Bitcoin, Marathon Digital Consolidate Within Trends: How To Trade It

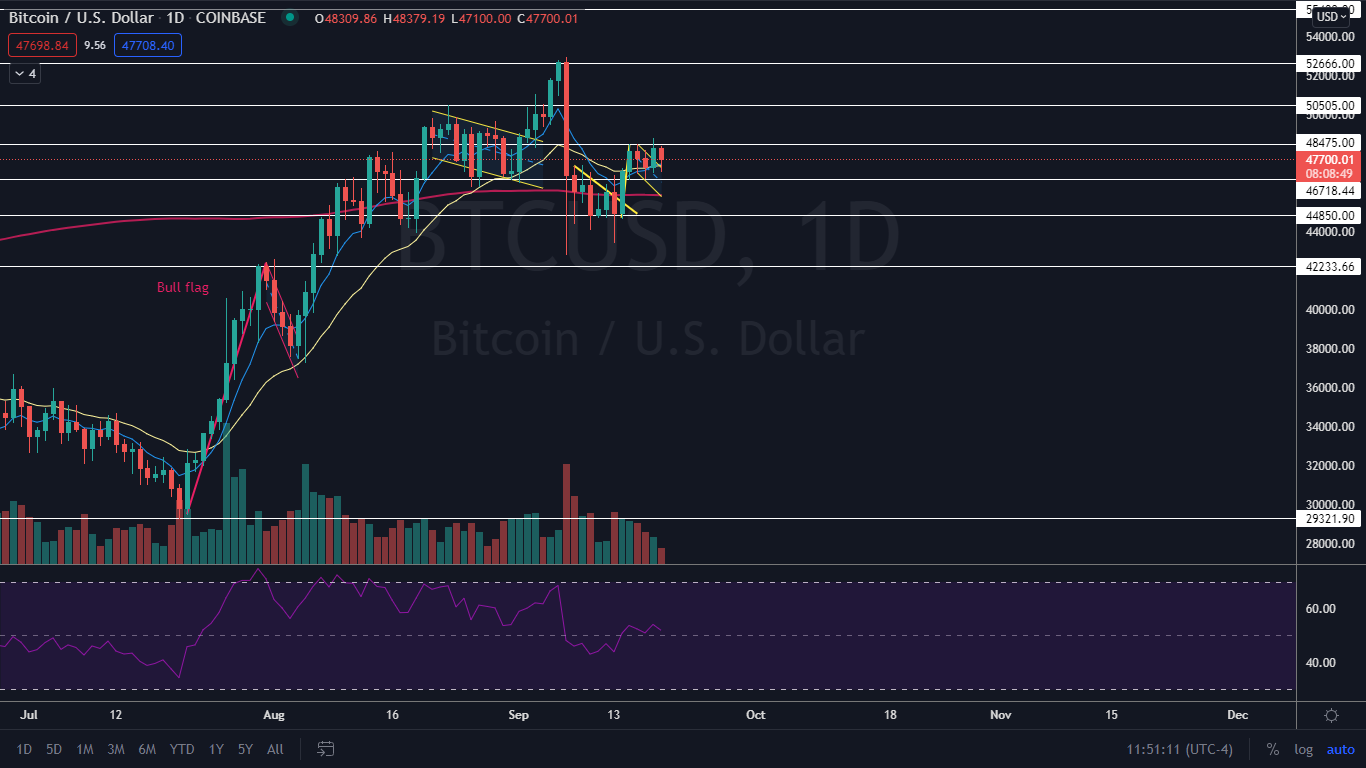

Bitcoin (BITCOMP) and Marathon Digital Holdings, Inc (MARA) have developed inside bar patterns on the daily chart. An inside bar pattern indicates a period of consolidation and is usually followed by a continuation move in the direction of the current trend.

An inside bar pattern has more validity on larger time frames (a four-hour chart or larger). The pattern has a minimum of two candlesticks and consists of a mother bar (the first candlestick in the pattern) followed by one or more subsequent candles. The subsequent candle(s) must be completely inside the range of the mother bar, and is called an "inside bar."

A double, or triple inside bar can be more powerful than a single inside bar. After the break of an inside bar pattern, traders would want to watch for high volume to confirm that the pattern was recognized.

Bullish traders will want to search for inside bar patterns on stocks that are in an uptrend. Some traders may take a position during the inside bar prior to the break, while other aggressive traders will take a position after the break of the pattern.

For bearish traders, finding an inside bar pattern on a stock that's in a downtrend will be key. Like bullish traders, bears have two options of where to take a position to play the break of the pattern. For bearish traders, the pattern is invalidated if the stock rises above the highest range of the mother candle.

The Bitcoin Chart

The Marathon Chart

Disclaimer: © 2021 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.