Biotech's Week Ahead: Relypsa, GW Pharmaceuticals, Regeneron And Exelixis

It’s an exciting week ahead for pharmaceutical companies Relypsa Inc (NASDAQ:RLYP), GW Pharmaceuticals PLC-ADR (NASDAQ:GWPH), Regeneron Pharmaceuticals Inc (NASDAQ:REGN), and Exelixis, Inc. (NASDAQ:EXEL), as analysts are anticipating these companies’ quarterly reports and sales updates on key drugs. Here is what to watch as each company posts earnings this week:

Relypsa Inc

The pharmaceutical company is expected to report first quarter earnings Wednesday, May 4 after market close. Analysts expect the company to post a loss per share of ($1.46) for the quarter and ($5.57) for the upcoming fiscal year. In the same quarter of last year, the company posted a loss per share of ($0.78).

Relypsa projects total operating expenses in the range of $275 to $300 million for 2016, claiming that the expenses will primarily be driven by ongoing commercialization and further clinical studies of Veltassa. Veltassa, Relypsa’s primary drug, is a potassium binder approved for the treatment of hyperkalemia. Demand for the drug has been increasing since it became available on December 21, 2015. From its release date, to February 12, 2016, there have been 1,229 new outpatient prescriptions for Veltassa.

2015 was a big year for Relypsa with the launch of its promising drug, but what is in store for 2016? The pharmaceutical company plans to submit a sNDA by mid-2016 to the FDA requesting a label change for Veltassa due to a recent successful Phase 1 drug-drug interaction study. Also, Relypsa is initiating a new Phase 4 clinical study of Veltassa, aimed at evaluating the drug’s safety and efficacy when given with and without food. If results for this are positive, it will only promote more success for the stock and positive reviews. Analysts will be listening for an update on this progress, as well as overall Veltassa sales.

Further, Relypsa and VFMCRP, which became a partner in 2015, are on track to submit a Marketing Authorization Application (MAA) for Veltassa to the European Medicines Agency (EMA).

John Orwin, Relypsa CEO, shared his optimism for the future of the company, noting, “We are looking forward to another exciting year. We are very pleased with the initial demand for Veltassa and, following a positive meeting with the FDA, plan to submit a sNDA requesting a label change based on the results of the Phase 1 drug-drug interaction studies.”

According to TipRanks, the overall consensus for RLYP is Moderate Buy, with 9 analysts bullish, 1 analyst neutral, and 1 analyst bearish.

GW Pharmaceuticals PLC-ADR

GW Pharma, a bio-pharmaceutical company focusing on the development of cannabis based medicines, will report its Q2:2016 earnings on May 5 before market open. For this quarter, analysts are expecting revenues of $5.99 million and a loss of $(1.57) per share, compared to revenues of $9.43 million and a loss of $(0.58) per share for the same quarter of last year.

For this report, investors will be watching for any updates on Epidiolex, a pipeline drug to treat epilepsy. In March, Epidiolex met its primary endpoint of reducing seizures in patients with Dravet Syndrome. Last month, it was granted Orphan Drug Designation for cannabidiol in Tuberous Sclerosis Complex, adding to Dravet syndrome and Lennox-Gastaut syndrome. The company is currently conducting trials of Epidiolex as a therapy to treat seizures associated with the condition.

Analysts will also be watching for how the company will manage regulatory hurdles going forward, as marijuana is currently classified as an illegal substance by the federal government. As a result, the company faces additional taxes and banking restrictions, specifically lack of access to lines of credit, which could impact its long-term growth. Similarly, the FDA has exceptionally high standards for marijuana-based drugs, making approval of Epidiolex a major challenge for the company. In spite of this, the FDA has granted expanded access for certain patients as well as issued indications for the drug, which bodes well for the company.

According to TipRanks, all 6 analysts who have rated the company in the past 3 months gave a Buy rating. The average 12-month price target for the stock is $149.33, marking an 84% upside from where shares last closed.

Regeneron Pharmaceuticals Inc

Regeneron will post first quarter earnings on Thursday, May 5 before market open. Analysts expect the company to post earnings per share of $2.60 on revenue of $1.17 billion. In the same quarter of last year, the company posted revenue of $870 million and earnings per share of $0.66.

All eyes will be on Eylea, the company’s flagship drug for AMD, or age-related macular degeneration. Eylea drove 68% of all revenue in the previous quarter. Analysts will be looking for continued growth of the drug moving forward and updates on the company’s efforts to expand the drug’s label indication.

Last month, the company announced a 6-year partnership with Intellia Therapeutics to advance gene-editing technology for in vivo therapeutic developments, which will give Regeneron the opportunity to diversify its pipeline. Analyst Jason Wittes of Brean Capital weighed in on the company following the announcement, noting, “While this approach isn’t without risk, or competition, it offers REGN a relatively cheap way of diversifying into gene therapy platform, while minimizing dilution, IP risk and keeping the focus on its core antibody technology and pipeline.”

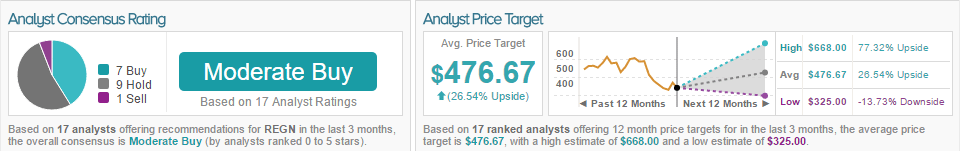

According to TipRanks, 7 analysts covering the biotech company are bullish, 9 remain neutral and 1 is bearish. The average 12-month price target between these 17 analysts is $476.67, marking a 26% potential upside.

Exelixis, Inc.

Exelixis is expected to report first quarter earnings Wednesday, May 4 after market close. Analysts expect the company to post a loss per share of ($0.25) for the quarter and ($0.90) for the upcoming fiscal year. In the same quarter of last year, the company posted a loss per share of ($0.18), with revenue of $9.4 million and profit of $8.6 million. Net revenues consisted entirely of product revenue related to the sale of COMETRIQ.

COMETRIQ (cabozantinib) is one of Exelixis’ three main products. The additional two are CABOMETYX (cabozantinib) and COTELLIC (cobimetinib). COMETRIQ is intended to treat patients with progressive, metastatic medullary thyroid cancer (MTC) and was approved by the FDA in 2012. CABOMETYX, the company’s other cabozantinib drug, was approved by the FDA on April 25, 2016. CABOMETYX is indicated to treat patients with advanced renal cell carcinoma (RCC) who have received prior anti-angiogenic therapy.

What does the approval of CABOMETYX mean for Exelixis? Many believe it will be a strong catalyst for the stock as the medicine is the first ever therapy to demonstrate robust and clinically meaningful improvements in all three key efficacy parameters; overall survival, progression free survival and objective response rate in a large, randomized Phase 3 trial for patients with advanced RCC.

Further, the Marketing Authorization Application (MAA) in Europe has been accepted and granted accelerated assessment for cabozantinib in advanced RCC. This allows the MAA eligibility for a speedy 150-day review, which will be beneficial to the stock.

Exelixis is also currently working with its partner, Genentech, to co-promote COTELLIC (cobimetinib) in the United States. The drug was approved in the US in 2015 and aims to treat patients with specific forms of metastatic melanoma. Additionally, COTELLIC approved in the EU, Canada and Switzerland.

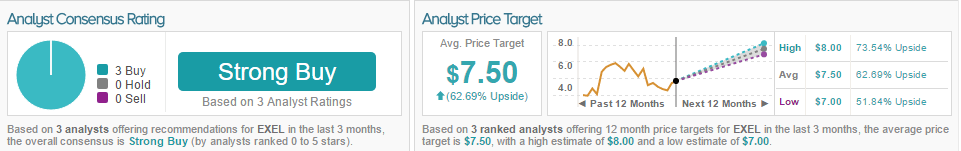

According to TipRanks, the average overall consensus for EXEL is Strong Buy, with 3 analysts recommending a Buy rating on the stock. The average price target for Exelixis is $7.50, with a 62.69% upside.

Disclaimer: Tip more