Bounce Continues With Volume

Buyers worked the bullish harami as a swing low with a second day of buying, this time on higher volume accumulation. The biggest winner of the lead indices was the Russell 2000, but all indices benefited.

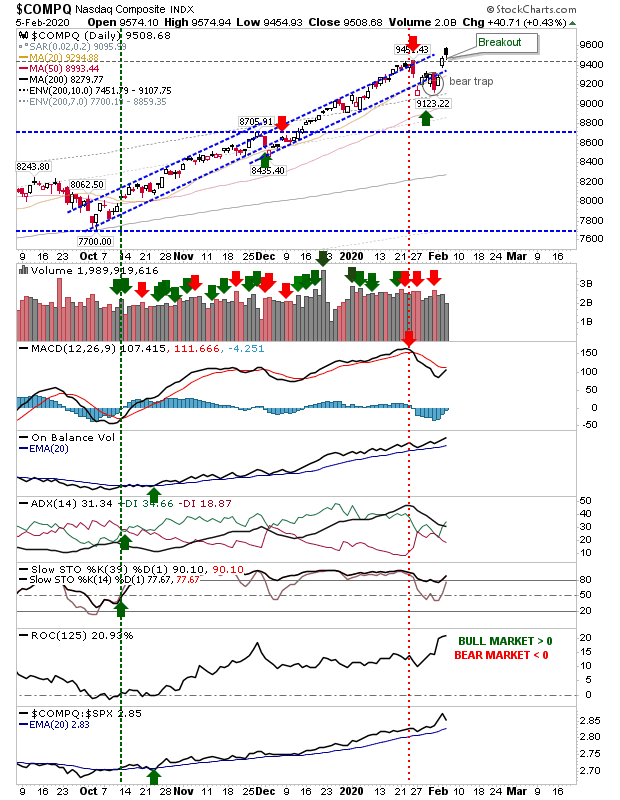

The gains in the Nasdaq counted as a breakout yesterday but volume was light. Today's gain registered as a bearish black candlestick, with the index closing below its open price. Despite the opening loss, it didn't reverse the breakout. If prices can stay above 9,400 it would complete a return to net bullish technicals with a MACD trigger 'buy'.

(Click on image to enlarge)

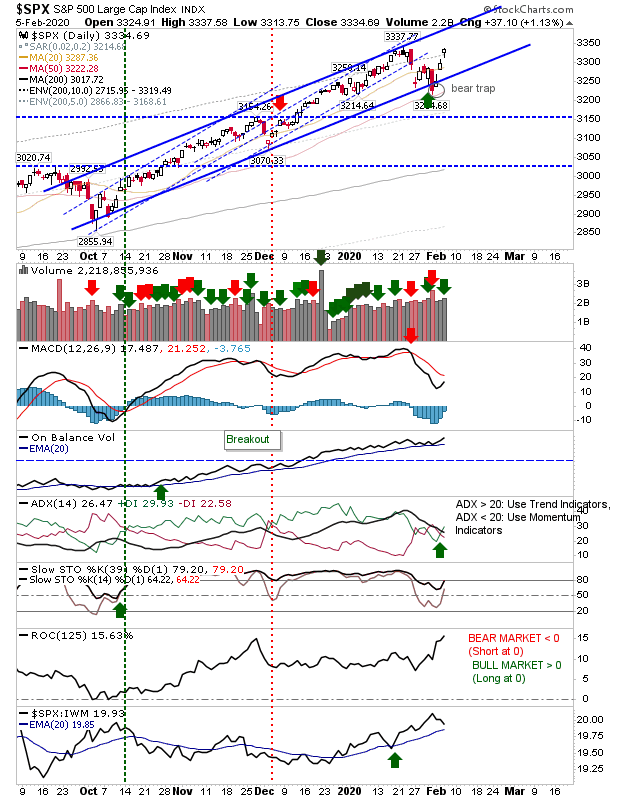

The S&P enjoyed higher buying volume accumulation, building on yesterday's gain. The rally off the 50-day MA counts as a 'bear trap', which if it plays to form typical of this pattern should see a rally to channel resistance.

(Click on image to enlarge)

The Russell 2000 gained 1.5% but it had fallen out of its channel and has a long way to make it back. Relative performance is still falling off a cliff but the buying in the IWM did enough to deliver a new 'buy' trigger in On-Balance-Volume.

(Click on image to enlarge)

On a final note, the Semiconductor Index added over 2% as it saw a return to the middle of its rising channel and finished with a close above its 20-day MA.

(Click on image to enlarge)

Tomorrow will be about holding on to the gains of the last two days. I still think this bounce has come a little early but with the Russell 2000 breaking higher, any chance of an A-B-C, zig-zag style correction is looking more unlikely with each passing day. Any big drop tomorrow will only open up for another run at the bullish harami swing low; indeed, a short attack in the opening hour of trading could set up an intermediate-term short play, lasting a few days.