Boeing Vs. Raytheon: Which One Has The Right Stuff?

I wrote one of my recent articles about Boeing (BA) back on Jan. 27 titled “Why I Won't Be Buying Boeing.” I implied but should have ended the title with the words “For Now.” I have owned the company’s shares before and, if BA fixes its problems, I will be delighted to own it once again. But for now, I will still not be buying it. After my current analysis, I find the company today, as then, “in transition.”

For the sake of the nation and Boeing’s workforce I hope the company is successful. When I wrote the article Boeing was $316 a share. It now trades at almost half that.

In that article, I was not piling on to the negative news about Boeing’s much-publicized failure to exercise quality control with the 737 MAX aircraft. That has been the subject of incredulity and disdain for more than a year. I saw no reason to state what had previously been stated.

Instead, I pointed out that Boeing’s problems go deeper than the 737 MAX fiasco. I cannot read a single issue of my Defense News without seeing some new horror with the troubled KC-46 Pegasus program. This is the Air Force’s new tanker aircraft. Our nation’s jet fighters are worthless without fuel. Our nation’s airborne tankers are in desperate need of replacement. Once stalwart Boeing is now $4.6 billion in the red for delivering a product that was declared unsafe by the US Air Force.

In fact, in addition to FOD (Foreign Object Debris) like screwdrivers, wrenches, soda cans and candy wrappers inadvertently left behind in critical components, there have been three “Category 1” deficiencies. These are what the Air Force classifies as problems “which may cause death or severe injury; may cause loss or major damage to a weapon system; critically restricts the combat readiness capabilities of the using organization; or results in a production line stoppage.”

How could such a storied company for more than 100 years fail to exercise the same brilliant engineering and uncompromising quality control that had characterized Boeing for decades?

I have probably flown in more Boeing commercial aircraft than any other person. I have traveled the world via 737, 747 (still my favorite commercial airframe), 767, 777, and, most recently 787. While in the service I flew in Boeing’s C-17, KC-135 (and RC-135) and CH-47 heavy lift helicopter. I can honestly say I never felt unsafe in any of those aircraft over many years. (Well, no more unsafe than any rational person who gets into any helicopter with any understanding of the aerodynamics and glide path of helicopters!)

In recent years, there was a changed culture at Boeing, foisted upon the company’s ingenious and accomplished engineers and dedicated workforce by management that was mostly interested in jacking up the stock price to get massive bonuses. They could instead have been fulfilling the promise and respecting the legacy of a great American company. It was Boeing, after all, that provided America and our allies the massive aerial firepower to bear on our enemies in existential battles in WWII. William Boeing would be rolling over in his grave.

Not only will many potential passengers decide to wait some time (six months? a year? more?) before flying in the 737 MAX even after it's certified, but Boeing’s management still seems tone deaf to the advice of its engineers and workforce.

For instance, they have stated they will make the $4.6 billion they are losing on the KC-46 program by selling it to other nations. I’m not so certain. If you were the Indian or French or Republic of Korea defense chief, and you have watched the US Air Force send the product back time and again to ensure it met the contractual specifications, you might just have second thoughts.

When will I once again buy Boeing?

When the new management team proves itself willing to listen to the workforce and the engineers. The new senior leadership is not part of a clean sweep, but they might just heed the problems of the recent past and be willing to make this juggernaut a powerhouse once again.

When the new management realizes they cannot afford to lose military business just at the moment new orders for civilian aircraft are in the dumps.

When the company can follow up its sales of Harpoon and SLAM-ER (Stand-Off Land Attack Missile-Expanded Response) missiles to other nations with even more such sales, in head-to-head competition with the Big Dog in missiles (see below.)

When management can refrain from buying back shares at elevated prices.

And when I can see these sorts of changes with the stock price at a reasonable price.

Meanwhile…

Raytheon Tech

I have written elsewhere that this has been a dangerous rally. I believe it still is, and yet I have been buying quality issues all along. “Danger” doesn’t mean I advocate sitting on the sidelines muttering, “It just shouldn’t be, it just shouldn’t be.” The time to fish is when the fish are running. Among my purchases for clients, there was a suggestion to subscribers that they conduct their own due diligence to see if they agreed that the “new” Raytheon (RTX) was an absolute steal the day the merger was consummated.

I also bought and advocated for others to review my favorite spin-off from the merger, Carrier Global Corp (CARR) – but that's the subject of a future article. (Both are in our model portfolio.) For now, here's what I told my subscribers about RTX:

Raytheon Technologies dominates electronics, precision weapons, radar and sensors. With the merger of equals with United Tech, it adds military and civilian components and engines.

Value Line rates Raytheon Tech A++ for financial stability. It earns a “1” (top rank) for safety. (You can see both if you subscribe to Value Line. Otherwise, it lies just out of reach beyond the paywall.) RTX is not cheap. Bur I agree with Value Line that it is a rock-solid company, clearly focused on the future, and with an outstanding balance sheet. That's my idea of a survivor. I'm paying a fair price for a great company with what I see as a clear runway to serious growth.

A number of other analysts think Raytheon "was" a fine company when it stuck to battlespace air, ground, sea and space sensors, electronics and precision weapons, especially in nth generation missile development. These analysts believe the recent merger to be ill-timed because it introduces United Tech’s Collins Aerospace’s aircraft avionics, electronics, actuators and more, and Pratt & Whitney jet engines to the mix. Both have military application, but both also sell into a currently weak civilian market for new commercial airplanes.

I disagree. True, this is what pre-merger Raytheon was best known for:

Source: Raytheon

So let me dive right in with why I believe this company is a great long-term buy. Rather than cite individual sources every other paragraph (!), I should note that my information comes primarily from Defense News, the standard for fair and unbiased reporting on the entire industry, as well as a healthy dollop from the pre-merger applications and correspondence from both companies.

What United Technology Brings to the Table

Collins Aerospace, the successor to fabled Rockwell Collins, does not build airplanes. Collins does not make helicopters. But mostly, Collins makes airplanes perform better and, on the commercial side of Collins’ business, the passenger experience safer, healthier and more comfortable.

I will venture two predictions about post-COVID-19 air travel:

First, any corporation that can afford it will be doing a cost/benefit analysis of buying business jets vs. sending their senior people, their salesforce, their engineers and others who must travel to visit vendors and customers on a commercial airplane.

The benefits are many. In a bizjet you can fly your team from point A to point B rather than waiting in line for security, flying to Hub 1, hoping to connect on another flight to either Hub 2 or, with luck, getting to Point B and getting out of the airport – only to repeat the process on the return. I believe bizjets of all sizes will be in increasing demand. Embraer even makes a very aerodynamic and fuel-efficient airplane (using RTX’s Pratt & Whitney geared turbofan engines!) that seats 76 passengers in a commercial aviation mode. It could instead seat 15 engineers, three IT people, and a dozen or so support staff in first class style that goes directly from point to point.

These newer, more aerodynamic aircraft also cost less to fly and maintain. With them the "stranger danger" of a possible COVID-19 resurgence is lessened.

Some airlines will buy these sorts of airplanes in the sardine-can mode. I believe there are companies that regularly send enough people to consider these, or other regional jet aircraft, as an alternative to such travel.

Second, while there's a surfeit of large aircraft now parked in various desert airport locations, those aircraft may need significant upgrades to meet new regulations for pilots as well as for cabin crew and passengers. If commercial airlines are not ordering new airplanes, that's not good news for Boeing. It's not, however, necessarily bad news for RTX’s Collins Aerospace and Pratt & Whitney subsidiaries.

You see, existing aircraft need to be made more passenger friendly with, at a minimum, better air filtering and ventilation, easier-to-clean interiors, more bathrooms with state-of-the art cleaning technologies. Different seats might not be a bad idea, either, with greater safety designed directly into the cabin.

Collins does all that.

Avionics upgrades are cheaper than new airplanes or even new engines, making it easier and safer to fly in either uncrowded or increasingly crowded skies as time goes by.

Collins does all that.

In commercial aviation, Collins does much of what passengers see when they board the airplane. This includes seating, lighting and engineering, oxygen systems, food and beverage preparation and storage equipment, galley systems, fire protection and evacuation systems, water and waste systems, advanced lavatory systems, video systems and customized cabin interior reconfiguration and certification services.

But that's not all. Building upon a decades-long reputation as Rockwell Collins, the company is one of the world’s largest providers of power controls and actuation systems as well as electric power generation aboard the aircraft and the ram air turbines that help to control and land the aircraft in the event of serious power loss. In the “front office” (the flight deck) Collins Aerospace provides the latest avionics technologies to ensure efficiency and safety.

Collins brings this same ability to provide cabin, platform, flight deck, advanced avionics, servicing, in-flight support and ongoing maintenance services to business jets manufacturers as well.

Of course, newer engines can make an airplane perform better with lower use of fuel, typically the most expensive part of any flight, while lowering the carbon impact of air travel.

Pratt & Whitney does that.

Indeed, GE and Rolls Royce, P & W’s only real competitors in big jet engines for commercial and military applications, are way behind the curve. Pratt & Whitney’s F135 engine is the propulsion wonder that powers every single US defense service’s version of Lockheed’s F-35 fighter as well as Northrop’s new B-21 bomber. I predict P & W will own the market for fighters and bombers for years to come.

In fact, the F135 engine has the potential to enjoy a life-cycle value of more than $1 trillion. The current market is for some 3,200 F-35s for the US and US allies. Writing about the F135 engine, famed defense analyst and Forbes contributor Loren Thompson noted it “…is the only propulsion system suitable for use on the single-engine F-35, not only because of the engine’s power and reliability, but because of its stealth features which enable the fighter to be invisible to enemy radar and heat-seeking missiles.”

The F135 produces twice the thrust of the engine used on the F-16 fighter that the F-35 fighter will replace.

Source: USAF (probably taken from the boom station of a current tanker)

For commercial aviation, although the pie may be currently shrinking, I think GE and Rolls Royce are behind the curve. I expect RTX’s share of the pie to grow. Pratt’s Geared Turbofan engine might one day generate more revenues than the F135 engine! It's that much more advanced than its competitors’ offerings.

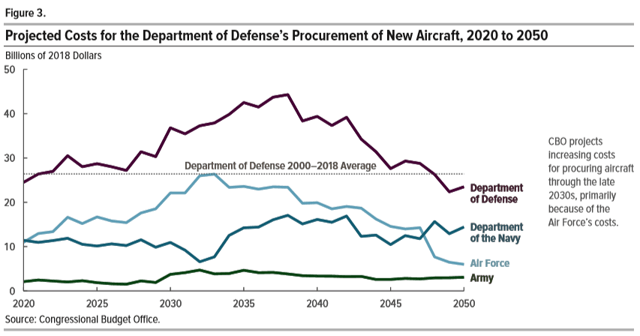

I leave my discussion of the United Tech side of the merger with this chart:

It's from the Congressional Budget Office and it speaks to the wear and tear on our current aircraft from nearly 30 years of counterinsurgency warfare, the Gulf War, the 2003 war in Iraq and, America’s Longest War, in Afghanistan. We need new aircraft – like the F-35 – as well as significant upgrades to existing aircraft.

I hope the above lays to rest any notion that United Technologies' two offerings in the recent merger, Collins Aerospace and Pratt & Whitney, are somehow albatrosses that will slow the growth of the new company. They are instead keys to the diversification from Raytheon’s traditional businesses.

What Raytheon Brings to the Table

Missiles. Actually, missiles, air defense systems and serious cybersecurity solutions. With 60,000 engineers in the new company, I believe the greatest number of any company in the world, you can innovate regularly and successfully.

As you will see, Raytheon does much more, but cutting-edge missiles for defense and offense are what Raytheon is best known for. The Patriot defensive missile system has been a workhorse for more than 30 years. It has been upgraded numerous times, sometimes incrementally, sometimes with major new Block changes. It was a godsend in the Persian Gulf War to remove Saddam Hussein’s forces from Kuwait.

In theater, we called Scud missiles “omnidirectional” because once launched, no one knew where they were going to land, including the Iraqis who launched them.

Scuds were a cheap surface-to-surface liquid propellant missile developed by the Soviets for sale to client states during the Cold War. Scuds could hit anywhere, anytime. That was where the Patriot defense system swung into action. In the event the Scud showed a trajectory that indicated it would be a threat to US or coalition forces, its high-performance radar systems would lock on to it and the advanced aerial interceptor missile would be launched to destroy it.

Raytheon also is the company behind other well-known air-to-air and air-to-ground missile systems like the Hawk, Sparrow, Tomahawk, Sidewinder and Maverick, many old news today but well known for many years.

Today, Raytheon functions with two primary divisions. The first of these is Raytheon Intelligence & Space. Headquartered in suburban-DC Arlington, Virginia (the parent company is in Waltham, Massachusetts), this division is responsible for the satellite-based sensors for missile defense and earth observation, electronic warfare, high energy lasers, airborne sensors like specialized radars, and electro-optical and infrared sensors.

This division also creates and conducts satellite signal processing, cyber operations, quantum computing, artificial intelligence, and acoustic signal processing. It provides development, operations and maintenance cybersecurity for all “.gov” domains. They also have responsibility for the GPS Next-Generation Operational Control System ground control. Heavy hitters.

The second division, Raytheon Missiles & Defense, creates ground-based and sea-based radars for air and missile defense, designs naval radar and sonar, and produces torpedoes and naval mine countermeasures. Having been one of the early inventors and innovators of radar, Raytheon knows a thing or two about this field.

Precision guided munitions are essential in the new battlespace we encounter today. Raytheon was an early, and remains a key, player in this space. In addition to its many specialized missiles, this division also produces specialized drones and air-launched decoy systems, counter-drone defense systems, non-lethal directed energy weapons, and ground vehicle sensors and weapons.

Some of these will be quite familiar to military veterans, like the AMRAAM, the TOW and the Javelin anti-tank missiles, the Stinger man-portable air defense surface-to-air missile, and the various radar systems to defend against incoming attack, most recently with upgrades to those used in the Terminal High Altitude Area Defense (THAAD) and the Exoatmospheric Kill Vehicle anti-ballistic missile systems.

I saved one for special mention. The Phalanx Block 1 version was in use as long ago as the Persian Gulf War. It was then primarily a naval weapon used for incoming supersonic missile defense. However, there's also a land version, called the Centurion. A client sent me a 2019 video of the Centurion version’s use by Israel, defending against fast-burning incoming missiles using (relatively) cheap 20mm rounds to take out a much more expensive enemy missile.

If you are interested, you can see it here:Israeli Phalanx Close-In Air Defense System (by Raytheon)

Since about half the comments after this short video claim this is just CGI and not real, I also include a longer video lasting about 10 minutes that describes the weapons system in appropriate detail. Some of these comments are from veterans who have spent more time in the desert or the mountains than in front of a video game and attest to the power of what we used to call “a wall of lead.” Just How Powerful is USA 20mm Phalanx CIWS

My Conclusion

Raytheon claims on its website that it's “the most trusted global partner in missile defense.” I believe that's true.

It's also a trusted partner in offensive as well as defensive weapons.

It's a trusted partner to the US intelligence community, the electronic warfare community, the anti-ballistic missile community and almost every other facet of national defense.

With exoatmospheric weapons that can intercept and engage incoming ballistic missiles beyond the earth’s atmosphere and detect, track, target, intercept and destroy an enemy’s offensive missiles traveling at hypersonic speeds, RTX proves its worth to the defense of the US and our allies every single day.

It's important to note that RTX is not only the world’s biggest builder of radars and missiles – that's the hardware side. But what sets Raytheon apart are the blindingly-fast software and precision networks that integrate the hardware into a system of systems that can defend against offensive weapons that are becoming smaller and faster.

There are many companies that build the various platforms, but in my opinion no other company has the engineering skills and the innovative processes to establish the sticky web of protections all across the electromagnetic spectrum, the goal being seamless interaction with all the other war-fighting domains on land, in the air, at sea and in space.

DARPA (the Defense Advanced Research Projects Agency) is looking more and more to move toward what Raytheon already has embraced within its culture: More low-cost and therefore readily replaced and deployable assets, moving away from expensive platforms that might be asymmetrically destroyed by an enemy with lesser hardware but more dispersed low-grade inexpensive weaponry. Think drone swarms instead of a battleship. (There is a reason battleships are no longer built deployed.)

Using this “web” approach, an F-35 no longer needs to rely upon on-board sensors to find the enemy, because that aircraft is connected to other fighters – and often to other manned and unmanned aircraft, sensors on the ground and in satellites above the earth.

These arrays need not all come from Raytheon. This is another part of RTX’s culture that sets it apart from other defense contractors. No one has a lock on innovation so why be proprietary?

I believe the Defense Department's way of telling contractors what they want, then selecting a single corporate program manager and lowest-cost bidder, is yesterday’s news. This locks taxpayers into big programs run by big companies and results in big over-runs when, to get the contract, companies purposely under-bid what they believe the real costs will be. Open architectures, where every trusted supplier can join in, are the only way to go forward to stop enemies who are already doing just that. The new Raytheon agrees.

Source: 2019 RTN-UTX Merger Website

In conclusion:

- 60,000 engineers under one “roof.”

- $74 billion in revenues.

- RTN was a Dividend Contender, UTX a Dividend Aristocrat. As a combined company, the current free cash flow covers the annual $1.90 dividend (2.7% yield) by a factor of 3.

- Promising new technologies on the drawing board.

- Life-saving systems protecting Americans and our allies right now.

That is what I see when I analyze Raytheon.

Disclaimer: I do not know your personal financial situation, so this is not "personalized" investment advice. I encourage you to do your own due diligence on issues I discuss to see if they ...

more