Bet On These 3 Stocks To Outperform In 2016

Fueled by strong economic tailwinds specific just to their sector, these stocks will move higher for years to come. And, unaffected by the same fears that hold a tight grip on the market right now, are low-volatility plays to earn solid returns in 2016.

The stock market has gotten more volatile as of late as investors soaked in the ramifications of a weak jobs report the previous Friday. Although this likely takes a Fed rate hike off the table in June and most probably in July, the pace of job growth has definitely seen a significant deceleration over the past few months and the economy is no longer close to producing the 200,000 monthly jobs we have averaged over the past two years. This is certainly going to be fodder for the upcoming presidential election and more importantly does not bode well for economic growth.

In addition, investors started to focus on global growth concerns once again as both the European and Japanese central banks have decided to swim into uncharted territory with negative interest rate policies. One perverse effect of these initiatives is a flood of investors into the high yield. Relatively that is, of the ten-year treasury bond; ironic because the ten-year bond now trades at a two-year low. This is hardly what the Federal Reserve envisioned late in 2015 when they forecasted they would raise interest rates four times in 2016 by a quarter point, a view that has since been dropped.

It could be a challenging few weeks as the U.K. goes to the polls on June 23rd to decide whether to stay or leave the European Union. Since this referendum was first proposed, it had been assumed that the vote would be to “stay” in the EU. The “stay” vote has consistently been about 10 points ahead of the “leave” vote for most of 2016. However, the latest polls show the “leave” vote now leading the “stay” faction.

It appears this vote is now a 50/50 proposition. A leave decision will have negative consequences for global currency and equity markets, which investors had been ignoring until the last few days in the market. This is just one more tailwind to the stock market rally that has been impressive since the equity indices fell sharply to begin the year.

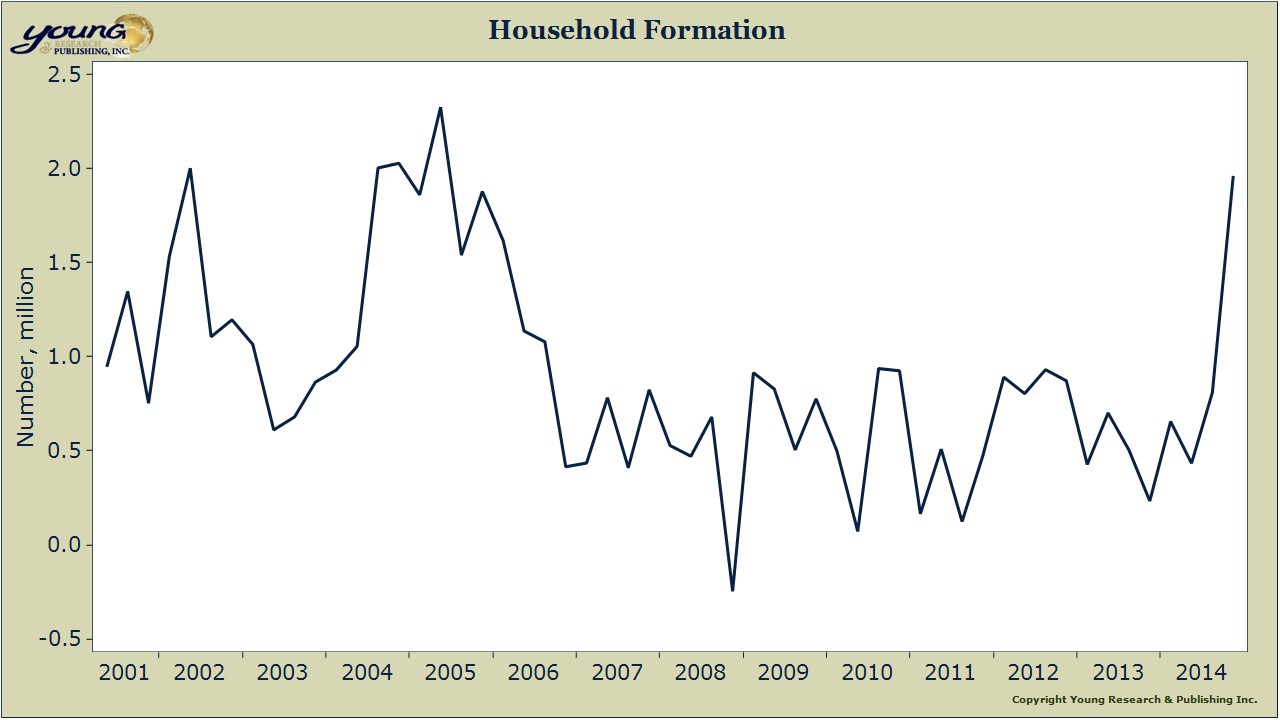

My outlook remains unchanged and I believe the overall market will end the year flat or slightly down, a repeat of its performance in 2015. That does not mean pockets of investable strength do not exist within the market. One of these pockets is in housing. Housing starts posted their strongest levels in 2015 since 2007. Even so, they were down substantially from the annual average of the past three decades. In addition, household formation now exceeds pre-financial crisis levels.

Combined with historically low interest rates and slowly loosening mortgage credit underwriting standards this should mean years of solid growth in the housing market barring an unforeseen recession. The easiest way to play this developing trend would be to buy a homebuilder ETF. The most popular of these seems to be the SPDR Homebuilders ETF (NYSE: XHB). However, about 40% of its holdings are actually retail stocks tied to homebuilding activity such as Home Depot (NYSE: HD) and Restoration Hardware (NYSE: RH) which recently cratered due to poor results.

A purer play among the ETFs is the iShares US Home Construction (NYSE: ITB) which has a much higher percentage allocation to homebuilders like giants Lennar (NYSE: LEN) and D.R. Horton (NYSE: DHI) as would be my preferred picks among the ETF.

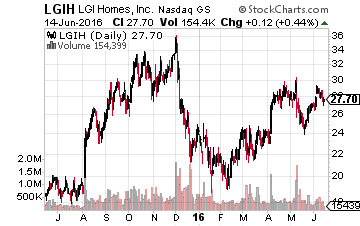

However, I would rather play this space by using targeted investments in some of the more attractive plays among the individual home builder stocks. Homebuilders have also shown some good strength recently. My favorite home building stock remains LGI Homes (Nasdaq: LGIH). Home closings at this fast growing Texas-based builder are up 35% so far this year from the same period a year ago as the company rapidly expands outside its home turf in the Lone Star State. LGI Homes now has 56 active housing communities as it targets high-growth states such as Colorado and Virginia to expands its geographical footprint.

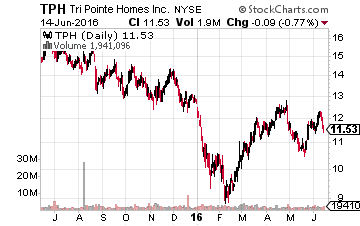

TRI Pointe Homes (NYSE: TPH) is another homebuilder I like and hold here. It is a top ten player by volume and the stock has shown strength recently as it has moved up some 10% over the last month even as the overall market has stayed relatively flat. Earnings should be relatively flat or slightly up this year but should move up some 15% in FY2017 on a 10% increase in revenues. The stock is a solid value here at under 10 times trailing earnings.

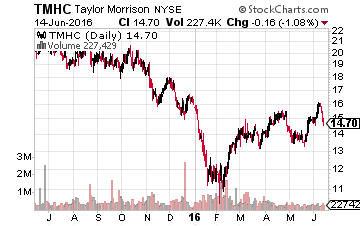

Turning to a homebuilder with a better current growth trajectory, we end with Taylor Morrison Home (Nasdaq: TMHC) which also has been strong of late posting a 15% gain over the last month of trading. Earnings should be up some 20% in both FY2016 and FY2017 on revenue gains in the mid-teens over the next couple of years. Given these growth projections, the stock is undervalued at just over nine times this year’s profits.

Disclosure: Positions: more