Best Russell 1000 Stocks: Consider Packaging Corporation Of America

A Ranking system sorts stocks from best to worst based on a set of weighted factors. Portfolio123 has a powerful ranking system which allows the user to create complex formulas according to many different criteria. They also have highly useful several groups of pre-built ranking systems, I used one of them the “Momentum Value” in this article.

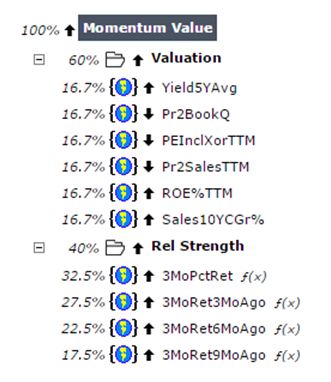

The “Momentum Value” ranking system is quite complex, and it is taking into account many factors like; yield, price to book value, P/E ratio, price to sales, return on equity, sales growth and relative strength. This system finds value plays with prices moving upwards. The rank is a combination of value factors and momentum factors. The value factors make up 60% of the rank and the momentum factors make up 40% of the rank, as shown in the chart below.

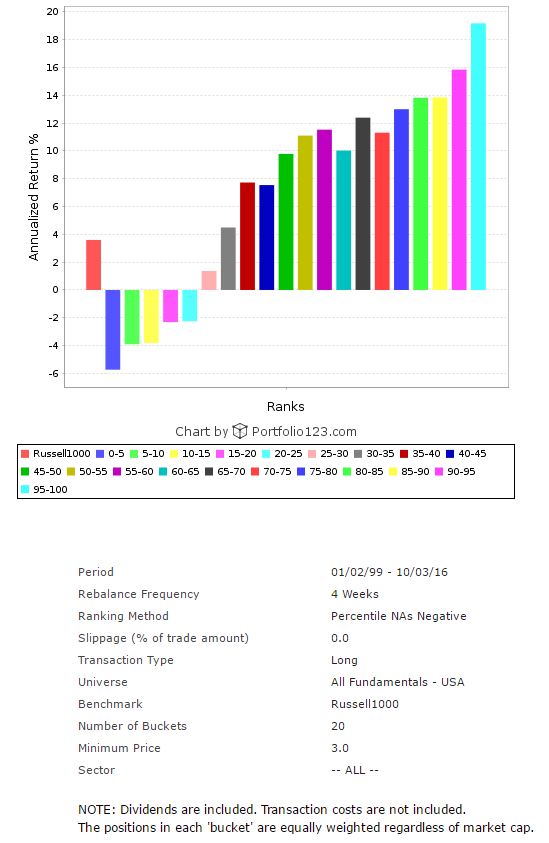

In order to find out how such a ranking formula would have performed during the last 17 years, I ran a back-test, which is available by the Portfolio123's screener. For the back-test, I took all the 6,287 stocks in our database.

The back-test results are shown in the chart below. For the back-test, I divided the 6,287 companies into twenty groups according to their ranking. The chart clearly shows that the average annual return has a very significant positive correlation to the “Momentum Value” rank. The highest ranked group with the ranking score of 95-100, which is shown by the light blue column in the chart, has given by far the best return, an average annual return of about 19.2%, while the average annual return of the Russell 1000 index during the same period was about 3.6% (the red column at the left part of the chart). Also, the second and the third group (scored: 90-95 and 85-90) have given superior returns. This brings me to the conclusion that the ranking system is very useful.

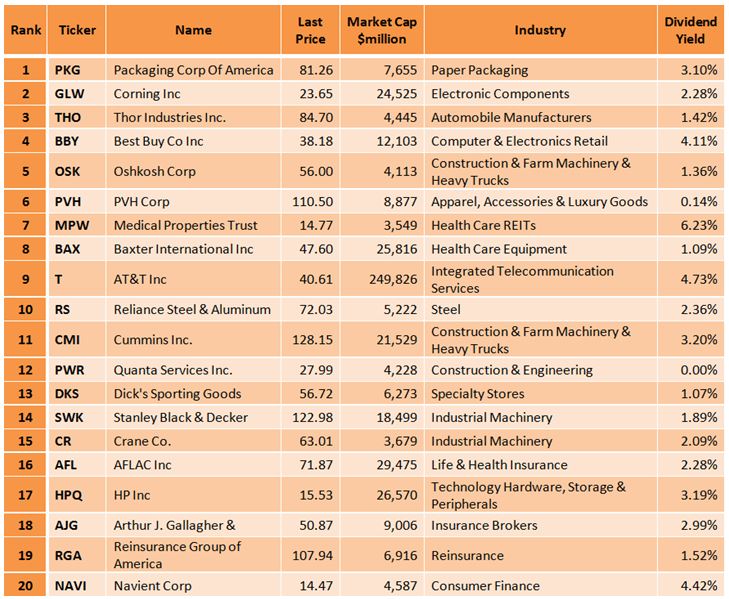

After running the “Momentum Value” ranking system on all Russell 1000 stocks on October 03, I discovered the twenty best stocks, which are shown in the table below. In this article, I will focus on first-ranked stock of the system; Packaging Corporation of America (PKG).

Packaging Corporation of America manufactures and sells containerboard and corrugated packaging products in the United States, Europe, Mexico, and Canada. The company offers various corrugated packaging products, such as conventional shipping containers used to protect and transport manufactured goods, multi-color boxes and displays that help to merchandise the packaged product in retail locations, and honeycomb protective packaging.

PKG Stock Performance

Year-to-date, PKG's stock is already up 28.9% while the S&P 500 index has increased 6.1%, and the Nasdaq Composite Index has also increased 6.1%. Moreover, since the beginning of 2012, PKG's stock has gained 221.9%. In this period, the S&P 500 Index has increased 72.4%, and the Nasdaq Composite Index has gained 103.9%.

PKG Daily Chart

PKG Weekly Chart

Charts: TradeStation Group, Inc.

Dividend

The annual dividend yield is pretty high at 3.10% and the payout ratio at 46.8%. The annual rate of dividend growth over the past three years was very high at 30.1%, over the past five years was also very high at 29.7%, and over the last ten years was at 8.2%.

Growth

Packaging Corporation of America has recorded substantial growth in the last few years. The company's annual average sales growth over the last five years was very high at 18.7%, and the average EPS growth was also very high at 17.4%. The average annual estimated EPS growth for the next five years is high at 9.3%.

Valuation

PKG valuation is good, the trailing P/E is at 17.26, its forward P/E is at 15.59, and its price-to-sales ratio is at 1.34. Furthermore, its price-to-free-cash-flow ratio is at 24.41, the Enterprise Value/EBITDA ratio is low at 8.59, and the PEG ratio is at 1.75.

In addition, PKG's Efficiency and Return on Capital parameters have been much better than its industry median, its sector median, and the S&P 500 median as shown in the tables below.

Source: Portfolio123

Conclusion

PKG's stock is ranked first among all Russell 1000 stocks according to the powerful “Momentum Value” ranking system. The company has recorded substantial growth in the last few years, and its valuation is good. Also, the company generates strong free cash flow and returns substantial capital to its shareholders by stock buybacks and increasing dividend payments currently yielding 3.1%. All these factors bring me to the conclusion that PKG's stock is a smart long-term investment.