Betterware: Better Where It Counts

Betterware de Mexico (BWMX) is a relatively small company with a market cap of about $1 Billion and strong financials. The company began trading publicly last year via a SPAC. Betterware is a direct-to-consumer company operating in Mexico. The company focuses on home and life improvement products priced for the lower tier of the Mexican middle class. While the Mexican peso has a long history of losing value versus the dollar, its growth prospects are strong enough to compensate for the impact.

Source: Betterware

In 2020 the pandemic reduced foot store traffic, and people spent more time at home, leading to increased demand for Betterware products reflected in the 2020 revenue growth. The pandemic will likely continue throughout 2021 in Mexico, and the company will likely experience similar o greater growth this year.

How is Betterware different?

Betterware functions similarly to other successful DTC companies by compensating the people who sell their products (distributors) by how many products they sell. Their relatively new app employs a system similar to Uber´s (UBER) to manage last-mile delivery of products. When anyone buys a product via the Betterware app, any distributor with the item and close to the customer can deliver it and gain the corresponding fee.

Source: Google Play Store

The system allows Betterware to maintain low inventories and a very effective last-mile distribution system with minimal operational expenditure. It also reduces the marketing expenses. As distributors do not have fixed compensation, labor costs are very flexible, which is valuable in uncertain times.

Why now is a good time

The same driver pushing Amazon(AMZN) and MercadoLibre (MELI) to the top side of the estimates during the pandemic will allow Betterware to perform on the estimates' topside in 2021.

There are currently many restrictions in Mexico for stores to open. It is unlikely that these restrictions are lifted any time soon as the country's vaccination plan extends into 2022. As traditional stores are constrained by the pandemic, online shopping will increase. However, the Mexican market typically uses cash and has limited access to credit or debit cards, especially in the population's lower-income segments.

Betterware´s model should have a huge advantage as it is one of the few companies that allow online shopping without the need for a credit card or debit card.

(Click on image to enlarge)

Source: Financial Times

Mexico is among the countries with the poorest management and response to the pandemic in the world. Because of this, unemployment is expected to rise, and Betterware stands to profit from this unfortunate trend. Like my thesis on Uber, as unemployment rises, becoming a Betterware distributor will likely become a better proposition. With a low barrier to enter the field, no capital requirement and flexible hours, it is an alternative that many families might welcome.

The increase in distributors with no cost to the company will allow it to grow faster than it has done in the past. As Betterware products are easily manufactured, the company can employ contract manufacturing to increase products' supply without capital expenses. With enormous flexibility in the company's cost structure paired with a growing sales force and ample room to increase its supply, Betterware has a winning strategy that could flourish in uncertain times.

Besides the impact that the downturn of economic activity in Mexico could have on Betterware sales, the company's biggest risk comes from MercadoLibre, which also provides a way to buy products online without using credit debit cards. While the risk should not be ignored, the competition that MercadoLibre has with Betterware is indirect, making the worst-case scenario a slight reduction in Betterware sales as MercadoLibre grows.

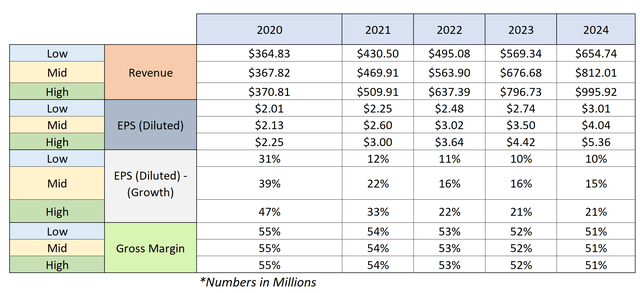

Valuation

In the past few years, revenue growth has been around 40%. The model forecasts average yearly revenue growth of 38.9% with an average gross margin of 52.5% compared to the past average of 60.3%. G&A as a percentage of revenue has oscillated from 32.1% and 38.7%, with a tendency to decrease. The prediction estimates an average G&A as a percentage of revenue of 33.5%. With the above considerations, we have the following chart.

(Click on image to enlarge)

Source: Author´s Charts

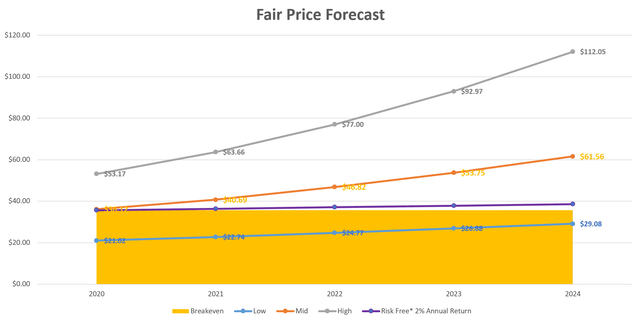

I like to use Peter Lynch's ratio when valuing a stock. This method uses the ratio between the expected earnings growth plus dividends and the P/E of the stock to determine its fair value. A stock that has a 1:1 ratio is reasonably priced. The higher the number, the more underpriced the stock is.

(Click on image to enlarge)

Source: Author´s Charts

This valuation does not take into account the assets and liabilities of the company. The growth considered in the valuation is the average yearly growth of the next years.

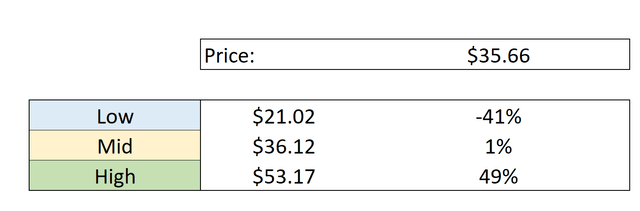

With this valuation, arguably, the stock is at worst overvalued by 41% and at best undervalued by 49%. So the stock is fairly valued.

(Click on image to enlarge)

Source: Author´s Charts

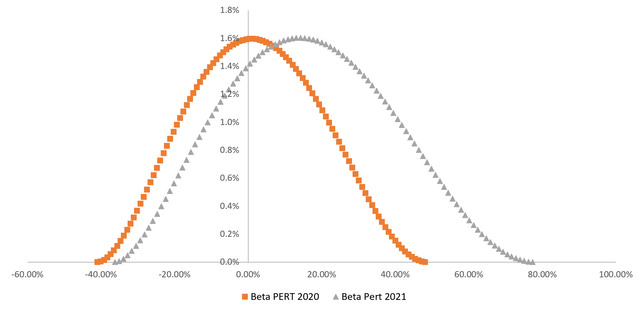

Building an adjusted Beta Pert risk profile for the stock's current fair price, we can calculate the risk profile for purchasing the stock now and in the long term.

The risk profile shows a 47% probability that Betterware will trade at a lower price than it is today. Considering the potential downside, upside, and the likelihood of each, the statistical value of the opportunity of investing now is 1.7%, but in just one year, the probability that the company will end up trading at a lower price than it is today drops to 29% and the statistical value of the opportunity increases to 14%.

(Click on image to enlarge)

Source: Author´s Charts

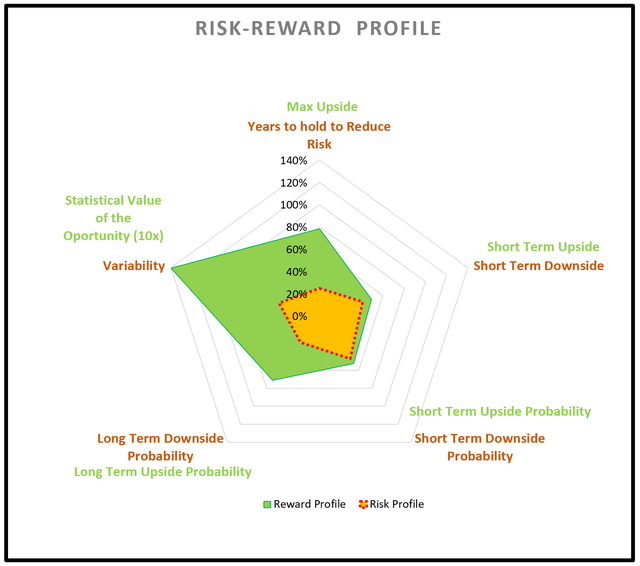

The risk-reward profile below shows that Betterware has a relatively low risk with a high reward potential. The risk reduces significantly during 2021, but the reduction decreases marginally in the following years.

(Click on image to enlarge)

Source: Author´s Charts

With an asymmetrical risk-reward profile, low and diminishing risk,s and trading at a fair price, it is a worthwhile stock that might be a welcome addition to many portfolios.

Conclusions

Given the substantial growth in revenue that the company has shown in the past, the powerful financials, and the shallow level of debt, now could be a good time to get the stock.

While the risk of operating in a country with a debilitating currency is not neglectable, the flexibility of the business model paired with a brilliant online strategy delivers a relatively low-risk stock with high rewards potential.

If there is anything in this article you agree or disagree with or would like me to expand further on; I would sincerely appreciate you leaving a comment. I will address it as soon as possible.

Disclosure: I am long BWMX, AMZN, MELI

Good read, thanks.