectations tend to continue doing so more often than not. If Bristol-Myers Squibb continues delivering better than expected numbers, then the stock would be even cheaper than what current numbers are indicating.

Multi-Factor Assessment

Valuation needs to be analyzed in the context of other return drivers. A company producing strong growth rates and consistently delivering earnings above expectations deserves a higher valuation than a business producing mediocre financial performance and underperforming expectations.

But sometimes it can be challenging to incorporate the multiple factors into the analysis in order to see the complete picture from a quantitative perspective. The PowerFactors system is a quantitative system that ranks companies in a particular universe according to a combination of factors, such as financial quality, valuation, fundamental momentum, and relative strength.

(Click on image to enlarge)

Data from S&P Global via Portfolio123

The backtested performance numbers show that companies with high PowerFactors rankings tend to deliver superior returns over the long term, and this bodes well for investors in Bristol-Myers Squibb.

The company has a PowerFactors ranking of 96 as of the time of this writing, meaning that Bristol-Myers Squibb is in the top 4% of companies in the US stock market based on financial quality, valuation, fundamental momentum, and relative strength combined.

Solid Dividend Yield

It's one thing to say that a stock is undervalued based on earnings and cash flows because this can sound like a purely theoretical idea to many investors. However, when the stock is cheap based on the cold hard cash that the company distributes to shareholders via dividends, undervaluation becomes much more tangible.

Bristol-Myers Squibb has a dividend yield of 3.47%, which is not exceptionally high in comparison to the high-dividend stock universe, but it's still quite an attractive yield coming from a financially sound business and in the current economic environment.

It's important to keep in mind that interest rates around the world are at historically low levels, and there is even $17 trillion in global debt with negative yields all over the world. In this context, most high dividend stocks are getting rather expensive as investors go hunting for current income in the stock market. Bristol-Myers Squibb presents a rare opportunity to invest in a solid business with compelling valuation levels and an attractive dividend yield.

The company has remarkably strong cash flow generation capabilities. The business produced $7.18 billion in cash flow from operations last quarter, with capital expenditures absorbing only $909 million. This leaves Bristol-Myers Squibb with $6.27 billion in free cash flow during the period. Dividend payments required only $2.6 billion, so Bristol-Myers Squibb can comfortably sustain dividend payments going forward.

Bristol-Myers Squibb has recently issued $19 billion in debt to pay for the Celgene acquisition, so this will put some pressure on the company from a financial perspective. Management is planning to sustain and even increase dividends going forward, but it makes sense to expect dividend growth to remain in the low-single digits in the middle term.

The main point is that Bristol-Myers Squibb is valued at conveniently low levels, especially for such a strong business. While investors wait for the uncertainty drivers to dissipate and for the stock to appreciate over time, the dividend yield should provide compensation for such patience.

Moving Forward

Drug manufacturers are under pressure due to patent expirations in the years ahead and political pressure to reduce healthcare costs across the board. In the case of Bristol-Myers Squibb, the Celgene acquisition will add significant debt to the balance sheet and it will also carry implementation risks.

However, those risks are already well known by the market and incorporated into the valuation to a good degree. In fact, the market seems to be overreacting to the uncertainty, since Bristol-Myers Squibb looks excessively cheap for such a high-quality business. If management executes well, the stock could deliver substantial gains from current valuation levels.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in BMY over the next 72 hours.

Disclaimer: I wrote this article myself, and it expresses my ...

more