Boeing Plunges After Unexpected 777X Delay; Cash Inferno Continues

One quarter after Boeing announced it would fire 11,000 workers in hopes to stem its massive cash burn (which in Q3 hit $5 billion), moments ago Boeing gave an update on how its attempt to halt the melting of the ice-cube is going. Alas... not good.

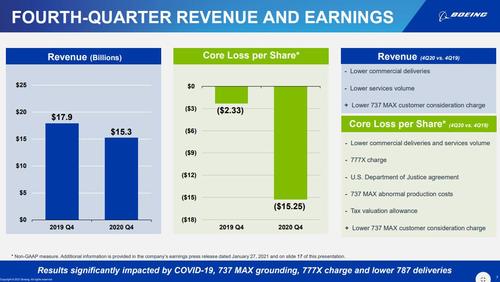

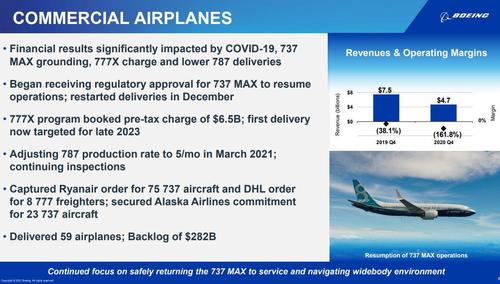

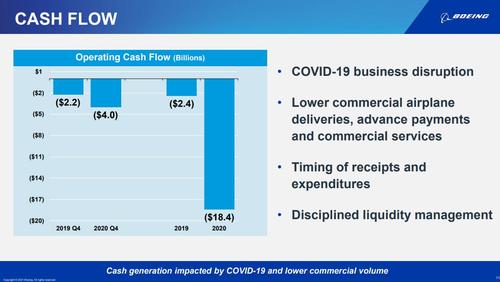

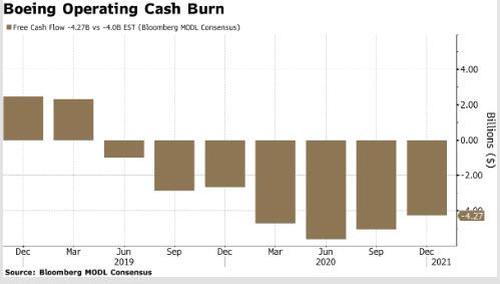

In Q4, the company reported revenue of $15.30BN, down from $17.9BN a year ago, if slightly ahead of est. of $15.09BN. The loss per share - which exploded - was meaningless, soaring to ($15.25) in Q4 up over 7x from the Loss of $2.33 a year ago, and clearly irrelevant in the context of the ($1.80 exp), largely as a result of another massive charge taken by the company due to delays on the 777X program. Meanwhile, Boeing's attempts to stem its massive cash burn continue to fail, with the company's free cash burn in Q4 at $4.27Bn, more than the $4BN estimate, and a record $18.4Bn for the full year.

And while everyone knows about the company's struggles with the 737MAX and covid, the big surprise this quarter was the headline charge on one of the day’s big announcements: the delay of the 777X. The first delivery of the behemoth wide-body jet now won’t be made until late 2023. The program took a $6.5 billion charge, Boeing said. Some other highlights from the quarter:

- Boeing Says 777X Program Recorded $6.5B Pretax Charge in 4Q

- Boeing Says First 777X Delivery Expected in Late 2023

- Boeing 4Q Neg Oper Cash Flow $4.01B, Est. Negative $3.98B

- Boeing 4Q Adj Free Cash Burn $4.27B, Est. Burn $4B

- Boeing 4Q Neg Adj Free Cash Flow $4.27B, Est. Negative $4B

This is what CEO Calhoun said about the quarter:

“The deep impact of the pandemic on commercial air travel, coupled with the 737 MAX grounding, challenged our results,” Calhoun said. “While the impact of COVID-19 presents continued challenges for commercial aerospace into 2021, we remain confident in our future, squarely-focused on safety, quality and transparency as we rebuild trust and transform our business.”

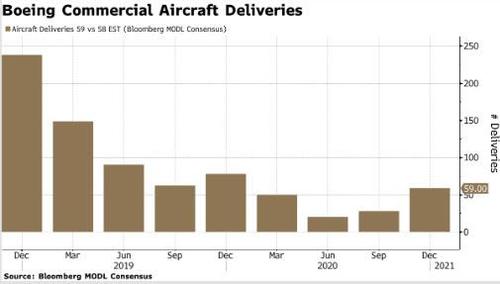

The company also reported that in Q4 total Commercial Planes Deliveries 59, slightly ahead of the estimated 58.60.

Some other highlights from the quarter:

- Boeing: Will Continue With Actions in Yr to Preserve Liquidity

- Boeing Sees Revenue, Operating Cash Flow Improving vs 2020

CEO Dave Calhoun gave some more color on the decision to delay the market debut of the company’s next new jet, the 777X, by about a year to late 2023.

“This schedule, and the associated financial impact, reflects a number of factors, including an updated assessment of global certification requirements, our latest assessment of COVID-19 impacts on market demand, and discussions with customers with respect to aircraft delivery timing. We remain confident in the 777X and the unmatched capabilities and value it will offer our customers,” he said in a message to employees.

Perhaps the delay should have been expected: Boeing cited the pandemic’s impact on market demand and “an updated assessment of global certification requirements” as reasons for the pushed-out launch. This will be the first plane scrutinized by the FAA since the Max debacle, and the regulator is going to carefully review every inch of the plane according to Bloomberg.

Just as troubling: there was no explanation from Calhoun why Boeing hasn’t delivered any of its 787 Dreamliners since mid-October. The company indicated in December that it had broadened inspections for tiny manufacturing defects in the jets’ carbon-composite frames, a process that involves ripping out interiors, in some cases.

“We also launched comprehensive production inspections of our 787 airplanes to ensure that each meets our rigorous engineering specifications prior to delivery, as we also drive stability in our production system to be better positioned for market recovery,” Calhoun told employees.

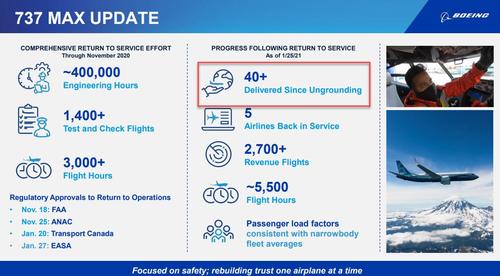

There was one encouraging sign in Boeing’s earnings report, that it has delivered 40 of its 737 Max planes since the U.S. grounding ended in November. Five airlines have returned the plane to service. Boeing has hundreds of Max jets that are built but undelivered. With the grounding ending, the company can start shipping them to customers and turning them into cash.

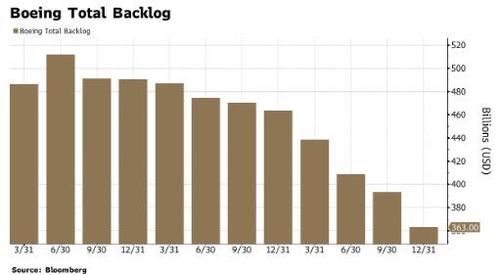

Unfortunately, that's not nearly enough, and as Bloomberg notes, the company's total backlog was about $363 billion at the end of 2020, down roughly $100 billion from a year earlier. The biggest decline was in the commercial aerospace division. This reflects a wave of cancellations for the Max jet as the prolonged grounding gave customers more room to negotiate when the pandemic hit.

And as the pandemic rages, commercial aircraft revenues continue to be smothered, and the result is lower wide-body volume because of Covid-19, 787 production issues, and grounded Maxes sent jetliner deliveries to their worst level in decades. The tally? Commercial aircraft revenue dropped in half last year to $16.1 billion.

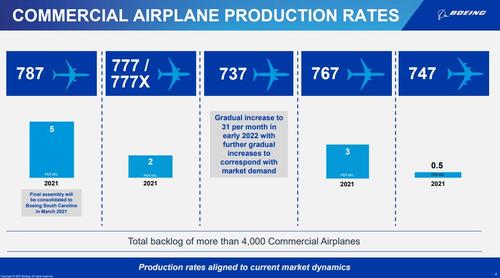

As an aside, Boeing has not changed its plans to speed production of the 737 to a 31-plane a month pace by early next year, “with further gradual increases to correspond with market demand.” That should a relief for investors after Airbus SE last week pared plans to increase output of the rival A320neo family.

As usual investor attention fell on the company cash flow, or rather cash burn, with Boeing burning another $4.3 billion in free cash in the fourth quarter, slightly more than the $4 billion cash use expected by analysts...

... bringing its full-year cash burn to $19.7 billion in 2020.

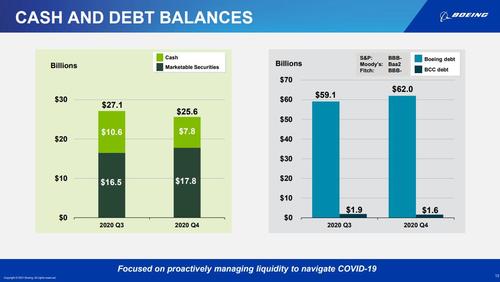

Amusingly, the company which two quarters ago was on the verge of collapse still has an investment-grade BBB-/Baa2 rating with a debt load which is now over $60 billion. Meanwhile, its cash declined by $2 billion in the quarter, from $27.1BN to $25.6BN.

Not boosting confidence was the continued lack of projections: once again Boeing failed to provide a detailed outlook for its 2021 results (for the simple reason that it can't). That’s a contrast with two of its biggest suppliers, GE and Raytheon Technologies, which yesterday resumed providing financial guidance.

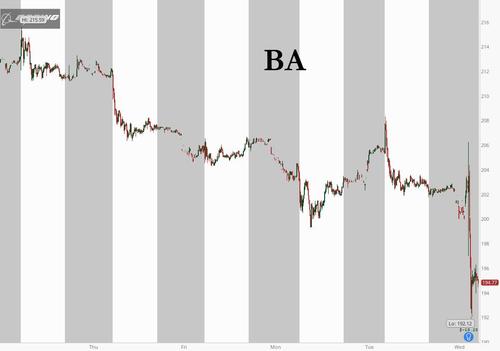

Bottom line: after surging higher in recent days, BA stock tumbled on yet another dismal quarter, and was last trading back under $200, at $194 after dropping as low as $192.