Bitcoin, No Genius Required

Many get intimidated by the unique language used in the markets, invented to do just that, intimidate. Nowhere else you get bombarded with that many lies and misinformation than market speculation. The truth is that most market behavior is based on human behavior. Human behavior isn’t a mathematical equation, and as such, one doesn’t have to have special knowledge to participate. It isn’t a math sport. It is a psychological competition. Bitcoin, no genius required.

Why do we mention this? Bitcoin is in a massive uptrend right now, and we are about to see another leg up. Typically, the choice of participating or staying sidelined is with more minor consequences than this time around. We are in a wealth transferring market cycle. An event happening typically every 93 years. An event at the end of a fiat currency dissolving into hyperinflation and leaving many in despair. E.g., have you noticed your grocery bill being over 20% higher and mass media not mentioning it? Get informed and not mislead and do not wrongly be instructed that this bitcoin ship has sailed and there are no ways to participate at these levels. They will look timid in a few years to come.

S&P-500 Index, Weekly Chart, Warning signs of a larger cycle ending:

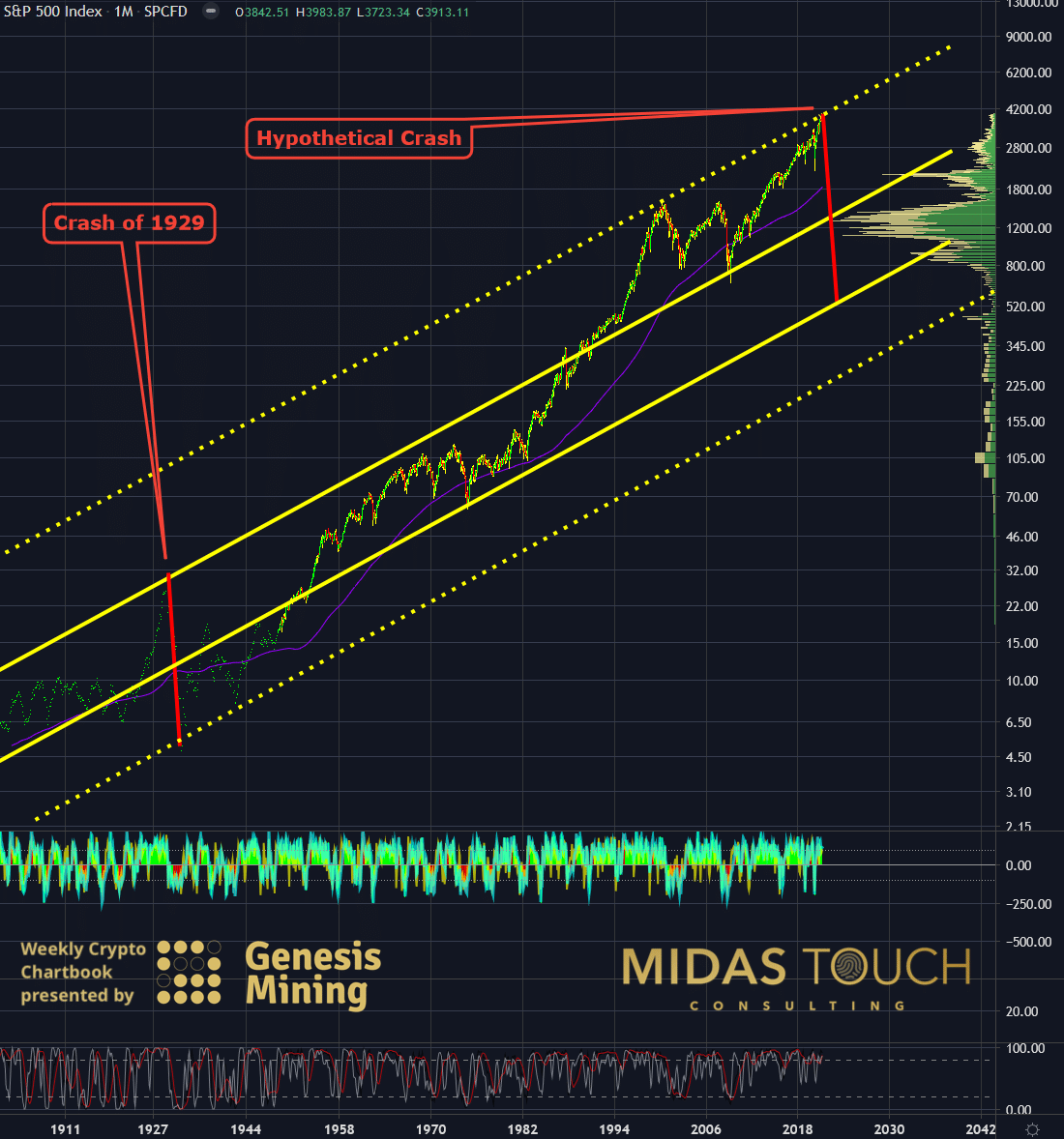

S&P 500 Index in US Dollar, monthly chart as of February 19th, 2021.

We posted a similar to the above chart on February 19th in our weekly Silver chartbook to indicate a possible extended stock market with a more than typical retracement possibility.

S&P-500 Index, Weekly Chart, Double top with Indicator divergence confirmation:

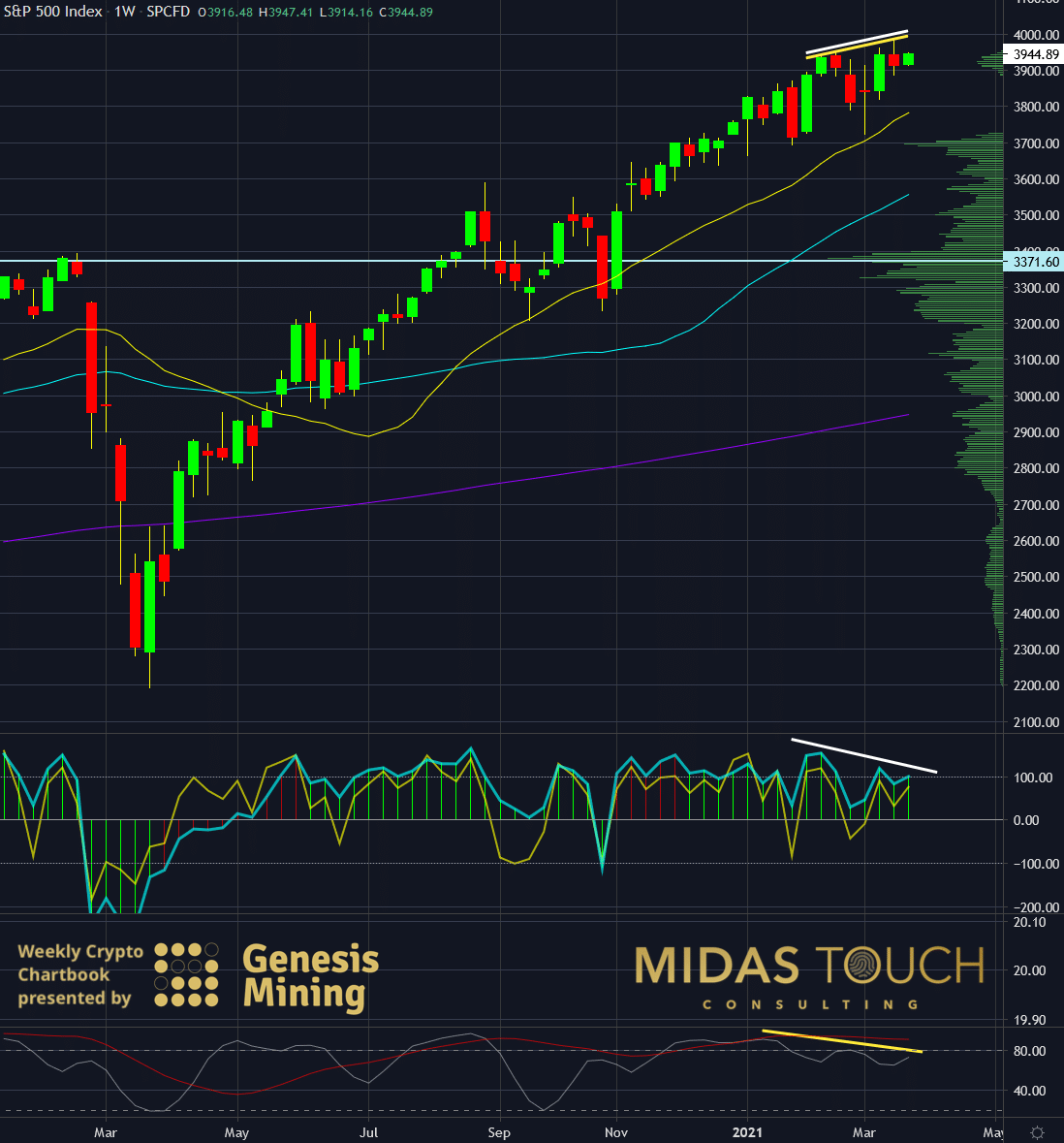

S&P 500 Index in US Dollar, weekly chart as of March 22nd, 2021.

Now only five weeks later, we see the first possible cracks. The weekly chart shows a possible directional change with divergences in both a directional indicator (Stochastic in yellow) and a momentum oscillator (Commodity Channel index in white), confirming this suspicion through divergences. Hence, we might get a trend reversal over the next few weeks or months.

BTC-USDT, Daily Chart, Possible breakout (Short to midterm):

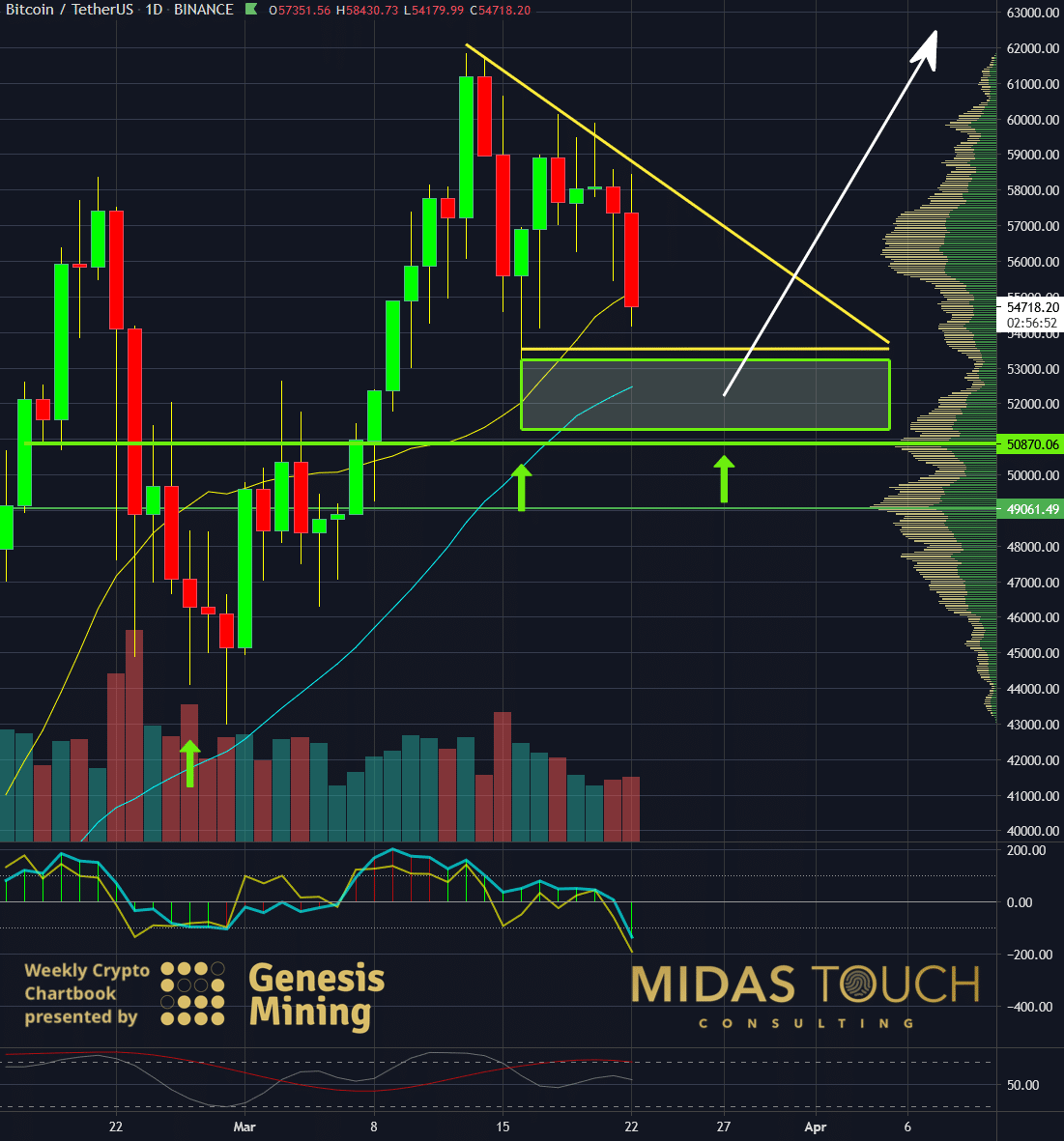

Bitcoin in US Dollar, daily chart as of March 23rd, 2021.

While due to the need to cover margin calls an actual market crash would temporarily drag all asset classes down, in the early stages of a trend direction change, money would flow from the stock market into safety asset classes like Bitcoin. The chart above shows Bitcoin in a consolidation phase that looks to resolve through a breakout to the upside. Besides, we find fractal volume transaction support at the US$50,870 price level.

BTC-USDT, Weekly Chart, Bitcoin, no genius required:

Bitcoin in US Dollar, weekly chart as of March 22nd, 2021.

The weekly chart of Bitcoin illustrates the health of the recent trend extension. Price is trading above directional support (yellow trendline) and within the norm of Fibonacci retracement levels.

Bitcoin, no genius required:

Systems promising more than a hundred percent returns earned within a year, sell at exorbitant prices. You do not need to have such returns as compound interest takes very well care for those getting consistent. Why would vendors sell these unique methodologies instead of making their own fortunes with them?

In short, you need high-quality principle-based guidelines, apply for hard work and be independent of the good opening of others versus getting fooled by “rich quick” schemes and fool’s gold promises. There is no genius required, just good old hard work like in any other field that requires mastery for competition level.

If trading were a mathematical competition, we would find all rocket scientists to be the winners in this game. But the is far from the truth. Instead, it is precisely the opposite based on a simple principle distinction. The mathematical mind seeks a precise and optimal solution. It aims at a reduction to a constant. This approach fails the high degree of aspects defining the human psyche and all the grey zones that come with it. It is much more essential to find a trading approach that fits your personality.

Consequently, eliminate any system purchase. One needs to work refining one’s own path. One needs to find a niche in the time frame, market, and volatility to one’s specific personal makeup.

Disclaimer: All published information represents the opinion and analysis of Mr Florian Grummes & his partners, based on data available to him, at the time of writing. Mr. Grummes’s ...

more