BofA Surges On Solid Earnings Beat Despite Big FICC Miss, Jump In Credit Loss Provision

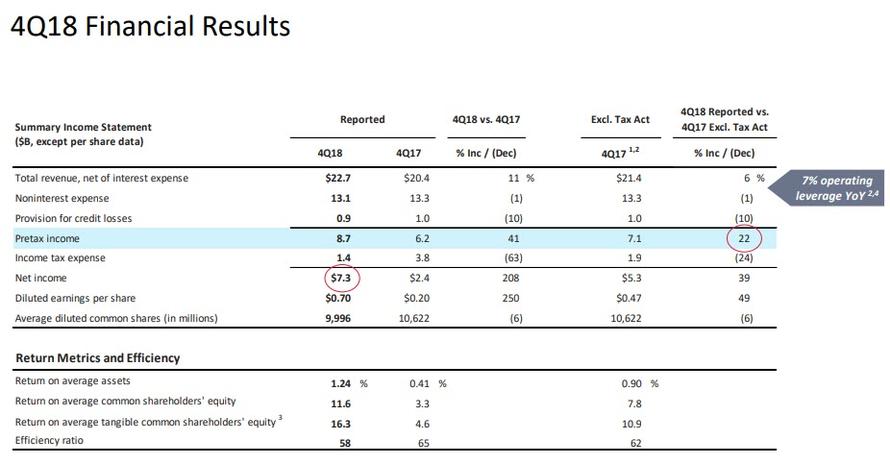

Following disappointing earnings from Citi and JPMorgan, which yesterday reported the first EPS miss in 15 consecutive quarters, the market breathed a sigh of relief when Bank of America reported strong top and bottom-line results, with revenue rising 6% Y/Y to $22.7BN, beating consensus estimates of $23.35BN, and resulting in stronger than expected Net Income of $7.3BN and EPS of 70 cents, up 49% Y/Y, and well above the 63 cent forecast.

(Click on image to enlarge)

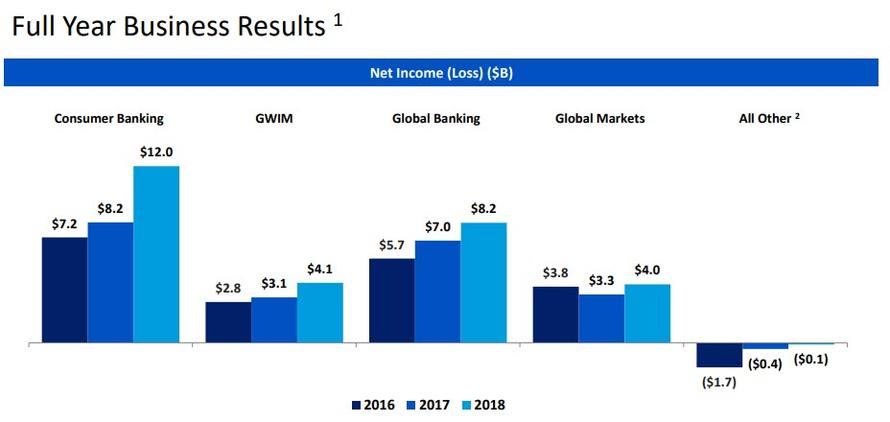

BofA performance, like Citi and JPM, has been a function of strong consumer banking income, which posted an impressive increase in 2018, even as Global Markets were generally flat for the full year...

(Click on image to enlarge)

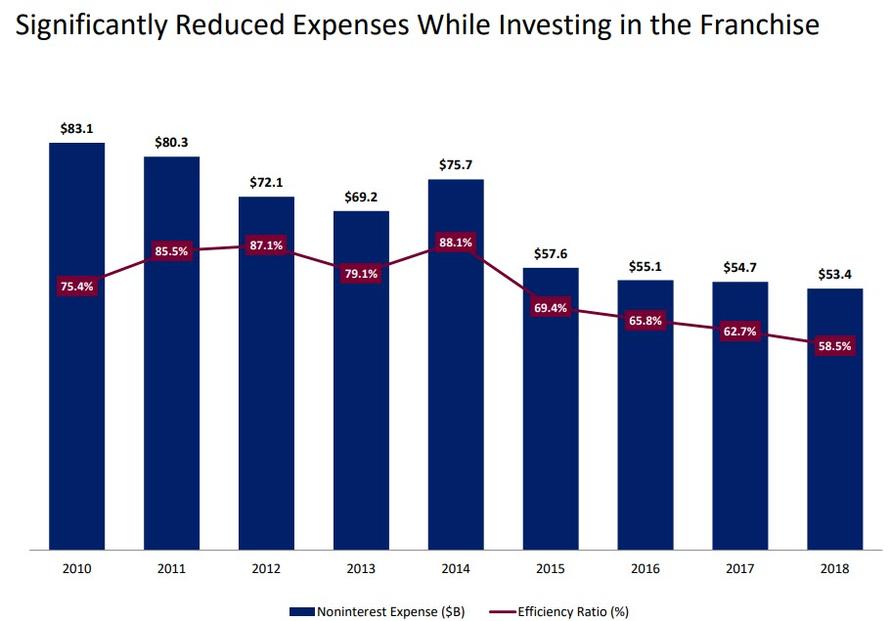

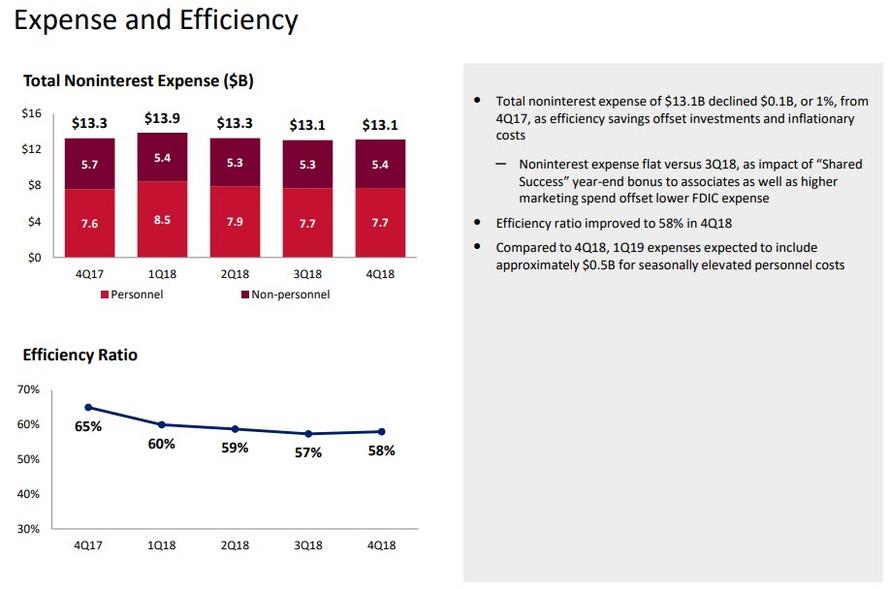

... largely the result of continued cost cuts across the business, which has seen its non-interest expense drop to the lowest this decade.

(Click on image to enlarge)

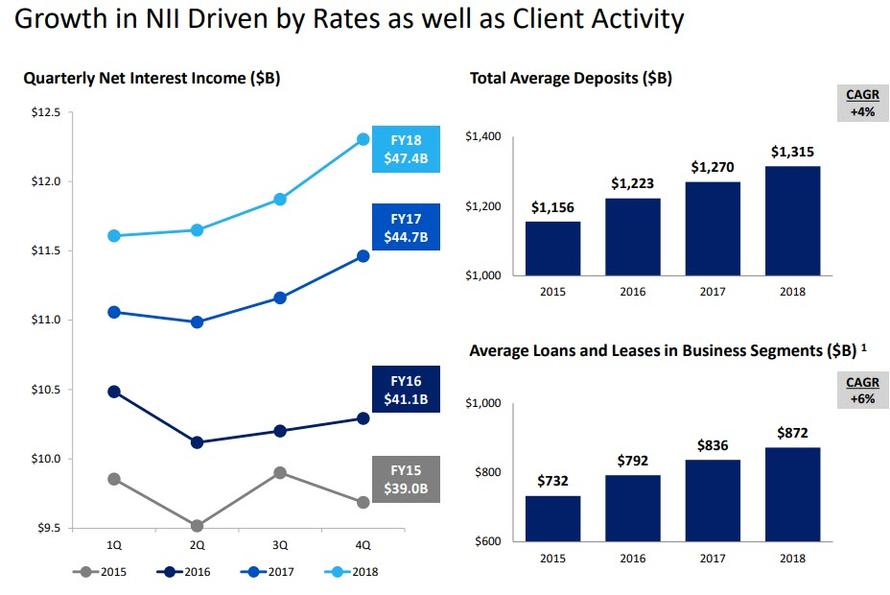

Meanwhile, even as Net Interest Income continued to grow...

(Click on image to enlarge)

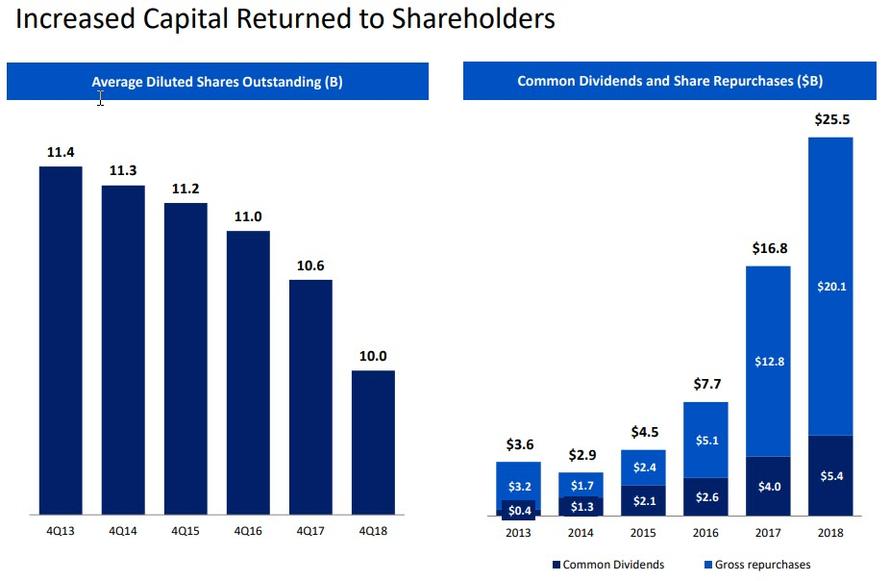

... one can argue that the bank's strong bottom line performance has been mostly a function of aggressive stock repurchases.

(Click on image to enlarge)

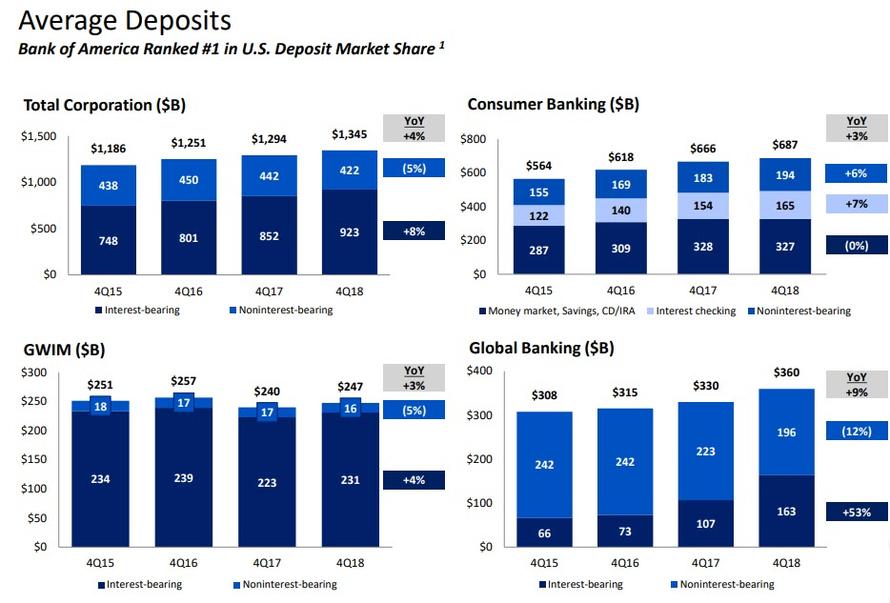

Going back to the 4th quarter, and looking at what did well, BofA is quick to note that it saw a 4% increase in total average deposits to a record high $1.345TN, driven by a 9% increase in Global Banking deposits.

(Click on image to enlarge)

At the same time, and in keeping with the overall cost-cutting theme, total noninterest expense was flat in Q4 versus 3Q18, as the impact of :Shared Success" year-end bonus to associates as well as higher marketing spend offset lower FDIC expense. According to BofA, compared to 4Q18, 1Q19 expenses expected to include approximately $0.5B for seasonally elevated personnel costs.

(Click on image to enlarge)

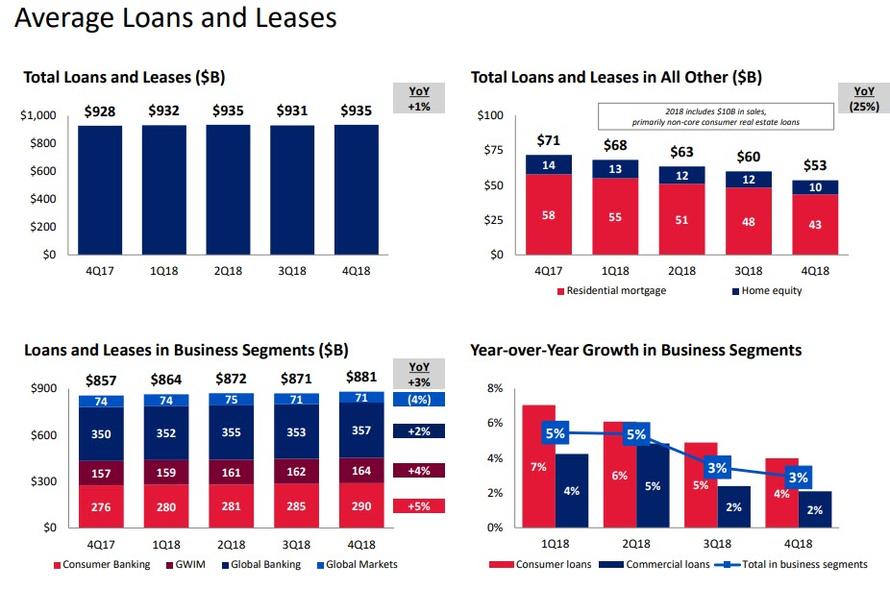

While not as impressive, average loans and leases also rose 1% Y/Y to $935BN, driven by a 5% increase in Consumer Banking loans despite a clearly slowdown in loan increases as shown below.

(Click on image to enlarge)

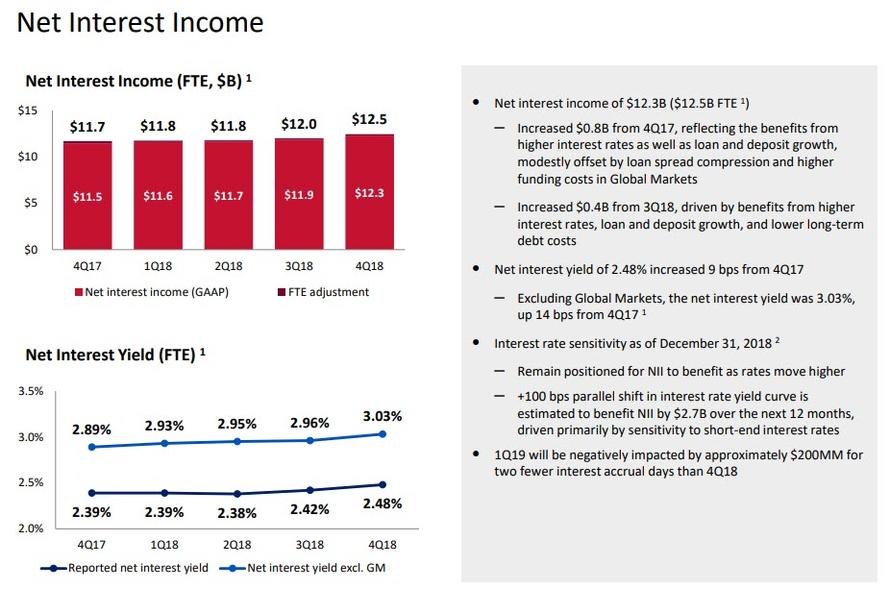

Confirming the strong performance of the consumer bank, Net Interest Income increased $0.8B from 4Q17 to $12.3BN, thanks to "benefits from higher interest rates as well as loan and deposit growth, modestly offset by loan spread compression and higher funding costs in Global Markets." Meanwhile, Net interest margin (or yield) of 2.48% increased an impressive 9 bps from 4Q17, while excluding Global Markets, the net interest yield was 3.03%, up 14 bps from 4Q17.

(Click on image to enlarge)

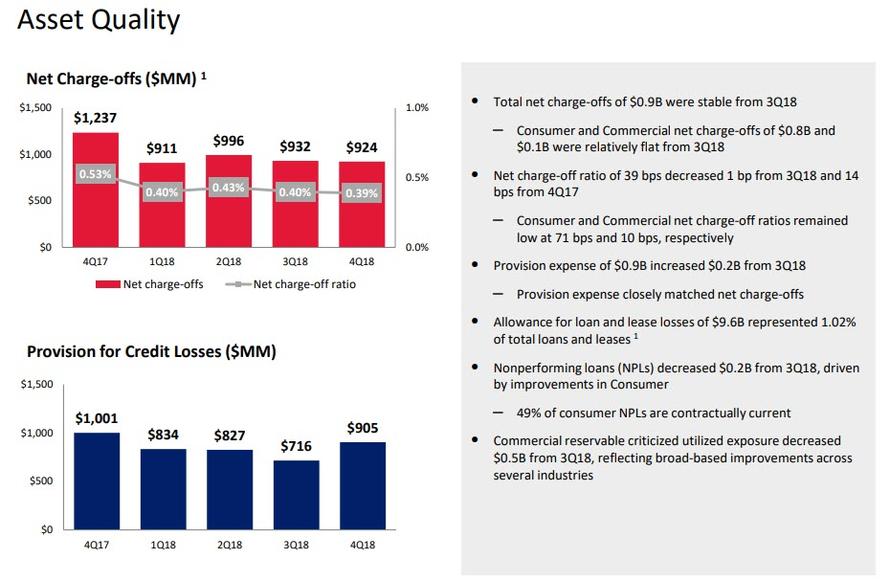

Now the not so good news: looking at the bank's asset quality, while total net charge-offs were relatively flat Q/Q and down over $300MM Y/Y, to $924MM, there was a surprising jump in provisions for credit losses, which surged in Q4 from $716MM to $905MM, similar to what JPM reported, and will likely prompt questions what BofA may be bracing for. Separately, the allowance for loan and lease losses of $9.6B represented 1.02% of total loans and leases, while nonperforming loans (NPLs) decreased $0.2B from 3Q18, driven by improvements in Consumer, with BofA noting that 49% of consumer NPLs are contractually current.

(Click on image to enlarge)

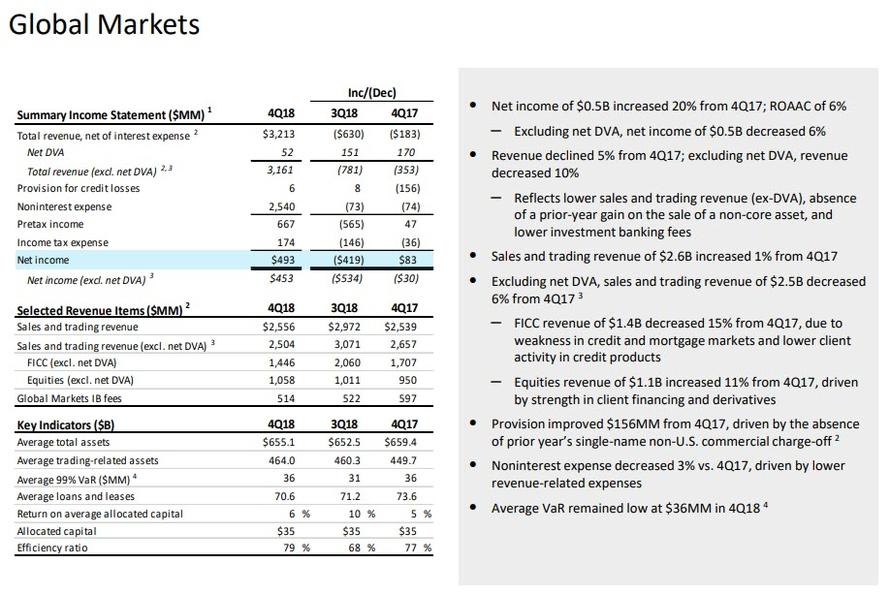

But the biggest disappointment, as in the case of Citi and JPM, emerged in the bank's Global Banking group, where total trading revenue ex DVA of $2.50BNmissed estimates of $2.64, and was down 6% Y/Y, largely due to yet another big miss in FICC, as BofA reported FICC trading revenue ex DVA of $1.45BN, sharply below the $1.64BN expected. This however, was modestly offset by equities trading revenue ex DVA of $1.06BN, above the $1.01BN expected.

Commenting on the results, BofA said that FICC revenue of $1.4B decreased 15% from 4Q17, "due to weakness in credit and mortgage markets and lower client activity in credit products" while "equities revenue of $1.1B increased 11% from 4Q17, driven by strength in client financing and derivatives."

The bank also took pride in paying less as noninterest expense decreased 3% vs. 4Q17, driven by lower revenue-related expenses, while risk-taking remained muted with the average VaR unchanged Y/Y at $36MM in 4Q18.

Separately, Investment Banking was also better than expected, generating revenue of $1.3 billion, better than the estimate $1.23 billion.

(Click on image to enlarge)

Taking all of this together, the market continued the recent trend of ignoring the FICC miss and the loss provision jump, and instead focused on the solid core earnings, and has sent BofA stock sharply higher up 3% in the premarket.

(Click on image to enlarge)

Disclosure: Copyright ©2009-2018 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more