Biggest Squeeze In 2 Months Sends 'Most Shorted' Stocks To Critical Resistance

One outlier in Wall Street's monster rally since mid-March is that the "Most Shorted" Stocks Index is still well off its peak while the broad-market (led by mega-techs) has shot to the moon, powering overall main equity indexes to record highs, or at least to near all-time-highs.

A handful of mega stocks in the S&P 500 now account for 22% of market cap have been responsible for the latest melt-up in main equity indexes.

This week's massive squeeze in "most shorted" stocks appears to confirm conventional wisdom that the latest recovery-ignorant (as the shape of the economic recovery is quickly transforming from a "V" to a "U" or even "L") parabolic move higher in stocks is yet another engineered short-cover rally...

An index constituent analysis of the Most Shorted Index reveals, on a market cap by sector basis, most of the bearish bets are in consumer cyclicals (47.48%), healthcare (13.89%), technology (12.72%), and financials (7.80%).

Here's the latest leavers and joiners of the index since the start of July.

A complete list of all constituents in the Most Shorted Index (as of Saturday, Aug. 8).

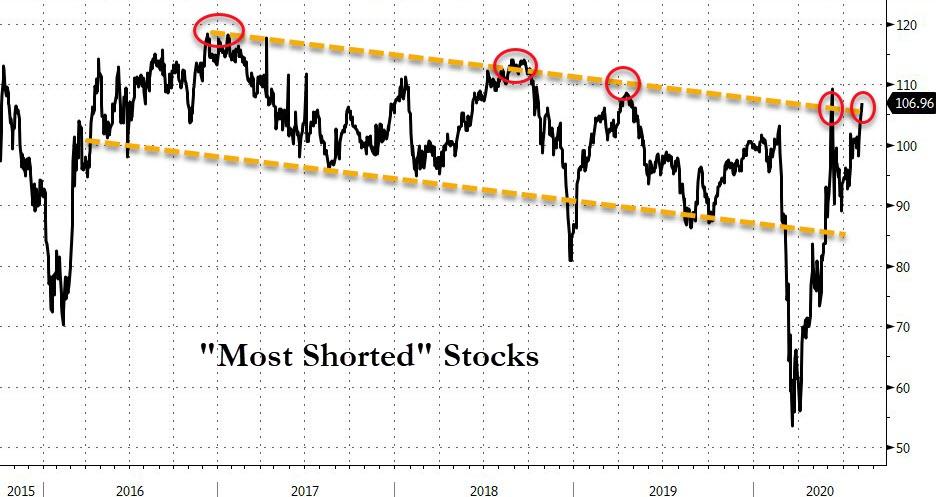

And this week's surge leaves The Most Shorted Index back at the upper-end of its multi-year down-channel, where historically it has been violently rejected.

With short-covering responsible for major bounces in the main equity indexes earlier this year, did this week's surge cause the 'squeeze' ammo to run out?

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more