BofA Downgrades Apple To Neutral, Cites Risks And Valuation Concerns

Apple received a rare analyst downgrade on Wednesday morning from Bank of America, as the market capitalization of the equity approaches an all-time high $2 trillion.

BofA analyst Wamsi Mohan downgraded Apple's stock to "neutral" from "buy", citing rapid multiple expansion that has pushed valuations to rich levels. Besides the downgrade, the analyst increased his price target from $420 to $470.

Mohan said Apple shares are trading at the highest premium to the S&P500 in a decade, and now represents 6.5% of the market cap of the entire S&P500.

(Click on image to enlarge)

He outlined several risks that remain ahead, including a lower impact from share buybacks, higher tax rate if Democrats win the U.S. elections in November, gross margin pressures for 5G iPhones, and tougher comparables in 2021 for high-margin App store growth.

(Click on image to enlarge)

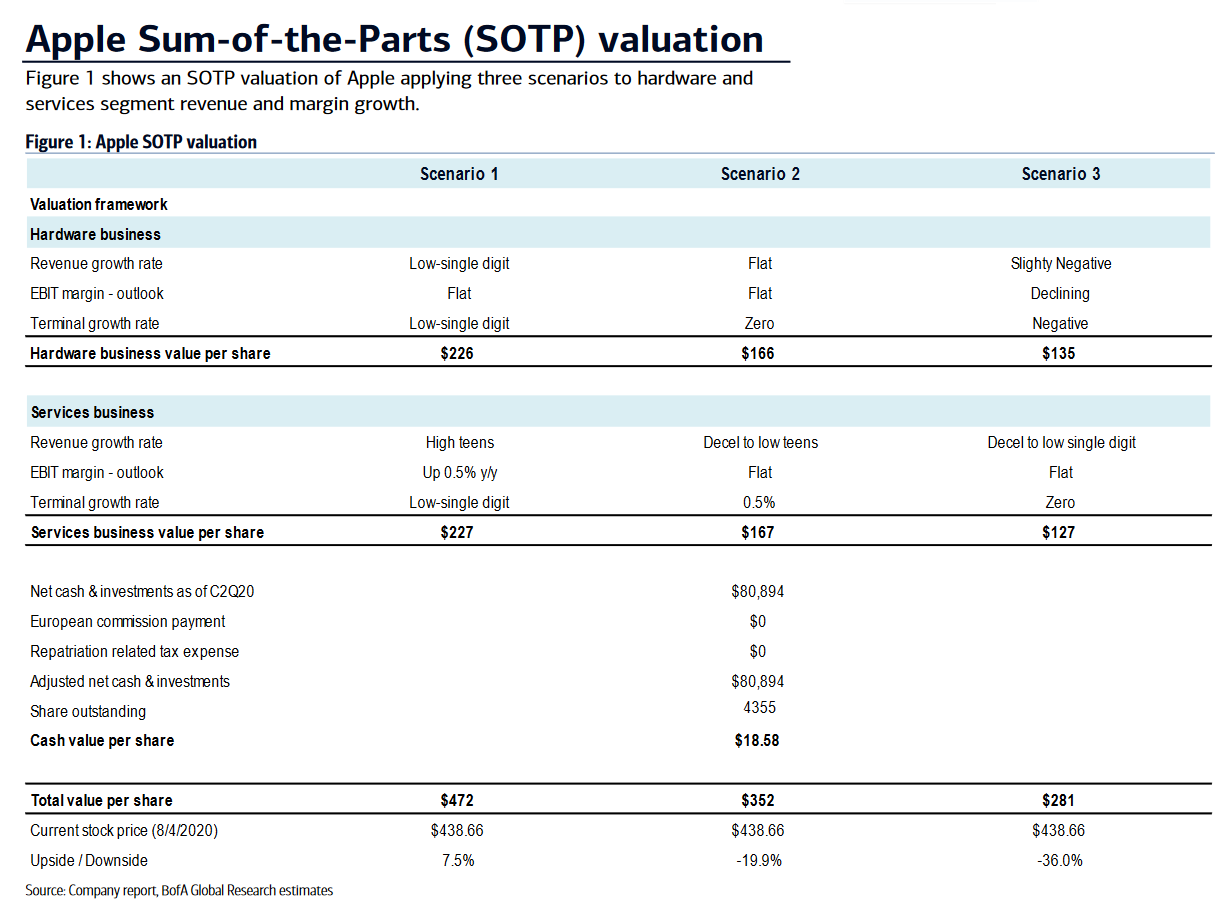

BofA's sum-of-the-parts valuation (SOTP)

(Click on image to enlarge)

He also said the virus pandemic, geopolitical risks with China, and anti-trust regulation on the App Store creates even more risks for the stock in 2021.

Mohan's concerns about AAPL's valuations come as the stock is trading at a record 45% above its daily 200-day moving average.

(Click on image to enlarge)

As revenue stalls, Tim Cook's successful scheme to goose the equity higher is a massive stock buyback program, making the company appear to beat earnings each quarter.

Apple Revenue (Billions)

— Charlie Bilello (@charliebilello) July 30, 2020

2020(est): 272

2019: 268

2018: 266

2017: 229

2016: 216

2015: 234

2014: 183

2013: 171

2012: 157

2011: 108

2010: 65

2009: 43

2008: 37

2007: 25

2006: 19

2005: 14

2004: 8.3

2003: 6.2

2002: 5.7

2001: 5.4

2000: 8.0

1999: 6.1

1998: 5.9

1997: 7.1

1996: 9.8$AAPL

And as shares outstanding evaporate - with the explicit blessing of the Fed which is now buying AAPL bonds whose proceeds are used to repurchase stock -the company's EPS and stock price continue to soar.

(Click on image to enlarge)

Twitter handle Ben Mackovak makes a great point:

Apple's rapid multiple expansion, pushing valuations to extremes, along with overstretched technicals, could result in a Fed-induced blowoff.

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more