Big Winning Stocks Can Take Weeks To Get Moving After Breaking Out

Patience is a critical component of trading and profiting from big moves in stocks. Being impatient can sabotage your ability to hold a big winning stock, especially after it has completed a Stage 2 breakout. When a stock breaks out into Stage 2, it often has a big initial move that is followed by a period of multiple weeks where the stock drifts sideways and consolidates.

Why does the stock consolidate? Because shorter term players in the market (swing traders/day traders) might be taking some profits, and even longer term players might be taking some partial profits. Also if the stock has overhead resistance then people who are at a losing position might be looking to sell and get out of the position at a better price.

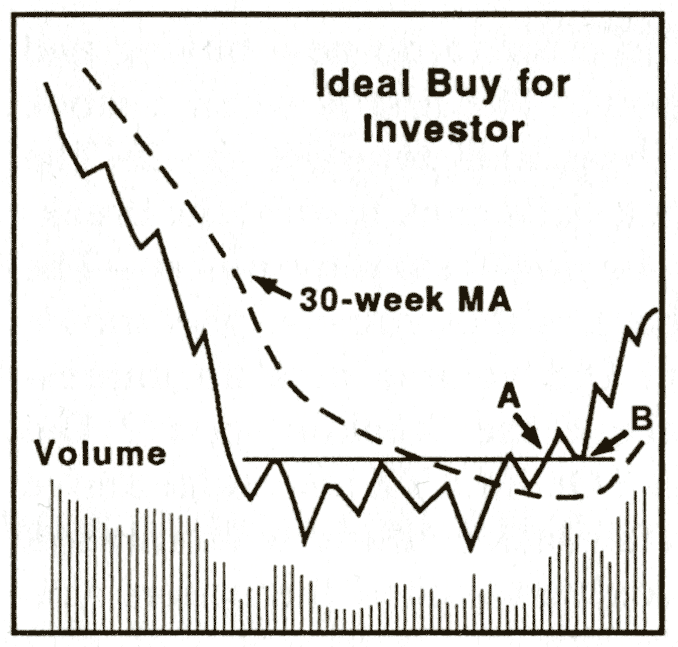

You can see this visually on the chart below from Stan Weinstein’s book Secrets for Profiting in Bull and Bear Markets. At Point A the stock has broken out into Stage 2 and the stock is at an ideal buy point. But the stock then pulls back to Point B and anyone who bought at Point A is at a short term loss. However, at Point B the stock is at another good buy point where it is retesting the breakout over resistance. So the buyer at Point A has to be patient and sometimes wait through a temporary short term loss in order to profit from the much bigger move that often comes after Stage 2 breakouts.

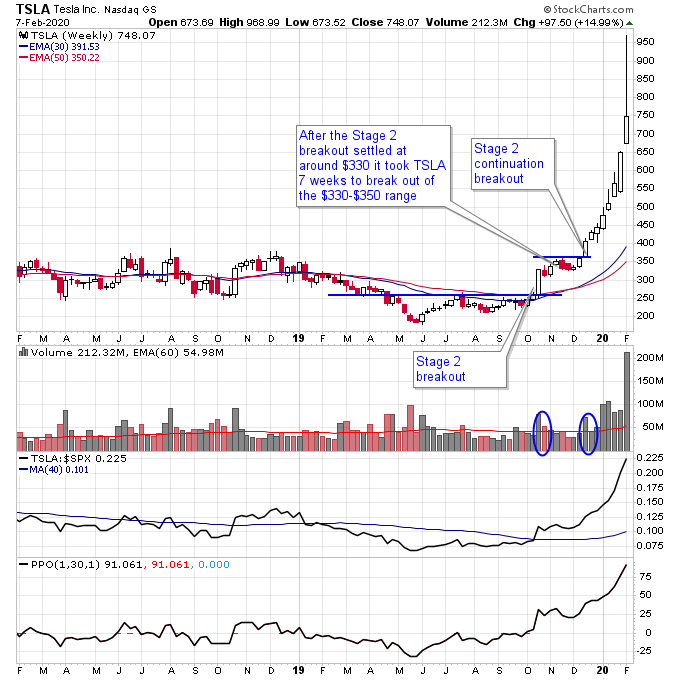

Let’s take a look at some examples of this from some big winning stocks. We identified the Stage 2 breakout in Tesla (TSLA) back in October 2019 which ended up being a monster winner. But what actually happened after the breakout is TSLA took 7 weeks to finally move out of the $330-$350 range. And during the first 2 weeks after the breakout, the trader might have been at a short term loss if they bought at the top end of the breakout. So patience was required to wait for multiple weeks before TSLA really got going after a Stage 2 continuation breakout in December.

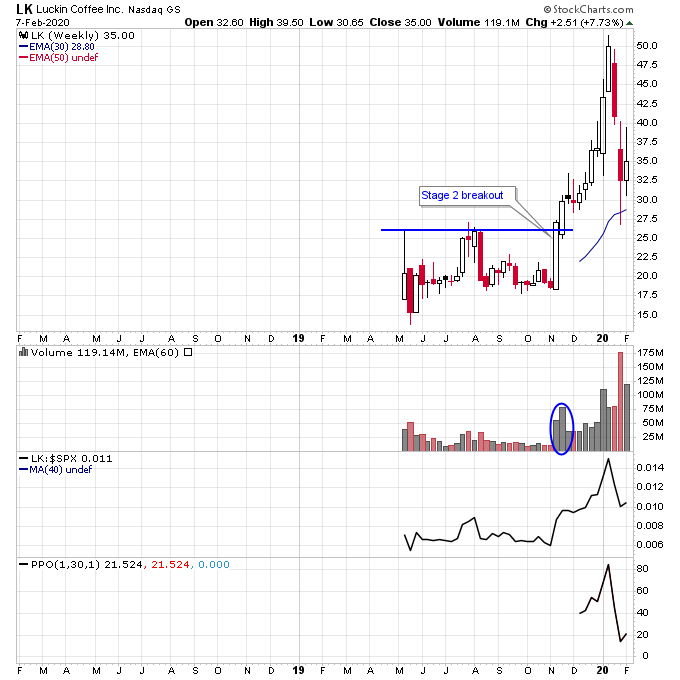

Luckin Coffee (LK) is another recent big winner which took a little less time than TSLA to get going but still had a multi-week consolidation. If you bought around the $30 level during the Stage 2 breakout you had to wait for about 4 weeks before LK finally cleared $30 and it quickly accelerated to $50 after that.

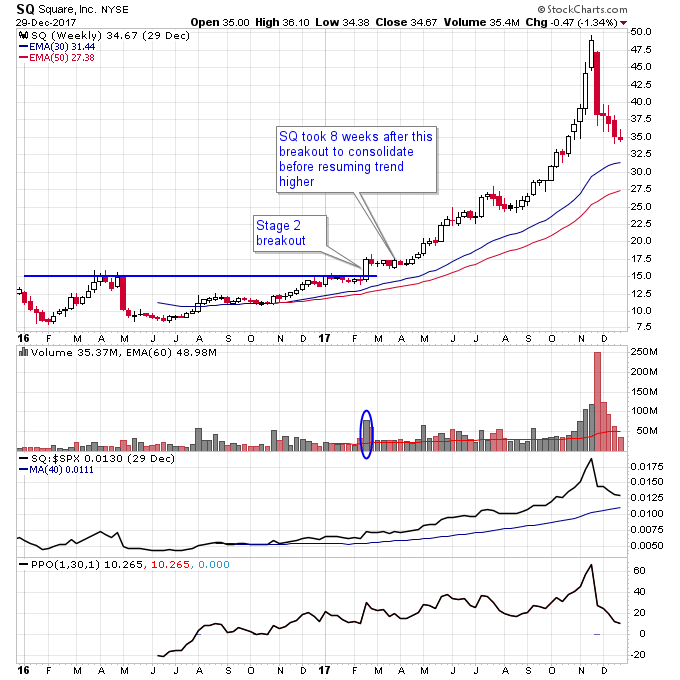

An older example is Square (SQ) which was a big winner in 2017 after completing a Stage 2 breakout in February. But SQ took 8 weeks to digest this initial breakout, if you had the patience to wait you were rewarded with almost a 200% move in the stock as it ran all the way to $50 in November 2017.

In summary, a key point to remember about Stage 2 breakouts is that it may take 2 weeks to 2 months for them to consolidate the initial breakout before resuming trend higher. If the stock retests the breakout level that is often a good secondary low risk buy point. Just because the stock digests the move doesn’t mean it won’t turn out to be a big winner, as Stan Weinstein said it can take time for solid Stage 2 momentum to build.

Disclaimer: The views and opinions expressed are for educational and informational purposes only, and should not be considered as investment advice. The author of this website is not a licensed ...

more