Biggest Winners Since Google IPO

Yesterday marked the 15th anniversary of Google’s (now Alphabet) IPO on 8/18/04. For those that were around at the time, you may recall that Wall Street’s reception to the IPO wasn’t particularly enthusiastic due to the fact that Google bypassed the traditional Wall Street model and opted for a Dutch Auction approach in which the initial price was set by online ‘bidders’ in order to make the process more democratic. In more than one article published ahead of the IPO, investors were advised to keep “their money safe in their pockets” due to issues like management credibility, delays in the registration process, competition, and “a stock price that has been driven to the sky”. Despite some of the initial skepticism towards the IPO, by just about any performance measure, it was ultimately a success. After pricing at a pre-split adjusted level of $85, GOOGL rallied by over 25% in its first two days as a public company and has rallied by a total of 2,675% since its IPO 15 years ago. That works out to an annualized return of 24.8%!

While GOOGL’s gains have been great, it isn’t even the best performing stock in the S&P 1500 during that span. Looking at current companies that are part of the S&P 1500 that were also publicly traded 15 years ago, we screened for the best and worst-performing stocks over that span. Of the current members of the S&P 1500, 377 weren’t even around back then. That’s more than a quarter of the entire index. Of the remaining 1,123 companies, though, 90 have been 10-baggers which means that investors who held the stocks back then have seen their investment multiply by more than ten times. Further, of those 10-baggers, four have been 100-baggers!

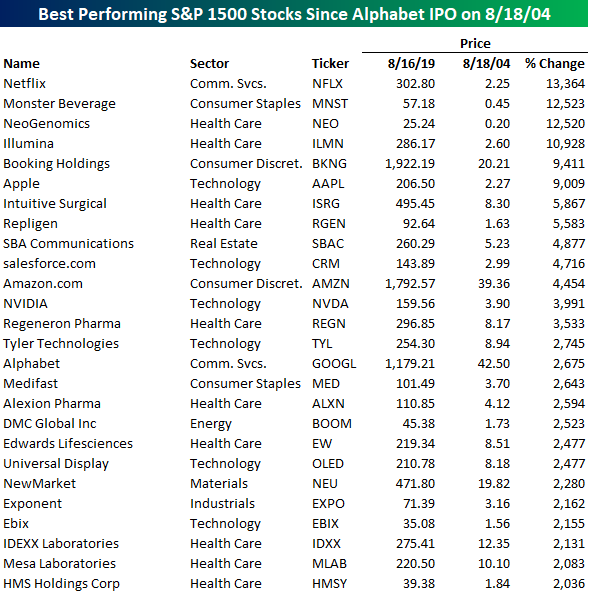

While there isn’t enough space to list the 90 10-baggers in the S&P 1500, the table below lists the 26 current stocks in the S&P 1500 that have rallied more than 2,000% since Google’s IPO (20-baggers). Topping the list is Netflix (NFLX) which is up over 13,000%. Behind NFLX, Monster Beverage (MNST), NeoGenomics (NEO), and Illumina (ILMN) are the remaining 100-baggers. Again, while GOOGL has been great, it isn’t even the best performing of the FAANG stocks during that span. In fact, of the three other FAANGs that were around at the time of the IPO (Netflix, Apple, and Amazon), they have all outperformed GOOGL. Facebook (FB) didn’t come public until 2012, but since its IPO, it has also outperformed GOOGL.

Looking at the individual names on the list of biggest winners, even after their enormous gains, a lot of them aren’t even household names. In terms of their sector distribution, though, ten of the 26 names come from the Health Care sector, while six are Technology stocks. Besides those two sectors, no other accounts for more than two stocks listed.

Technology and Health Care have certainly been two of the biggest winners over the last decade and a half, but which sectors will be the leaders moving forward?

(Click on image to enlarge)

Start a two-week free trial to one of Bespoke’s premium research offerings to stay on top of all the markets ...

more