Boeing: Wait For A Pullback Before Buying This Dow Stock

The Boeing Company (BA) has attracted the attention of the entire investing community since early March when an aircraft of Ethiopian Airlines crashed shortly after its takeoff. Since then, the stock of Boeing has remained under pressure and hence it is now trading 15% off its recent all-time high, which was recorded just nine days before the crash.

Despite this headwind, Boeing continues to reward shareholders with strong dividend growth. The stock has a current yield of 2.2%, making it one of the Dow 30 stocks that pays a dividend to shareholders. You can see the entire list of Dow 30 stocks here.

As there are serious concerns over the safety of the company’s 737 MAX model, the big question is whether the stock is likely to reward those who purchase it after its recent correction or the risk outweighs the return potential of the stock.

Business Overview

Boeing is the world’s largest commercial jet manufacturer and the second largest producer of military weapons. The company was founded in 1916 and operates in the following segments: Commercial Airplanes, Defense, Space & Security, and Global Services.

Boeing stock has been under pressure since the aforementioned plane crash in early March. When a Boeing 737 MAX of Lion Air crashed in late October, the stock of Boeing plunged 7% on that day but it retrieved all its losses within just three days, as there was no evidence that Boeing was responsible for that accident. However, things changed on 3/10/2019, when Ethiopian Airlines Flight 302 crashed in a similar manner, shortly after its takeoff.

Boeing has been accused of not informing air carriers that their pilots needed to go through additional education courses in order to become familiar with the new safety feature.

Due to the resultant safety concerns, the 737 MAX aircrafts have remained grounded in recent weeks and Boeing has reduced its production rate of this model due to lower demand. As a result, its performance in the first quarter was negatively affected.

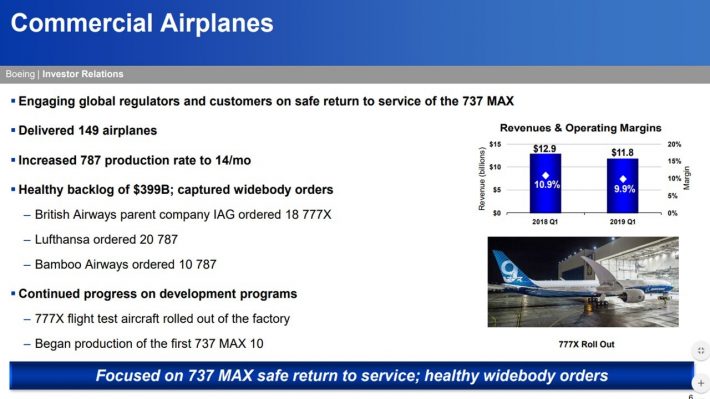

More precisely, Boeing delivered 149 commercial airplanes in the quarter, which was 19% lower compared to last year’s first quarter. Earnings per share fell 13%, from $3.64 in last year’s first quarter to $3.16 in the 2019 first quarter, while the company incurred a $1 billion charge due to the increased production cost of its 737 series. The charge results from higher input costs due to lower production volume.

(Click on image to enlarge)

Source: Investor Presentation

Moreover, management pulled its guidance for this year’s results and stated that it will provide a new guidance in the near future when the uncertainty over its business outlook subsides.

Since the accidents, Boeing has addressed the safety issue. To this end, it has issued a 737 MAX training proposal. The Allied Pilots Association has claimed that this training program is not sufficient to alleviate the safety concerns of pilots and the traveling public but the FAA may clear the airplane to fly in late May or the first half of June.

While no one knows when the FAA will give the green light to 737 MAX to return to flight mode, it seems that the worst is behind the company. It is also reasonable to assume that the revamped airplanes will be safe, as least with respect to the above mentioned faulty mechanism.

Growth Prospects

Boeing benefits from a strong secular trend, namely the increasing tendency of people to travel by plane more and more often. While one trip per year was the norm in the past, people have steadily increased the frequency of their flights. This trend should remain in place for the foreseeable future.

Over the next 20 years, Boeing and Airbus expect average annual passenger growth of 4.7% and 4.4%, respectively. While it is unclear which of the two jet manufacturers will prove the most precise in its forecast, one thing is certain; both companies will greatly benefit from the sustained, multi-decade passenger growth.

Moreover, airlines need to replace their fleets quite often for several reasons. First of all, they need to do so in order to acquire new airplanes, with a lower fuel consumption. As the fuel cost is their largest and most volatile operating expense, airlines invest hefty amounts to replace old aircrafts with much more economical ones, which will help them remain competitive in this highly competitive business.

Due to the suppressed oil prices in the last three years, the incentive for renewal of fleet has decreased and hence this tailwind has somewhat attenuated for Boeing. However, as soon as the price of oil rises, it is likely to trigger much higher demand for new, economical airplanes.

In addition, airlines sometimes have to replace old airplanes in order to comply with new, stricter safety standards. These investments are burdensome for the airlines and lead them to carry high amounts of debt and post poor free cash flows. However, they are highly beneficial to Boeing.

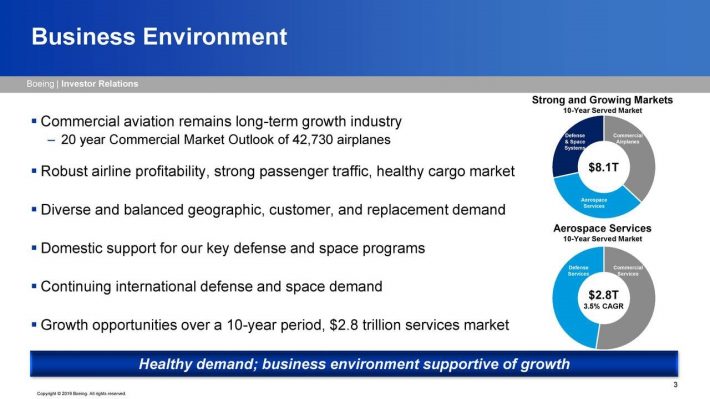

Boeing has grown its earnings per share at a 16% average annual rate in the last decade. This growth has been consistent, as the company has grown its earnings every single year since 2009. Thanks to the above tailwinds, Boeing is likely to continue growing its earnings at a high rate for several more years. The company forecasts that approximately 42,730 additional airplanes will be needed over the next 20 years in the commercial market.

(Click on image to enlarge)

Source: Investor Presentation

Almost half of the additional airplanes will be directed to Asia, driven by increased demand in China and India, while almost half of them will be used to replace older and less efficient models.

Moreover, management sees significant growth potential in the Aerospace Services segment, which is a $2.8 trillion market that grows at a 3.5% average annual rate.

Furthermore, Boeing currently has a backlog of more than 5,600 airplanes, which are valued at $399 billion. This means that the backlog of the company is equal to the revenues that the company achieves in four years.

(Click on image to enlarge)

Source: Investor Presentation

Therefore, it is evident that the jet manufacturer has ample room for future growth while its excessive backlog will provide a great cushion in the case of an unexpected headwind.

It is also important to note that Boeing has significantly enhanced its EPS growth rate via its consistent share repurchases. In the last five years, the company has reduced its share count by 26%, or 5% per year on average. As Boeing spends less than a quarter of its operating cash flows on capital expenses, most of its earnings end up in its free cash flows that are available for shareholder distributions. As a result, share repurchases are likely to remain a significant growth driver in the upcoming years.

It is worth noting that Boeing has temporarily paused its share repurchases due to its major issue with its 737 model. While the company reduced its share count by 1.2% in the first quarter (before the plane crash), it is not likely to perform meaningful share repurchases this year. Nevertheless, as soon as the uncertainty from the above safety issue subsides, the company is likely to resume its aggressive share repurchases in 2020 and beyond.

Competitive Advantages and Recession Performance

Boeing is an industrial manufacturer, which typically operate in highly competitive markets with very narrow margins. However, Boeing is an entirely different case. The company operates in an essential duopoly, as Boeing and Airbus have a dominant position in this business. As a result, Boeing has strong pricing power and thus enjoys one of the strongest competitive advantages investors can hope for.

In fact, Boeing probably has the widest moat in its business among the 30 stocks of Dow Jones, with the possible exception of Apple (AAPL). The competitive advantage of Boeing is clearly reflected in its performance record, which is characterized by a remarkably consistent and strong growth rate.

Boeing is highly leveraged to the underlying global economic growth. As long as the global economy continues to grow, even at a lackluster rate, the airplane manufacturer will keep thriving. This is clearly reflected in the growth pattern of the company, which has grown its earnings per share at a double-digit rate almost every year in the last decade, even though some years were characterized by modest economic growth.

On the other hand, Boeing is vulnerable to recessions. During rough economic periods, consumers curtail their discretionary expenses and thus travel less often. In addition, airlines drastically reduce their investments in order to preserve cash and navigate through the rough periods without any liquidity problems. Consequently, the business of Boeing is adversely affected during economic downturns.

To provide a perspective, in the Great Recession, the earnings per share of the company plunged 64% between 2007 and 2009 while its stock price plunged 72% from top to bottom, thus making it hard for the shareholders to maintain their shares throughout the downturn.

As Boeing is a cyclical stock, it is highly vulnerable to recessions and hence investors should not expect the stock to outperform the market during such periods. On the other hand, it is important to note that it took the company just three years after the Great Recession to return to its pre-crisis earnings per share.

Moreover, the company has a remarkably strong balance sheet. Its net debt of $109.4 billion is only 10 times its annual earnings while its interest expense consumes just 4% of its operating income. It is difficult to find an industrial company with such a strong financial position, as many companies have accumulated significant amounts of debt due to their capital expenses and their shareholder distributions.

Thanks to its rock-solid balance sheet and its strong competitive advantage, Boeing should easily recover from any future economic downturn.

Dividend Analysis

Boeing is offering a lackluster 2.2% dividend yield. As a result, it is not a popular stock in the income-oriented investing community. However, it will be a great mistake for dividend-oriented investors to dismiss the stock for its modest current yield. To be sure, the company has not cut its dividend for more than 30 years.

This dividend record, which is an impressive achievement for a cyclical industrial manufacturer, is a testament to the strength of the business model of the company and its business execution. Boeing has raised its dividend at a 17% average annual rate in the last decade. And, it has a remarkably low payout ratio of 43%.

Given the exciting growth prospects of the company, its low payout ratio and its strong balance sheet, Boeing is likely to continue raising its dividend at a double-digit rate in the upcoming years. If Boeing raises its dividend at a 10% average annual rate over the next seven years, it will result in a 4.3% yield on cost in seven years from now.

It is thus evident that the stock is suitable even for income-oriented investors, as long as the latter can maintain a long-term investing horizon.

Valuation and Expected Returns

Due to the issue with the 737 MAX model, we expect earnings growth to stall this year. However, as we believe that this issue will soon prove a one-time event, we are confident that the worst is behind the company. As a result, we expect the company to earn approximately $23.50 per share by 2024.

It is also worth noting that Boeing has traded at an average price-to-earnings ratio around 17.0 over the last decade. Thanks to its strong growth prospects, we expect the stock to trade at an earnings multiple around 18 in five years from now.

If our above forecasts prove correct, the stock will trade around $423 by 2024 for a 2.3% annualized stock price appreciation. If we add the 2.2% dividend yield of the stock, we conclude that the stock is likely to offer an approximate 4.5% annualized return over the next five years.

While this is a positive return, it is not attractive, particularly given the cyclical nature of the stock. If the exciting growth potential of the stock leads it to achieve a price-to-earnings ratio around 20 in five years from now, the stock will offer a 6.7% average annual return over the next five years. Therefore, in either case, investors should probably wait for a better entry point, specifically our fair value price of $287 per share, or a price-to-earnings ratio of 18.

Final Thoughts

Thanks to the duopoly status of its market, Boeing enjoys one of the strongest competitive advantages investors can hope for. As a result, it is hard to find this stock attractively valued.

We believe that the recent safety crisis that has hurt the stock will prove a one-time event and the company will soon return to its growth trajectory.

However, the expected return of the stock is not sufficient to justify an investment in the stock right now. Therefore, we recommend waiting for the stock to fall to $287 in order for Boeing to become an attractive buy.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more