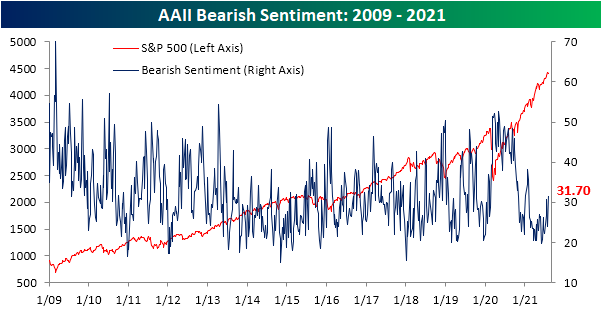

Biggest Jump In Bearish Sentiment Since Last Spring

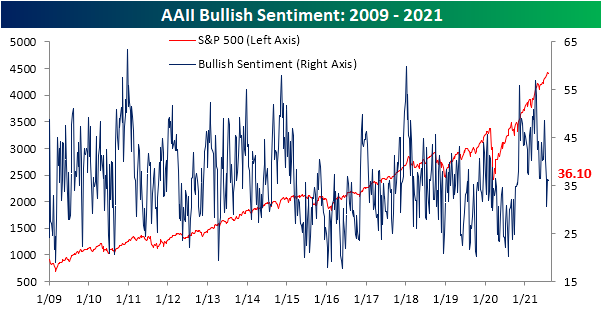

The S&P 500 has been moving sideways around record highs over the past couple of weeks. As such, bullish sentiment from the AAII was relatively flat this week. After a sizeable 5.6 percentage point jump to 36.2% last week, bullish sentiment fell 0.1 percentage points this week. With that reading, bullish sentiment is still 2 percentage points below the historical average of 38%.

Whereas bullish sentiment did not change much, bearish sentiment surged 7.6 percentage points. That was the biggest single-week uptick since June 18th of last year when it rose 9.73 percentage points. At that time though, just under half (47.78%) of respondents reported bearish sentiment compared to only 31.7% today which is only slightly elevated versus the historical average of 30.53%.In fact, the current level of bearish sentiment is now the highest since only February. Put differently, bearish sentiment has been muted recently, and while this week’s increase was large, it does not leave sentiment at any sort of extreme level.

In spite of the large uptick in respondents reporting as bearish, sentiment continues to favor the bulls. The bull-bear spread remains positive at 4.4.

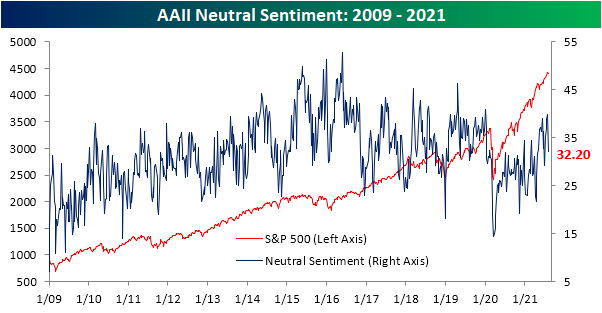

Given bullish sentiment went little changed, the rise in bearish sentiment borrowed almost entirely from those reporting as neutral. Neutral sentiment fell 7.5 percentage points to 32.2%. That is the lowest reading since the first week of July, and it was the largest week-over-week decline since April 8th. This week now marks the first time in three weeks that neutral was not the predominant sentiment reading.