Bitcoin: Get Ready For Another Wave Higher

Photo by aislan13/iStock via Getty Images

What seems like eons ago now, was essentially only around 2 years ago. Yes, I am talking about a time when Jamie Dimon didn't "care so much" for Bitcoin (BTC-USD), when Warren Buffet was "explaining" that Bitcoin was not an investment, and when many market participants were simply calling the digital asset un-investible. Back in early 2019, the blockchain enterprise market was bottoming, and Bitcoin was trading around $3,500. Fast forward to May 2021, and we're looking at Bitcoin at $58,000, roughly a 1,500% return in slightly more than a 2-year period.

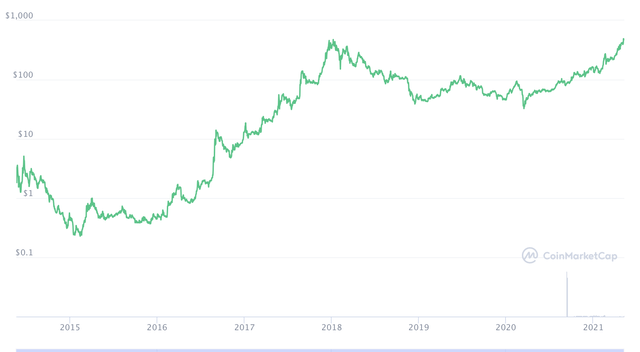

Source: CoinMarketCap.com

Incidentally, this was the time I wrote about Bitcoin's bear market transitioning into a new bull cycle. Now, while returns have been excellent, I believe there is a substantial deal of upside remaining in Bitcoin as well as in the broader digital asset market. A combination of crucial technical, fundamental, and psychological factors should continue to amplify popularity and drive demand going forward.

The Technical Viewpoint

Source: BitcoinCharts.com

In prior Bitcoin wave technical analyses, I called for a likely peak around the $50-100K level. This was in late 2018 when Bitcoin was still hovering below $6,000. However, back then we had no idea about the numerous trillions of dollars in monetary stimulus. Thus, expectations have been adjusted to a higher price point for the next peak in price action.

Just to revisit how we arrived at such figures, let's look at this long-term chart of Bitcoin's bull and bear market cycles. We see that Bitcoin has gone through 3 major up waves, and is now in its fourth. The first one took Bitcoin’s price from about $2-200 or about 10,000%, the second wave took the price up from about $50 to roughly $1,200, or approximately 2,300%, and the third wave brought Bitcoin’s price from $200 all the way to over $19,500, or nearly a 10,000% again.

Now, each one of these waves has been followed by a substantial washout or a bear market. After wave one, Bitcoin declined from about $200 to $50, or 75%, after wave two Bitcoin came down from about $1,200 to $200, or approximately 83%, and the most recent wave higher had been followed by a washout of approximately 84%.

Now, since history appears to repeat itself, we can probably expect to see an up move of roughly 2,300% - 10,000% in this bull market cycle as well. In fact, if we gauge the move from the bear market low of about $3,200 to Bitcoin's recent high of approximately $65,000, we see a gain of nearly 2,000%. However, given all the variables, this is not likely going to be the top in my view.

My previous price targets of around $75,000 were based on lower-end, relatively conservative estimates, and were modeled well before the easiest monetary environment in history was in place. Thus, to arrive at an approximate top for the current bull cycle, I want to use slightly more aggressive figures, a 5,000% gain from the bear market bottom (roughly the midpoint of prior returns). This brings us to a possible high of around $163,000 in the current bull market cycle. Please keep in mind that if we get another 10,000% return from the bear market low (a best-case scenario in my view), BTC could hit a high of over $300,000 in this current wave.

The Fundamental Perspective

From a fundamental standpoint, I see no reason why the current bull run should end now or any time soon for that matter. The fact is that it is essentially impossible to pinpoint when a bull market will end. Once we are very close to a top, there should be some signs, like parabolic price action, panic buying, and other elements. However, we are not seeing this yet in my view. Instead, we're seeing methodical gains in Bitcoin, followed by the altcoin market, followed by corrections and healthy consolidation phases, and then the cycle repeats itself, again and again.

The digital asset market is experiencing increased demand from individuals and institutions alike. While global debt loads and monetary supplies explode, the digital asset market is becoming ever more popular. We can call this a bubble, or whatever we want, but it can probably continue to expand for a lot longer than many market participants anticipate.

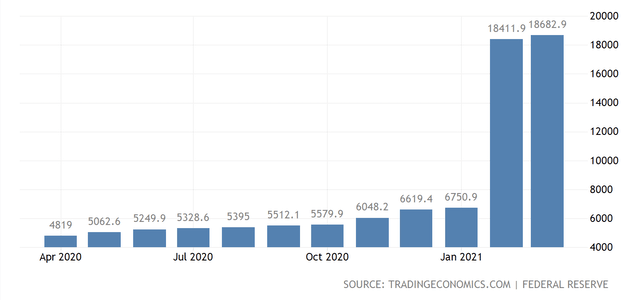

The U.S. national debt has now eclipsed $28 trillion, and the country's total debt now towers at a massive 143% of its GDP. The U.S.'s money supply is also being inflated at an unprecedented pace. We see enormous increases in M1 money supply, as well as in other areas of the monetary arena.

U.S. M1 Money Supply

Source: TradingEconomics.com

Also, it's not just the U.S., as dramatic monetary increases can be observed all over the world right now. The U.S. is probably the worst out of all developed nations, as it showed a massive 27% YoY increase in its broad money supply. Since the U.S. has the world's reserve currency, more dollars need to be created to flow around the globe, and this massive increase illustrates just how easy it has become for central banks to inflate and manipulate the money supply. Many other nations also show substantial double-digit percent increases in broad money supply over the last year.

Bitcoin doesn't have this issue, and that is partly why it so attractive. Bitcoin, like many other digital assets has a set limit of "coins" that can ever exist. For Bitcoin, the magic number is 21 million, and once that last coin is mined, no new Bitcoins will ever be "minted". The set, or limited supply, coupled with potential for essentially unlimited demand is an extremely powerful equation that is largely foreign to fiat currency markets.

Typically, in the fiat world, you have a country with a certain number of people, and you have a central bank that can essentially issue as much fiat currency as it sees fit. Thus, with fiat currencies, demand can be limited to the people living in a given country, yet supply can essentially be limitless due to the central bank's ability to print as much fiat paper as it deems necessary. Even with the dollar, while demand can be viewed as global, supply is essentially limitless. Bitcoin flips this old world dynamic on its head, as there are relatively few Bitcoins that can ever exist in circulation and essentially unlimited global demand potential.

How Much Money is Out There?

Many people are saying, "Bitcoin is worth so much already". However, if we look at the big picture, Bitcoin's $1 trillion market cap is really not that big in the greater scheme of things. Apple (AAPL) alone is worth around 2 Bitcoin market caps combined. Moreover, Alphabet (GOOG) (GOOGL), Microsoft (MSFT), and Amazon (AMZN) all still have substantially greater market caps than Bitcoin right now.

If we look at the global broad money supply of around $100 trillion, Bitcoin is worth just around 1% of that. If we take global debt of over $250 trillion, Bitcoin's market cap is just 0.4% of it, and if we look at an estimated quadrillion in derivatives, Bitcoin's market is worth only around 0.1% of that. There is a lot of gold (about $11 trillion worth), fiat paper (roughly $7 trillion), broad money, debt, derivatives, and other "assets" out there. Bitcoin appears to have established a solid place amongst the world's global assets, and its value is likely going to continue to increase from here.

The Bottom Line

Bitcoin doesn't have a P/E ratio, it is not a company, it's not a stock, it is not consumed, nor is it used in industry like many other commodities. Nevertheless, Bitcoin is widely used as an investment and a trading vehicle. It is also utilized as a digital store of value, and as a medium of exchange. Bitcoin is a symbol of the future, blockchain technology, and is emblematic of a world less reliant on central banks and the monetary fiat order. Bitcoin is a global phenomenon, one in which popularity drives demand, and demand leads to price discovery. Mass adoption seems likely as individual and institutional interest continues to increase. Thus, higher prices are also likely going forward. Ultimately, Bitcoin's appreciation could go on for many years. Naturally, there will be boom and bust cycles in the future, but I suspect Bitcoin can reach a price of roughly $160,000 in this current bull market wave.

Assets to Consider

Bitcoin is not the only attractive digital asset out there. In fact, many "coins" are likely to appreciate far greater while the current bull market remains in motion. In addition to digital assets, some Bitcoin-related companies are also likely to perform quite well while the Bitcoin bull market persists going forward.

Favorite Transactional Coins

Transactional coins are key components of the digital asset market, as these coins are designed to act as efficient medium of exchange vehicles.

Bitcoin Cash (BCH-USD)

Still down by about 58% from its all-time highs, but up by around 1,700% from its recent bear market low.

ZCash (ZEC-USD)

Still down by about 55% from its highs in 2018, but up by around 1,250% from its lows last year.

LiteCoin (LTC-USD)

Trading around ATHs, up by roughly 1,500% from its recent bear market low.

Dash (DASH-USD)

Still down by around 67% from its all-time high in early 2018, but up by approximately 1,000% from its recent bear market low.

Monero (XMR-USD)

Trading around ATHs, up by about 1,240% from its low last year.

Top Functional Coins

Functional coins represent the other extremely important side of the digital asset market. Functional projects provide numerous applications for the developing blockchain/digital asset arena.

Ethereum (ETH-USD)

Trading around ATHs, up by about 4,700% from the recent bear market low.

Cardano (ADA-USD)

Trading around ATHs, up by approximately 7,400% from its recent bear market low.

PolkaDot (DOT-USD)

Trading around ATHs, up by roughly 1,370% since appearing in 2020.

Chainlink (LINK-USD)

Trading around ATHs, up by roughly 34,300% since its low in 2018.

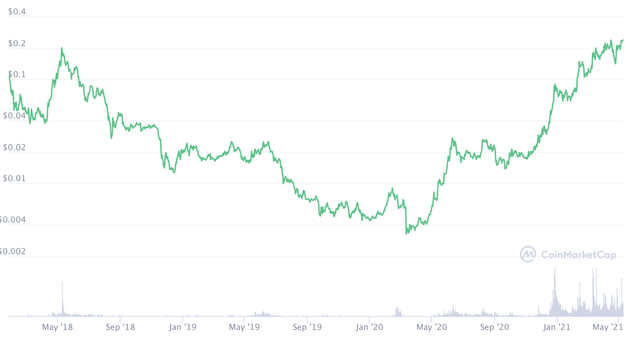

VeChain (VET-USD)

Trading around ATHs, up by approximately 9,500% since its low last year.

Zilliqa (ZIL-USD)

Trading around ATHs, up by about 7,200% from its low last year.

Digital Asset Companies

Bitcoin/blockchain-related companies provide many essential services to the digital asset industry and are an integral part of the growing sector.

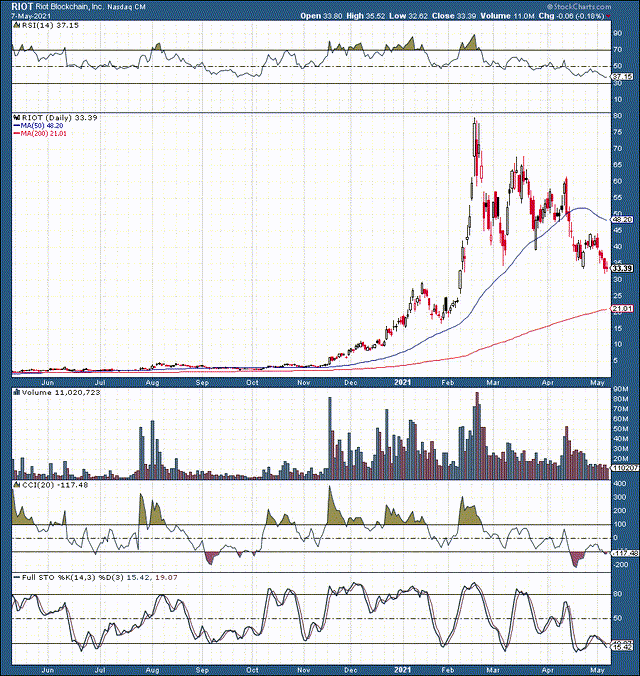

Riot Blockchain (RIOT)

Riot is down by about 58% from recent ATHs, but is still up by roughly 2,100% from its low point over the last year.

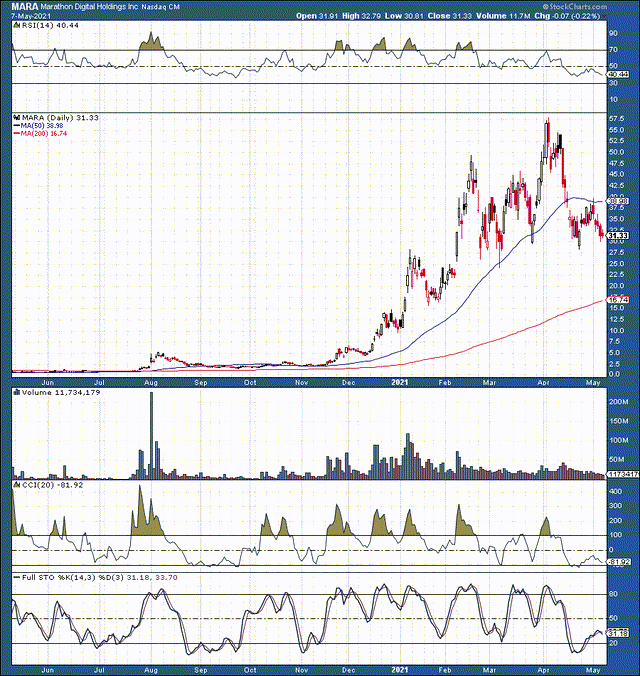

Marathon Digital Holdings (MARA)

MARA is down by about 45% from recent ATHs, but is up by roughly 5,000% from its low point over the last year.

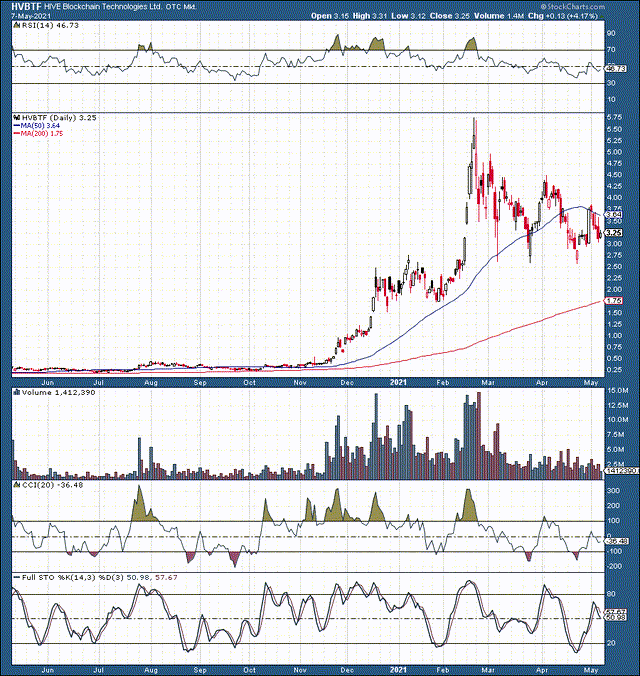

HIVE Blockchain Technologies (OTCQX: HVBTF)

HIVE is down by about 44% from recent ATHs, but is still up by roughly 1,300% from its low point over the last year.

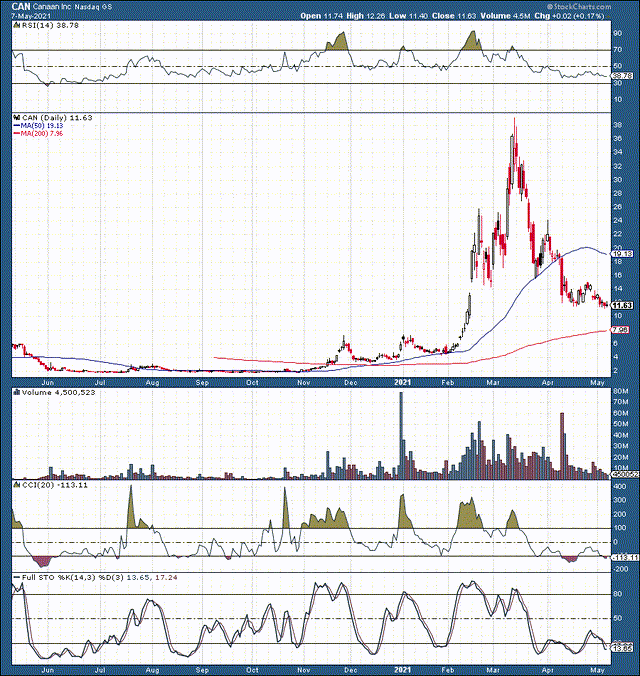

Canaan (CAN)

CAN is down by about 70% from recent ATHs, but is still up by roughly 660% from its low point over the last year.

The Takeaway

We can see several interesting phenomena here. First, we notice the extreme volatility in Bitcoin/blockchain-related stocks. Huge roller coaster rides and extremely overbought conditions as Bitcoin skyrocketed early this year. However, we've seen significant givebacks as BTC stopped appreciating notably and has been going through a consolidation process in recent weeks. I believe there is more upside in these names, likely once BTC breaks above $60-65K resistance and heads to new ATHs.

Next, we see that functional coins have outperformed transactional coins in recent years. Now, this is likely due to increased potential recognition in the broader digital asset market. Several years ago much of the emphasis was placed on transactional tokens, but as the broader industry develops, increased emphasis is placed on many functional elements in the blockchain enterprise segment.

Also, it's interesting to see that many coins bottomed in 2019, or in 2020. This illustrates that the Bitcoin/digital asset bull market is likely not in its late stages yet. Therefore, there should be more room to make money here. Finally, we can see that investing in altcoins can be extremely profitable, even when compared relative to Bitcoin. While BTC has come up by approximately 1,500% from its bear market lows, many altcoins (especially the functional ones) have appreciated by 5,000%, 7,000%, or more during the same time frame. Given the explosive dynamics of the blockchain enterprise market, the trend of altcoin outperformance should continue with this current wave higher.

Risk Factors

Bitcoin remains a volatile asset and is not suited for everyone. Numerous factors like increased government regulation, hacking, functionality issues (such as speed, cost, and scale), fraudulent activity, and other negative elements could impact Bitcoin's popularity and thus affect BTC's price negatively.

Therefore, for investors with low to mild risk tolerance perhaps a position size of 3-5% of total portfolio holdings may be appropriate. For investors with higher risk tolerance, a position size of 10% or more of total portfolio holdings may be more suitable.

It remains unclear exactly how Bitcoin's future will play out. The digital asset could be worth a lot more than it is now several years down the line or it could be worth a lot less if negative elements begin to plague the digital asset market.

Disclosure: I am/we are long BTC-USD, ETH-USD, VET-USD, ZIL-USD, ZEC-USD, LINK-USD, XMR-USD, DASH-USD.

Disclaimer: This article expresses solely my opinions, is produced for informational ...

more