Beyond Meat’s First Day Pop Is A Double-Edged Sword

It remains to be seen how big an appetite consumers have for Beyond Meat’s products, but investors sure are hungry for its stock. After a wild first day of trading that saw the stock top out at nearly $73/share, Beyond Meat (BYND) ended the day at a valuation of ~$66/share, 163% above the IPO price of $25/share.

In our pre-IPO report, we called BYND a “high-risk, high-reward proposition”, and that description still holds true. On the one hand, BYND’s successful IPO gives it more capital to scale its business. On the other hand, the company’s lofty valuation raises the expectations in what is already a crowded industry.

Rapid Growth, Rising Losses

Beyond Meat was founded in 2009 with the goal of developing plant-based products that would, in the words of its S-1, “look, cook, and taste” like meat. The company uses pea proteins that are processed, woven, and combined with various flavorings to produce a variety of meat substitutes.

While BYND produces a variety of products, it is best known for the Beyond Burger, which is sold in ~15,000 grocery stores and ~12,000 restaurants, including Carl’s Jr., TGI Fridays, and BurgerFi. Overall, BYND earns 58% of its revenue from grocery stores and other retail channels and 42% from restaurant and foodservice customers.

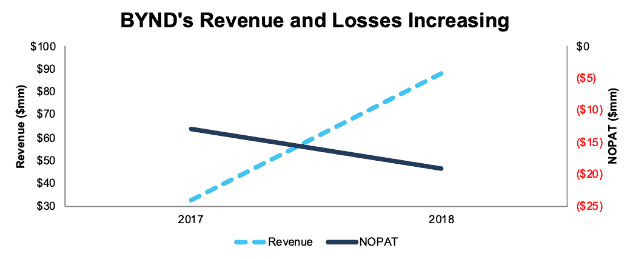

The widespread availability of the Beyond Burger is impressive considering the product was only launched in July of 2016. BYND is growing rapidly, with revenue increasing by 170% from 2017 to 2018. However, as Figure 1 shows, that revenue growth has been accompanied by rising losses. Net operating loss after tax (NOPAT) increased 48%, from $13 million in 2017 to $19 million in 2018.

Figure 1: BYND Revenue and NOPAT: 2017-2018

Sources: New Constructs, LLC and company filings

The market’s reaction to BYND’s IPO shows that, for the moment, investors care more about growth than profits. All signs point to the trends in Figure 1 continuing in the near term. BYND doesn’t have audited Q1 2019 numbers yet, but it estimates that revenue increased by ~200% year-over-year while operating losses increased anywhere from 20-38%.

Evidence of Economies of Scale

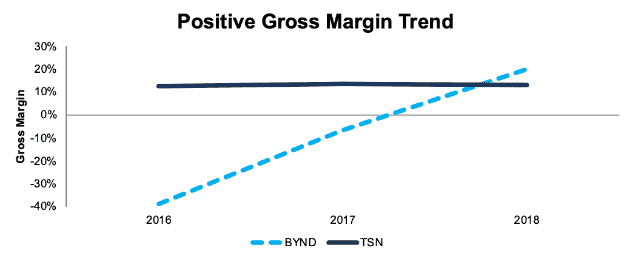

The good news for BYND is that, while the company is still losing money as it tries to gain mainstream adoption, it’s already showing signs of achieving economies of scale. Gross margins turned positive for the first time in 2018. More impressively, at 20%, its gross margins have already surpassed Tyson Foods (TSN), the largest meat producer in the U.S.

Figure 2: BYND vs. TSN Gross Margins: 2016-2018

Sources: New Constructs, LLC and company filings

The positive gross margin trend shows no sign of letting up either. BYND has tripled its production capacity over the past year, and it estimates that its investment in production led to gross margins of 25-26% in the first quarter of 2019.

The ~$250 million that BYND meat raised in its IPO should definitely help the company fund increased production as it continues to scale its business. The positive stock performance on day one of trading should also make it easier for BYND to raise more capital in the future.

However, the strong performance of BYND’s stock is a double-edged sword. The huge success of BYND’s IPO should also attract even more competition into what is already a crowded space.

Rising Competition

While BYND is the largest company in its category, it faces serious competition from both smaller startups and traditional meat producers.

Most notably, Impossible Foods made headlines recently with the news that Burger King will launch the “Impossible Whopper” nationwide by the end of this year. With 7,300 locations nationwide, Burger King will be the largest restaurant chain to sell a plant-based burger.

Impossible Foods is reportedly seeking to raise more capital, and they should have a much easier time raising capital now that they can peg their valuation to BYND’s nearly $4 billion market cap. Other competitors, such as Boca Foods, Gardein, and Field Roast Grain Meat Co., should also find it easier to raise new capital now that VC’s can see the potential for a lucrative IPO.

In addition, Tyson Foods is working on its own plant-based meat products. TSN recently sold its 6.5% stake in BYND (a decision it may be now be regretting), which indicates it plans to compete with BYND rather than partner with it. For TSN and other meat producers, the message from BYND’s IPO is clear: this is a space they need to be in. Look to see TSN – as well as other companies in the industry like Hormel (HRL), Cargill, and JBS – devote more capital to their efforts to develop plant-based alternatives in the near future.

If one of these larger competitors successfully develops a product with comparable taste/texture to the Beyond Burger, their superior scale and distribution channels should give them a significant advantage.

How Big is BYND’s Market?

Like many recent IPOs, BYND’s grand ambition is to disrupt and take over a massive industry. Rather than market itself as a niche product for vegans and vegetarians, BYND wants to compete directly in the meat industry, which it estimates at $270 billion in the U.S. and $1.4 trillion globally.

To this end, BYND has made a point to market its products as meat rather than as a vegetarian alternative. Its products are sold in the meat section of grocery stores, and it has long resisted the labeling of its products as “veggie burgers”.

This strategy of marketing their products towards meat eaters appears to be working so far. The company claims in its S-1 that 93% of customers that bought a Beyond Burger at Kroger in the first half of 2018 also purchased animal meat products during that timeframe.

However, there are still major question marks as to how large the potential market for plant-based meat products really is. Several states are considering adding labeling rules that would restrict BYND and other companies from marketing their products as meat if they don’t contain any animal products. These rules would make it much harder for BYND to make inroads among meat eaters.

The biggest question facing BYND over the next few years is whether its products will gain mainstream acceptance as a form of meat. If they succeed at that goal, the stock could still look like a bargain even after this big runup. If, on the other hand, plant-based proteins never amount to more than a small, alternative product, it will be hard for BYND to justify its valuation.

High Expectations, But Still Potential for Upside

Our reverse discounted cash flow (DCF) model shows the expectations implied by BYND’s current valuation are high, but achievable.

In order to justify its current valuation of $66/share, BYND must grow revenue by 53% compounded annually for 10 years and achieve NOPAT margins of 8%, slightly above TSN’s margins of 6%. See the math behind this dynamic DCF scenario.

In this scenario, BYND would earn $6.2 billion in revenue in 2028, just 2% of annual U.S. meat industry sales, and just 15% of TSN’s 2018 revenue. 53% annual revenue growth is ambitious, but it’s by no means impossible.

In fact, one can build a plausible scenario where the company still has significant upside. If BYND achieves 8% margins and grows revenue by 65% compounded annually for 10 years, the stock is worth $173/share today, a 163% upside from the current price. See the math behind this dynamic DCF scenario.

In this scenario, BYND would have $12.9 billion in revenue in 2028, roughly double the first scenario. While that’s undoubtedly an ambitious projection, it’s still just 4% of U.S. meat sales and 32% of TSN’s revenue.

On the other hand, the increase in valuation adds to the risk for BYND. if the company grows revenue by 43% compounded annually for 10 years and achieves NOPAT margins of 6%, equal to TSN, the stock is only worth the IPO price of $25/share today, a 62% downside from the current stock price. See the math behind this dynamic DCF scenario. The fact that such a high level of growth and profitability could lead to such significant downside shows the high risk embedded in this stock.

Public Shareholders Have Rights

Encouragingly, BYND actually allows public shareholders to exercise a role in corporate governance. The company has bucked the recent trend and went public with a single class of common stock, meaning all shareholders have the same voting rights.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings. Below are specifics on the adjustments[1] we make based on Robo-Analyst[2] findings in Beyond Meat’s S-1:

Income Statement: we made $11 million of adjustments, with a net effect of removing $11 million in non-operating expense (13% of revenue). You can see all the adjustments made to BYND’s income statement here.

Balance Sheet: we made $34 million of adjustments to calculate invested capital with a net decrease of $18 million. You can see all the adjustments made to BYND’s balance sheet here.

Valuation: we made $96 million of adjustments with a net effect of decreasing shareholder value by $96 million. Our largest adjustment is $61 million (5% of market cap) in employee stock options liabilities. You can see all the adjustments made to BYND’s valuation here.

[1] Ernst & Young’s recent white paper “Getting ROIC Right” demonstrates the link between an accurate calculation of ROIC and shareholder value.

[2] Harvard Business School Features the powerful impact of research automation in the case study New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Disclosure: New Constructs staff receive no compensation ...

more