Biotech Investing: Many Choices, Few Winners

TM editors' note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

This year I started to construct my speculative portfolio. Some speculative elements are vital to any investor's success. One of the sectors that I added to my expanding investment portfolio is small cap biotech stocks.

Biotech investing is not for the faint of heart. After some disappointment news from Tenax Therapeutics (TENX), I started to invest some money in Belgian biotechs Thrombogenics (TBGNF), AST biotech and Biocartis.

(Click on image to enlarge)

The last biotech that I added is a company called Xenetic Biosciences (XBIO). It's an interesting choice because it does not depend on one technology/product, which is often the case with biotech stocks.

As you can see in my current speculative portfolio above, I have six biotechs, three with a listing on Euronext Brussels, Belgium and three with a Nasdaq listing.

Investing in the biotech atmosphere is risky, but the awards can be fruitful.

Last year November Xenetic Biosciences transferred from the OTCQB to the Nasdaq Capital Market. Like most biotech companies in my portfolio, it's a clinical-stage biopharmaceutical company.

The company is focused on the discovery, research, and development of next-generation biologic drugs and novel orphan oncology therapeutics. Stone Fox Capital already once ran an article on SA, called Xenetic Biosciences: Small Biotech With Large Partners And Shareholders.

From Russia With Love

On November 13, 2015, Xenetic entered into an Asset Purchase Agreement with AS Kevelt, an Estonian biotech company and OJSC Pharmsynthez, a Russian pharmaceutical company.

Certain intellectual property rights held by Kevelt and Pharmsynthez were transferred.

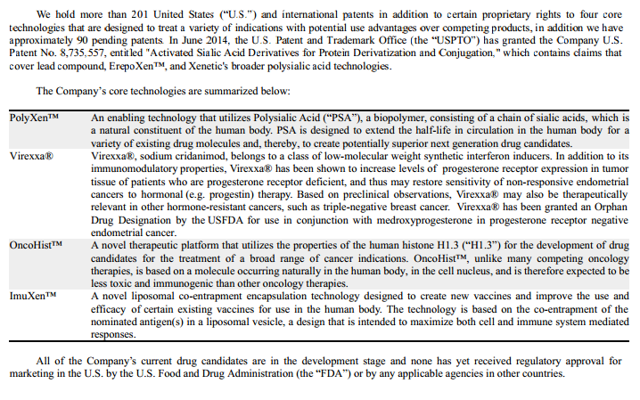

According to the Xenetics' 10-K filing (page 6), it holds now more than 201 patents and 90 pending patents. Where do you find a company with so many intellectual properties at such a small market capitalization?

(Click on image to enlarge)

Pipeline

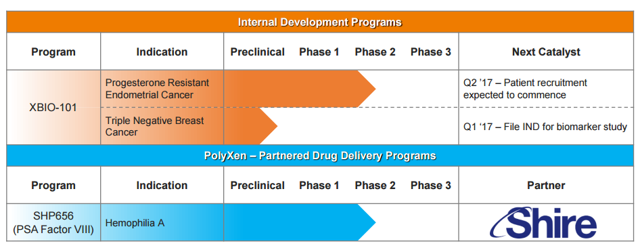

(Click on image to enlarge)

The most advanced technology Xenetics has incorporated is Virexxa® (sodium cridanimod). It belongs to a class of low-molecular-weight immunomodulators, which have been relevant in a wide range of therapeutic areas (antibacterial, antiviral, anti-inflammatory and antitumor). Sodium cridanimod has been approved and marketed in the Russian Federation, and numerous CIS countries for the treatment of certain infectious diseases already for more than 17 years. Approximately 11,000,000 doses have been sold for noncancer indications under Neovir® and Primavir®.

Outside the U.S. there have been 22 completed clinical trials conducted, that assessed the efficiency and safety of sodium cridanimod in certain non-cancer indications.

The decision to investigate Virexxa® under the XBIO-101 program for the treatment of progesterone receptor negative (PrR-) endometrial cancer and triple negative breast cancer (PrR-, ER-, HER2-) triple negative breast cancer is partly based on the history of sodium cridanimod in preclinical and clinical research conducted by others outside the US.

In in vivo cancer models, sodium cridanimod induces expression of progesterone receptors in PrR- EC tumors. Restoration of PrR expression may sensitize endometrial tumor tissue to progestin therapy in unresponsive tumors.

The phase 2 clinical development for treatment of hormone-resistant endometrial cancer will be expected to commence in Q2 2017. Hormone-resistant endometrial cancer has currently no FDA-approved treatment. On August 19, 2016, the company announced that its Investigational New Drug application for Virexxa® (sodium cridanimod), has been granted a US Orphan Drug designation for PrR- endometrial cancer by the FDA.

PolyXen™

Another interesting product candidate in the company's pipeline is ErepoXen™.

ErepoXen™ (poly-sialylated erythropoietin ("PSA-EPO")) works with Xenetic's PolyXen™ technology for the treatment of anemia in chronic kidney disease patients. Polysialylation employs the natural polymer polysialic acid to modulate the pharmacokinetic and pharmacodynamic profiles of protein drugs. It is modeled on the multi-billion dollar success of PEGylation which uses the synthetic polymer polyethylene glycol.

The PolyXen license agreement with Shire (SHPG) covers the development of a series of novel poly-sialylated blood coagulation factors. Shire is the leader in the treatment of hemophilia, with a 40-50% market share in hemophilia A and B. It is also a leading strategic investor and one of XBIO's largest shareholders with a $13 million equity investment to date.

On January 6, 2017, Xenetic received a $3 million milestone payment from Shire, under the signed license deal of January 2014, Xenetic is entitled to milestone payments of up to $100 million. A potentially successful product launch could even lead to royalties on net sales.

The Dynamics

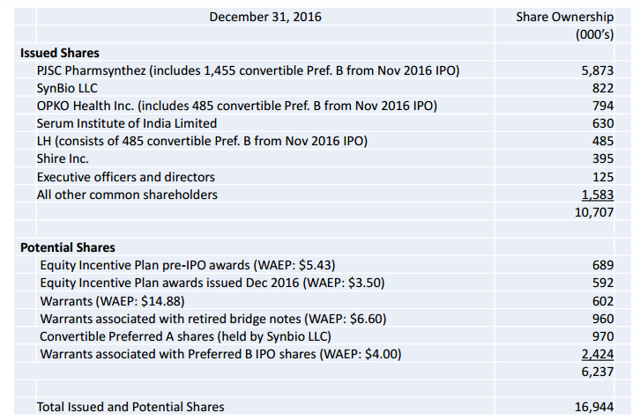

Partners and funding will be needed going forward. The current float of almost 1.6 million shares is too small to take a big position. This illiquidity is a risk but also an opportunity for investors who have a long-term view and are aware of the pitfalls of biotech investing.

(Click on image to enlarge)

Current institutional shareholders such as Pharmsynthez are important for the company to have access to new funding opportunities. The appointment of Roman Knyazev as a non-executive director in May 2014 is a crucial asset for Xenetic. Especially, the connection to RUSNANO can be seen as valuable, because it is a semi-governmental Russian investment vehicle.

The biotechnology sector is an important priority for Russia, and the mission of the RUSNANO Group is to develop a competitive nanotechnology industry in Russia, so investing in developing innovative technologies such as biotech gives room for opportunities and collaboration. As an investor in Pharmasynthez, the biggest shareholder of Xenetic Biosciences, priority could be given to a profitable pay-back of its investments.

For investors in Xenetic that could mean a nice paycheck.

Take-Away

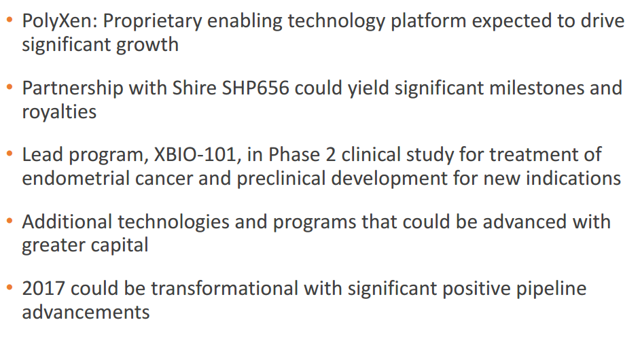

One of the latest sheets in the investment presentation says it all.

(Click on image to enlarge)

Equity financing is needed to make the shares more attractive and liquid. The attractive platform opportunities and the fact that it has some notable shareholders was for me the trigger to buy a small position in this stock.

But as said before biotech investing is not for the faint of heart!

Dutch Trader has a position in Xenetic Biosciences. Please do your own research before investing. It is ...

more

Thanks for sharing