BioSig's Targets Enormous A-Fib Market With Game-Changing Device

TM editors' note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

BioSig Technologies, Inc. (BSGM) is a Minnesota-based medical device company developing a proprietary technology platform designed to improve the rapidly growing $4 billion dollar electrophysiology (EP) marketplace. The company’s leading product is PURE EP™, a novel surface electrocardiogram (EKG) and intracardiac multichannel recording and analysis system designed to assist electrophysiologists during catheter ablation procedures to treat cardiac arrhythmia.

Below is a "Mock Q&A" designed to help investors understand cardiac arrhythmia and atrial fibrillation, the PURE EP system and what the recently published impressive data mean, how and why PURE EP could be a game-changer for electrophysiologists, and what BioSig might be worth if management is successful at bringing PURE EP to market in the next year.

What Is Electrophysiology?

Electrophysiology is the study of the electrical activity of the heart. An electrophysiology study (EPS) is a diagnostic procedure performed by a specialized cardiologist, called an electrophysiologist, with the intent to help understand the nature of an abnormal heart rhythm. The results of an EPS facilitate the assessment of complex arrhythmias, elucidate symptoms, evaluate abnormal EKGs, assess the risk of developing arrhythmias in the future, and design treatment options, which may include pharmaceutical therapy or the surgical implantation of a cardiac defibrillator, pacemaker, or a cardiac ablation procedure. An EPS takes place in an electrophysiology or catheterization (cath) lab, usually under mild sedation.

What Do Electrophysiologist Hope To Learn From An EPS?

The primary diagnostic output of an EPS is an electrogram or intracardiac signal. In essence, an EPS is like an EKG performed from inside the heart through the use of specialized catheters inserted into the femoral artery or vein through small incisions in the inner thigh and guided by x-ray videography into the heart. Small electric pulses through these catheters make the heart beat at different speeds. Electrical signals produced by the heart are picked up by the catheters and recorded. An EPS can last several hours, during which time an immense amount of information is recorded and analyzed. This is called cardiac mapping, and the procedure allows the electrophysiologist to locate where arrhythmias are coming from within the heart or aorta.

What Is Cardiac Arrhythmia?

An arrhythmia is an abnormal heartbeat or a change from the normal sequence of electrical impulses that control the beating (contraction) of the heart. The beating of the heart is caused by an electrical impulse that begins in the sinoatrial node (also called the SA node or sinus node). This is the heart's natural pacemaker. The impulses move in a coordinated way from the right atrium throughout the atria to the atrioventricular (AV) node. From the AV node, electrical impulses travel down a group of specialized fibers called the His-Purkinje system to all parts of the ventricles. This is the exact route that must be followed for the heart to pump in a synchronous matter causing blood to flow through the valves in the proper direction. As long as the electrical impulse is transmitted normally, the heart pumps and beats at a regular pace, sending blood into the pulmonary and systemic circulation.

An arrhythmia occurs when the heart beats outside of a normal coordinated pace, which may include beating too fast or too slow, or in an irregular fashion. There are three main types of arrhythmia:

- Tachycardia – An abnormally fast heartbeat (usually above 100 beats per minute) at resting rate.

- Bradycardia – An abnormally slow heartbeat (usually less than 40 beats per minute) at resting rate.

- Fibrillation – An irregular beat of the heart that may include tachycardia or bradycardia, or the heart beating in a chaotic or quivering fashion.

Atrial fibrillation (AF) is the most common form of arrhythmia. In AF, the electrical impulses do not originate in the SA node. Instead, they come from different parts of the atrium or in the nearby pulmonary veins. The abnormal firing of electrical impulses causes the atria to quiver or beat in a chaotic (irregular and rapid) fashion, which causes the ventricles to pump the blood ineffectively throughout the body. Ineffective pumping may result in blood pooling in atrial appendages that may lead to clot formation.

How Big Is The AF Market?

According to the American Heart Association (AHA), an estimated 2.7 million Americans are living with AF. Untreated AF doubles the risk of cardiovascular-related death and causes a 4-5-fold increase in the risk of stroke due to the potential for clot formation originating from inside the heart or the atrial appendages. According to the U.S. Center for Disease Control and Prevention (CDC), more than 750,000 hospitalizations and 130,000 deaths occur each year in the U.S. because of AF. AF is the underlying cause for 15-20% of ischemic strokes and costs the U.S. an estimated $6 billion in direct medical expense each year.

What Is The Primary Treatment Option For AF?

The primary treatment options for AF include procedures designed to control the heart’s rhythm and rate, medications to reduce the workload of the heart, and/or medications to prevent the formation of clots to reduce the risk of stroke. Electrical cardioversion is a medical procedure where an electrical shock is delivered to the heart through paddles or patches placed on the chest that shock-stop the heart momentarily in hopes that when it resumes at a normal rhythm. Pharmaceutical options for the treatment of AF include antiarrhythmic drugs, calcium channel blockers, beta-blockers, and antiplatelet and/or anticoagulant medications to thin the blood and reduce the risk of clot formation.

For many patients, pharmaceutical options are not sufficient to control the arrhythmia. In these patients, pacemakers or cardiac defibrillators may be surgically implanted to provide low-energy pulses to the heart to restore rhythm and monitor the heart to prevent sudden cardiac arrest. In the U.S., over 225,000 pacemakers and 135,000 cardiac defibrillators are implanted each year.

What If Pharmaceuticals and Cardioversion Fail?

Medications and cardioversion to control atrial fibrillation are not always effective. In these cases, a cardiologist may perform a procedure to ablate the area of heart tissue that's causing the erratic electrical signals in an effort to restore the heart to a normal rhythm. This is done by the use of specialized catheters that deliver radiofrequency energy, extreme cold (cryotherapy), or heat to ablate small areas of the heart, either by isolating or destroying the tissue causing the asynchronous signal. This corrects the arrhythmia without the need for medications or implantable devices.

However, determining the exact tissue to isolate that is causing the erratic electrical signals is paramount to a successful catheter ablation procedure, hence the importance of the cardiac mapping and real-time information noted above during the electrophysiology study. A surgeon looking to remove a cancerous tumor must remove the entire tumor or the risk of recurrence is high. The concept is similar during an ablation procedure. The entire area responsible for asynchronous signal must be isolated or destroyed or fibrillation will remain. That being said, electrophysiologists clearly do not want to over-ablate heart tissue in fear of excess scar formation or loss of heart function. It's a delicate balance.

What Type of High-Tech Equipment Is Necessary For Cardiac Ablation?

Highly fidelity 3D cardiac mapping can only be obtained through the use of a cutting-edge diagnostic software and hardware system employed by the electrophysiologist during the EPS. The system helps the electrophysiologist in locating the defective tissue and in monitoring target ablation sites in real-time.

Who Are The Major Players In Electrophysiology?

Major players in the electrophysiology space include GE Healthcare, St. Jude Medical (now part of Abbott Labs), Boston Scientific, and Medtronic. Together these companies control over 90% of the entire market, with GE Healthcare the market leader at nearly 50% of the installed unit base. However, these companies did not grow organically. There are have been a significant number of acquisitions in the EP sector over the past decade, with several deals closing before the target company ever recorded commercial sales.

The Problem With Their Current Systems?

Cardiac ablation is an invasive procedure. A cardiac mapping system with low fidelity or high signal-to-noise ratio can result in incomplete ablation of the target area. This may result in recurring arrhythmia and the potential for a repeat procedure at some point in the future. A poor signal quality might also lead to longer procedure time, adding cost to the hospital and potential detrimental adverse effects on the patient.

For example, recent data published in JAMA found that radiofrequency catheter ablation procedures had a success rate of only 46% on the first try. In fact, roughly half of the study population had symptomatic recurrences of atrial tachyarrhythmia and declining quality of life measures within two years of the procedure. The website www.stopafib.org reports success rates for catheter ablation procedures, usually in concert with anti-arrhythmia medications, ranges between 30 and 60% after the first procedure.

An analysis of patient outcomes following catheter ablation procedures for the treatment of AF published in Arrhythmia and Electrophysiology found that the average patient undergoes 1.3 procedures before the success rate, defined as no required further anti-arrhythmic medication, eclipsed 80%. The report cited "ineffective technique" as the primary cause of recurrent arrhythmia necessitating a follow-up procedure. The study looked at 16,309 patients from 521 centers in 24 countries around the globe. To further this point, Dr. John Mandrola MD, a cardiac electrophysiologist in private practice and columnist at theHeart.org / Medscape stated in November 2012:

"One of the greatest drawbacks of AF ablation is the need to redo the procedure. Recurrent AF occurs in too many ablation patients—up to 30% to 40% in honest reports. In nearly all redo procedures, the problem is gaps in conduction block between the pulmonary vein and left atrium. Again, it's not exactly clear why these gaps occur, though lack of transmural burns is the leading hypothesis. Good AF ablationists understand the importance of making each burn effective and continuous, but the technology is not quite there yet. It's hard to make continuous lines with dots."

What Are The Advantages of PURE EP?

PURE EP stands for Precise Uninterrupted Real-time evaluation of Electrograms (PURE) EP Systems. BioSig's proprietary system is similar to traditional EP recording systems produced by GE Healthcare or St. Jude Medical, which have two computer screens and allow for independent, real-time review capabilities. However, where PURE EP is superior is in the systems very low noise (1 11V RMS), coupled with a minimum gain and maximum bandwidth (1 KHz). PURE EP delivers unique proprietary topology features, including high input impedance, high common mode rejection ratio (110dB@60Hz), and rejection of noise generated by an RF ablation generator.

This is all rather technical, but what investors need to understand is that as clinical decisions are made in real-time during ablation procedures, PURE EP's ability to display both small and large signals with similar resolution is a significant leap forward in the treatment of arrhythmias, including atrial fibrillation (AF) and ventricular tachycardia (VT). But don't take my word for it; instead, read what Dr. Samuel Asirvatham at Mayo Clinic thinks:

So, It's A Market Share Play?

No, not necessarily. BioSig's PURE EP System is designed to be used in conjunction with existing EP recording devices, essentially creating a new category within the market where EP labs can add on the platform without the significant cost of replacing or upgrading the expense technology already in place. It is designed to improve the signal and recording so that analysis at previously undetectable levels can be conducted with high accuracy. This is the key to the BioSig investment thesis, as the company is not competing with industry behemoths Boston Scientific, Abbott Labs, and GE Healthcare, but instead bringing a new product to the market - an EP Information System - that makes interpretation and visualization of challenging signals possible.

What Does The Data Look Like So Far?

Throughout 2016, BioSig and its research partners have been active in presented in vivo data on BioSig showing the significant advantages of the system outlined above. For example, in March 2016, at the 13th Annual IDSS meeting, researchers from the Mayo Clinic presented pre-clinical data from three canine studies comparing BioSig's PURE EP System to a traditional FDA cleared recording system, System-A, which was later revealed to be CardioLab® by GE Healthcare, the market leader in this area with 50% share. Analysis of the two systems was done head-to-head, simultaneously, in real-time.

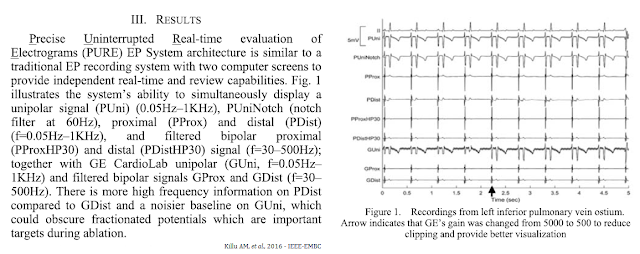

Results at IDSS show enhanced recording and improved signal acquisition and differentiation compared to GE's market leading system. For example, the output from PURE EP shows significantly less noise and improved signal clarity of the pulmonary vein, the papillary muscle, and left ventricle. Dr. Ammar M. Killu, M.D of Mayo Clinic concluded that PURE EP provided improved cardiac signal recording (signal-to-noise ratio and visualization of juxtaposed signals) versus GE's CardioLab, and is likely of value to electrophysiologists during EP procedures.

In June 2016, Dr. Killu published findings in JACC: Clinical Electrophysiology entitled, "Novel Electrophysiology Signal Recording System Enables Specific Visualization of the Purkinje Network and Other High-Frequency Signals." The paper highlights the ability of PURE EP to "Consistently demonstrate superior Purkinje potentials and other high-frequency signal visualization compared with the standard recorder in all sites of the cardiac conduction system." This work was fully published in JACC in January 2017.

In September 2016, more data from Mayo Clinic became available at the IEEE Engineering in Medicine and Biology Society (EMBC2016). New data presented at IEEE-EMBC2016 further builds upon the advantage of the high sampling rate (2000 samples/second) coupled with a high-resolution AID converter (24 bits) and an input voltage range of (±250mV) of PURE EP compared to existing EP recording systems. The figure below highlights the key findings presented by Killu et al at IEEE-EMBC.

What's The Current Status of PURE EP?

PURE EP has been designated as a Class II medical device by the U.S. FDA. As such, human clinical data is not usually necessary as part of the 510(k) application. BioSig simply needs to include preclinical in vivo data supporting the safety and utility of the device as an enhancement to the existing market. Numerous preclinical programs are ongoing, including additional work with Mayo Clinic and Mount Sinai Hospital. BioSig recently initiated its seventh preclinical trial to further research the capabilities of the PURE EP system. The company has worked with other prestigious institutions such as UCLA and Case Medical Center to help collect all the necessary data prior to the 510(k) submission. The U.S. 510(k) submission is expected to take place in the first half of the year, with the FDA making a decision likely in the fourth quarter of 2017. If all goes well, BioSig should be in a position to launch PURE EP before the end of 2017.

Management has also engaged Minnetronix, an innovative medical technology company, to complete design and development of the first version of the PURE EP System. BioSig is currently working with regulatory agencies, both domestically and abroad in order to secure clearance to market and sell the PURE EP System. Management is currently working with the National Standards Authority of Ireland (NSAI) as the Notified Body to obtain CE Mark in Europe.

What's The Market Opportunity?

The most recent MD&D report shows the global Electrophysiology (EP) market revenues will grow nearly 10% annually, from currently $4 billion to approximately $6 billion by 2020 with accompanying procedure growth close to 10% annually, from 865,000 patients in 2015 to 1,350,000 in 2020. Procedure growth in the U.S. alone is projected at an 11.0% annual rate, from 250,000 in 2015 to 422,000 in 2020. This is accompanied by an 11.7% growth in revenues, from $1.85 billion in 2015 to $3.220 billion in 2020.

What's The Commercialization Strategy?

BioSig has been engaged in discussions with two major distributors located in strategic European markets. Management is confident that once the company has secured all the necessary approvals from the required governing agencies, they will be capable of immediately entering key sales markets.

I believe BioSig is a clear acquisition target by either of the four major EP players noted above. This is a fiercely competitive space where 1% market share within the cath lab is worth $40 million. A complementary “bolt-on” type product like PURE EP would be highly coveted and too important to allow falling into a competitor’s hands. It is highly plausible that a company like Abbott, GE, Medtronic, or Boston Scientific would pay to acquire PURE EP once approved. As noted above, this has been the modus operandi for the larger companies over the past two decades.

Who Runs The Company?

Management execution is the final piece of the puzzle. BioSig looks to be run by an outstanding team of experienced industry executives, renowned cardiac electrophysiologists, and astute entrepreneurs. The management team and Board of Directors is a mix of industry and Wall Street, and the company’s scientific advisory board includes directors and professors some of the nation’s top cardiology research centers. Recall, credibility is one of BioNap's 5 C's.

What Are The Big Risks?

The biggest risk in the near-term is a delay in the filing of the U.S. 510(k) application that pushes the commercial launch of the product from late 2017 / early 2018 into the second half of 2018. Investors want catalysts (another BioNap 5 Cs). Unexpectedly negative data, manufacturing setbacks, or enforced regulatory delays by the U.S. FDA could result in a delay in the 510(k) application.

The second biggest risk is the company's financial position. BioSig is backed by experienced investors and entrepreneurs that have successfully and conscientiously funded the company to date with over $15 million in capital. However, BioSig has historically carried a low cash balance, choosing instead to fund operations through small financing activities on a quarterly basis.

Recently, management has made its intention known to seek an uplisting to a major exchange in the near future. A stock price over $2.00 per share and beefed-up balance sheet will qualify BioSig for the NYSE. I think this could act as a major catalyst for the share (see Matinas Biopharma as an example), but a financing will likely take place ahead of the uplist. Funding has never been an issue for BioSig and the upside to a national market listing far outweighs the risks of dilution.

What's BioSig Worth?

As noted above, PURE EP is designed to deliver improved signals and information over the existing already installed equipment, making the product a nice add-on to the expensive systems in place at EP labs across the world. PURE EP might cost $175,000 per install, and 25-30% penetration of the estimated 5,500 EP labs in the developed world is a feasible target. However, I also expect that BioSig will offer both software and hardware upgrades to the installed system, with a useful life of roughly ten years, along with yearly service revenue that sums to total revenue of around $405,000 per system installed over a ten year period.

From a valuation standpoint, BioSig is an estimated 10-12 months away from revenue generation, with peak sales likely five years later based on PURE EP system installs. This brings the cumulative revenue opportunity over the next 10-15 years to $615 million, with estimates peak revenues of around $175 million. Large medical device players like Medtronic, Boston Scientific, GE, and Abbott Labs trade at approximately 3.9x projected revenues and 16.3x projected EBITDA (see below).

If we apply the industry average EV/Rev multiple noted above to our projected peak sales estimate of $150 million in 2022, and then discount back to present day at 15%, we arrive at a fair market value for BioSig of $225 million. If we assume the industry average EBITDA margin of 24% and apply a similar valuation methodology, only this time using the industry average EV/EBITDA multiple from above, we arrive at a fair market value for BioSig of $224 million. The blended average of these two methods yields a target market value of $225 million. This equates to $10 per share on a basic count.

Conclusion

BioSig is currently trading at only $1.50 per share, well below my $10 target. I think the market is applying an overly pessimistic probability adjustment to my forecasts. Additionally, my target is calculated by applying multiples derived from the industry’s largest players with mature businesses and significantly lower growth rates. It is highly plausible that a company like Abbott, GE, Medtronic, or Boston Scientific would pay significantly higher than 4x peak sales or 16x peak EBITDA. After all, PURE EP would be plugged into the existing business at these companies, likely resulting in significantly higher profitability than what a small, standalone company like BioSig could achieve. Keep in mind, my target equates to only $225 million in value. This is a drop in the bucket to GE or Abbott and a bidding war for BioSig could get really fun to watch.

Disclosure: Please see additional information on BioNap and our relationship with BSGM in our Disclaimer.

BioNap holds no ...

more